Forge SPAC Presentation Deck

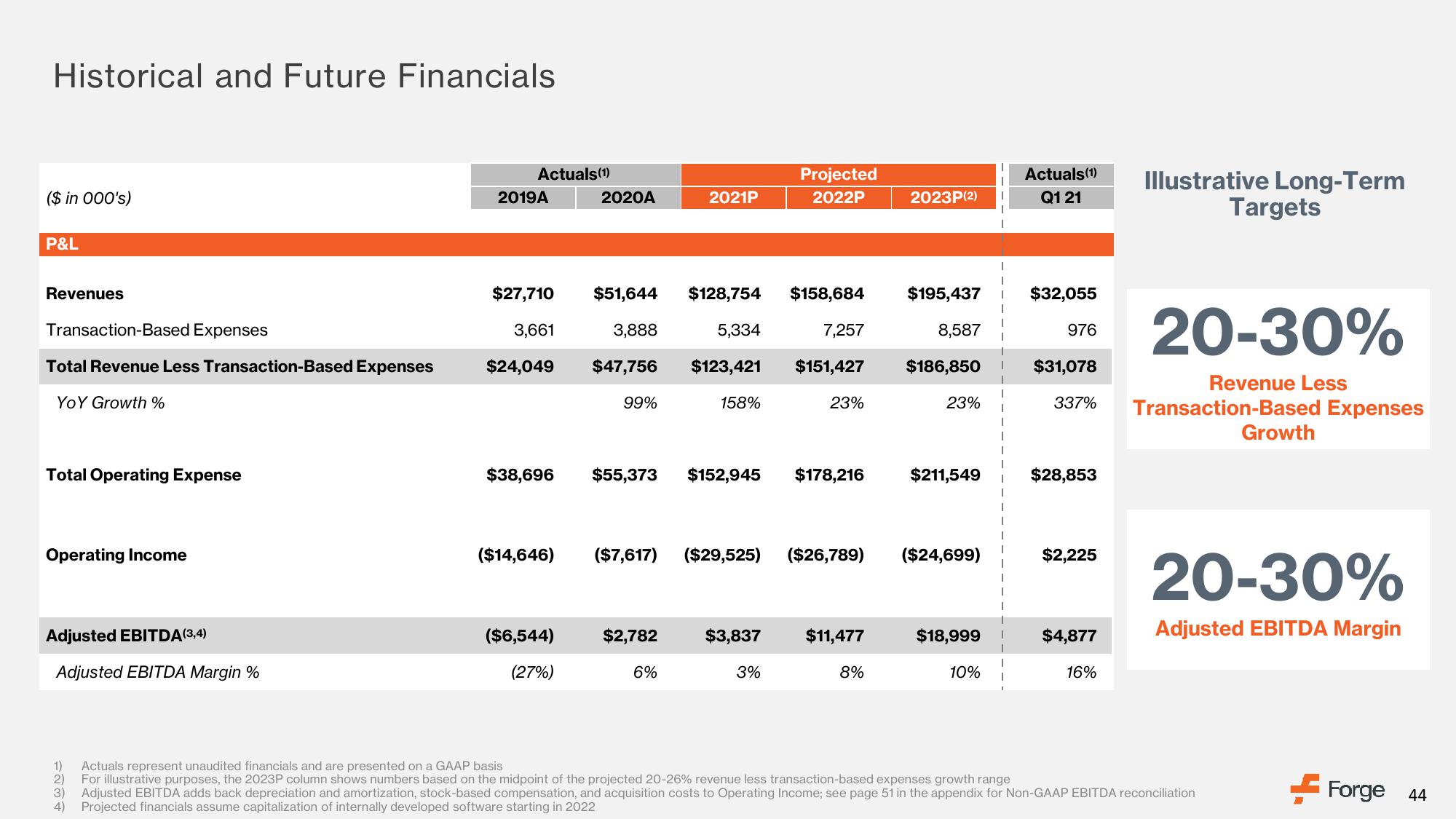

Historical and Future Financials

($ in 000's)

P&L

Revenues

Transaction-Based Expenses

Total Revenue Less Transaction-Based Expenses

YOY Growth %

Total Operating Expense

Operating Income

EBITDA (3,4)

Adjusted EBITDA Margin %

Actuals (1)

2019A

$27,710

3,661

$24,049

($14,646)

2020A

($6,544)

(27%)

$51,644

3,888

$47,756

99%

2021P

$2,782

$38,696 $55,373 $152,945 $178,216

6%

$128,754 $158,684

5,334

7,257

$123,421 $151,427

158%

Projected

2022P

23%

3%

($7,617) ($29,525) ($26,789) ($24,699)

$11,477

2023P(2)

8%

$195,437

8,587

$186,850

23%

$211,549

$18,999

10%

I

Actuals (1)

Q1 21

$32,055

976

$31,078

337%

$28,853

$2,225

$4,877

16%

Illustrative Long-Term

Targets

20-30%

Revenue Less

Transaction-Based Expenses

1)

Actuals represent unaudited financials and are presented on a GAAP basis

2)

For illustrative purposes, the 2023P column shows numbers based on the midpoint of the projected 20-26% revenue less transaction-based expenses growth range

3) Adjusted EBITDA adds back depreciation and amortization, stock-based compensation, and acquisition costs to Operating Income; see page 51 in the appendix for Non-GAAP EBITDA reconciliation

4) Projected financials assume capitalization of internally developed software starting in 2022

Growth

20-30%

Adjusted EBITDA Margin

Forge 44View entire presentation