SmileDirectClub Investor Presentation Deck

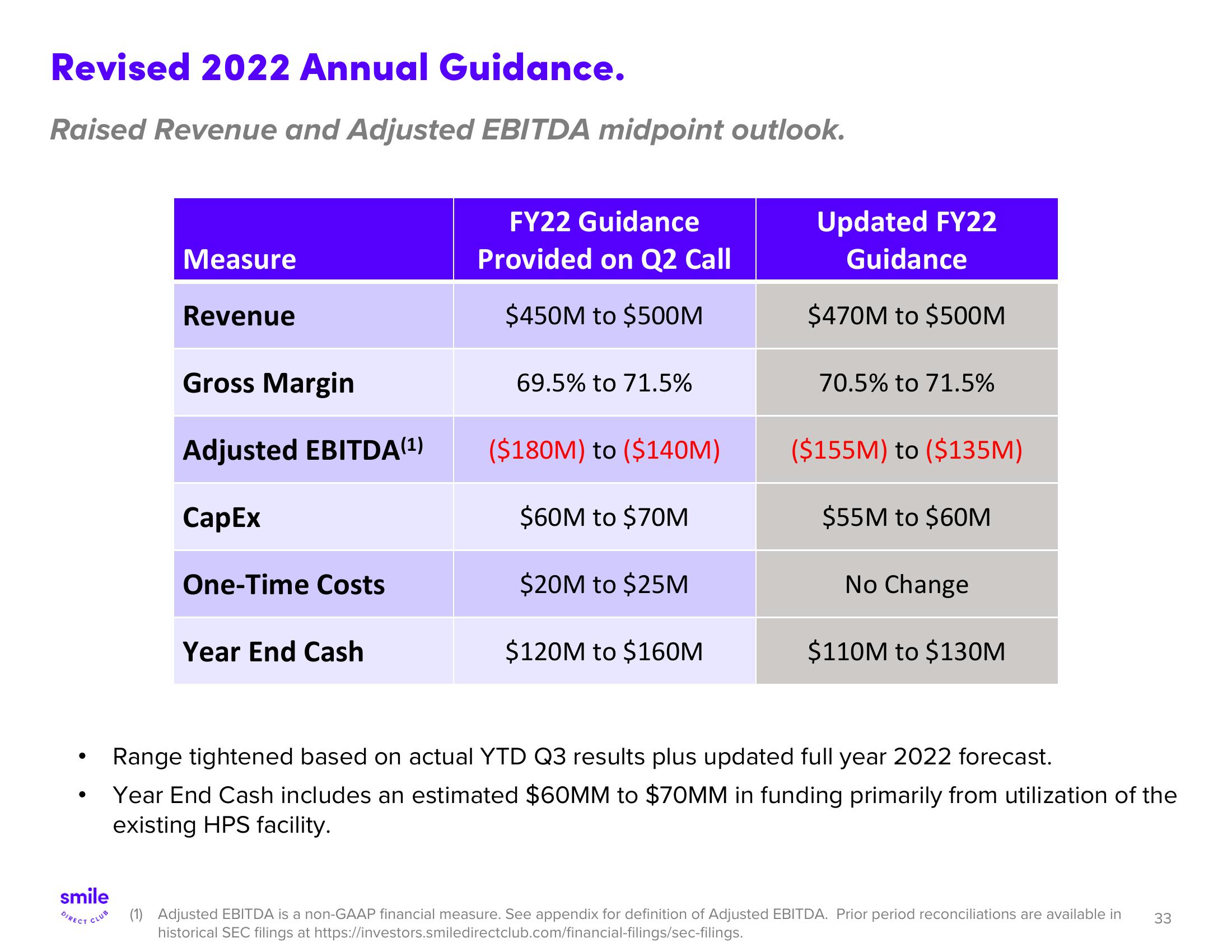

Revised 2022 Annual Guidance.

Raised Revenue and Adjusted EBITDA midpoint outlook.

●

●

smile

DIRECT

CLUB

Measure

Revenue

Gross Margin

Adjusted EBITDA(¹)

CapEx

One-Time Costs

Year End Cash

FY22 Guidance

Provided on Q2 Call

$450M to $500M

69.5% to 71.5%

($180M) to ($140M)

$60M to $70M

$20M to $25M

$120M to $160M

Updated FY22

Guidance

$470M to $500M

70.5% to 71.5%

($155M) to ($135M)

$55M to $60M

No Change

$110M to $130M

Range tightened based on actual YTD Q3 results plus updated full year 2022 forecast.

Year End Cash includes an estimated $60MM to $70MM in funding primarily from utilization of the

existing HPS facility.

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA. Prior period reconciliations are available in 33

historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.View entire presentation