First Merchants Investor Presentation Deck

Business Highlights

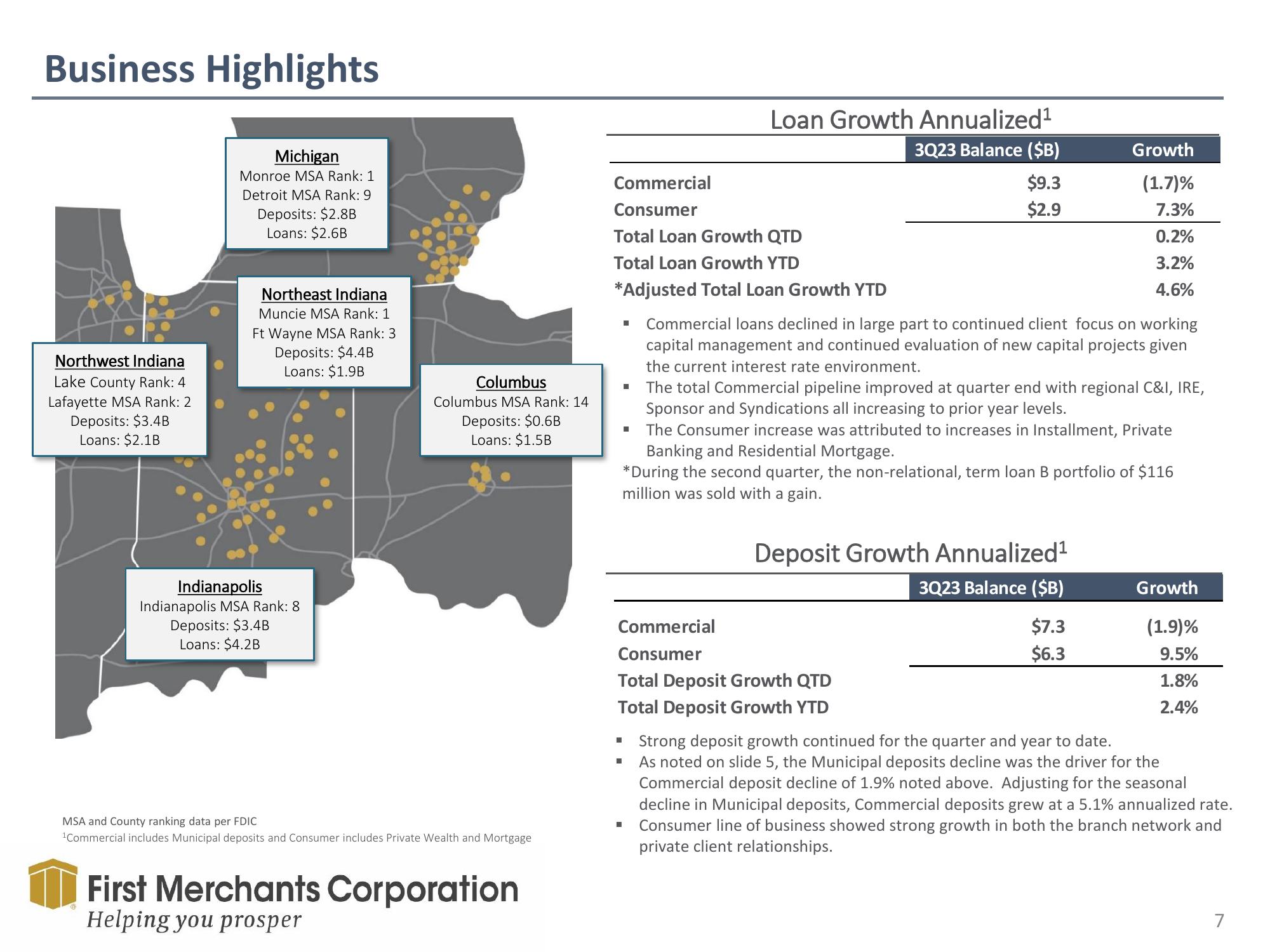

Northwest Indiana

Lake County Rank: 4

Lafayette MSA Rank: 2

Deposits: $3.4B

Loans: $2.1B

Michigan

Monroe MSA Rank: 1.

Detroit MSA Rank: 9

Deposits: $2.8B

Loans: $2.6B

Northeast Indiana

Muncie MSA Rank: 1

Ft Wayne MSA Rank: 3

Deposits: $4.4B

Loans: $1.9B

Indianapolis

Indianapolis MSA Rank: 8

Deposits: $3.4B

Loans: $4.2B

Columbus

Columbus MSA Rank: 14

Deposits: $0.6B

Loans: $1.5B

MSA and County ranking data per FDIC

¹Commercial includes Municipal deposits and Consumer includes Private Wealth and Mortgage

First Merchants Corporation

Helping you prosper

Commercial

Consumer

Total Loan Growth QTD

Total Loan Growth YTD

*Adjusted Total Loan Growth YTD

■

Loan Growth Annualized¹

3Q23 Balance ($B)

Commercial

Consumer

$9.3

$2.9

Commercial loans declined in large part to continued client focus on working

capital management and continued evaluation of new capital projects given

the current interest rate environment.

■

The total Commercial pipeline improved at quarter end with regional C&I, IRE,

Sponsor and Syndications all increasing to prior year levels.

The Consumer increase was attributed to increases in Installment, Private

Banking and Residential Mortgage.

*During the second quarter, the non-relational, term loan B portfolio of $116

million was sold with a gain.

Total Deposit Growth QTD

Total Deposit Growth YTD

Growth

(1.7)%

7.3%

0.2%

3.2%

4.6%

Deposit Growth Annualized¹

3Q23 Balance ($B)

$7.3

$6.3

Growth

(1.9)%

9.5%

1.8%

2.4%

▪ Strong deposit growth continued for the quarter and year to date.

■

As noted on slide 5, the Municipal deposits decline was the driver for the

Commercial deposit decline of 1.9% noted above. Adjusting for the seasonal

decline in Municipal deposits, Commercial deposits grew at a 5.1% annualized rate.

Consumer line of business showed strong growth in both the branch network and

private client relationships.

7View entire presentation