Ratification of PwC as Auditor

MANAGEMENT PROPOSALS

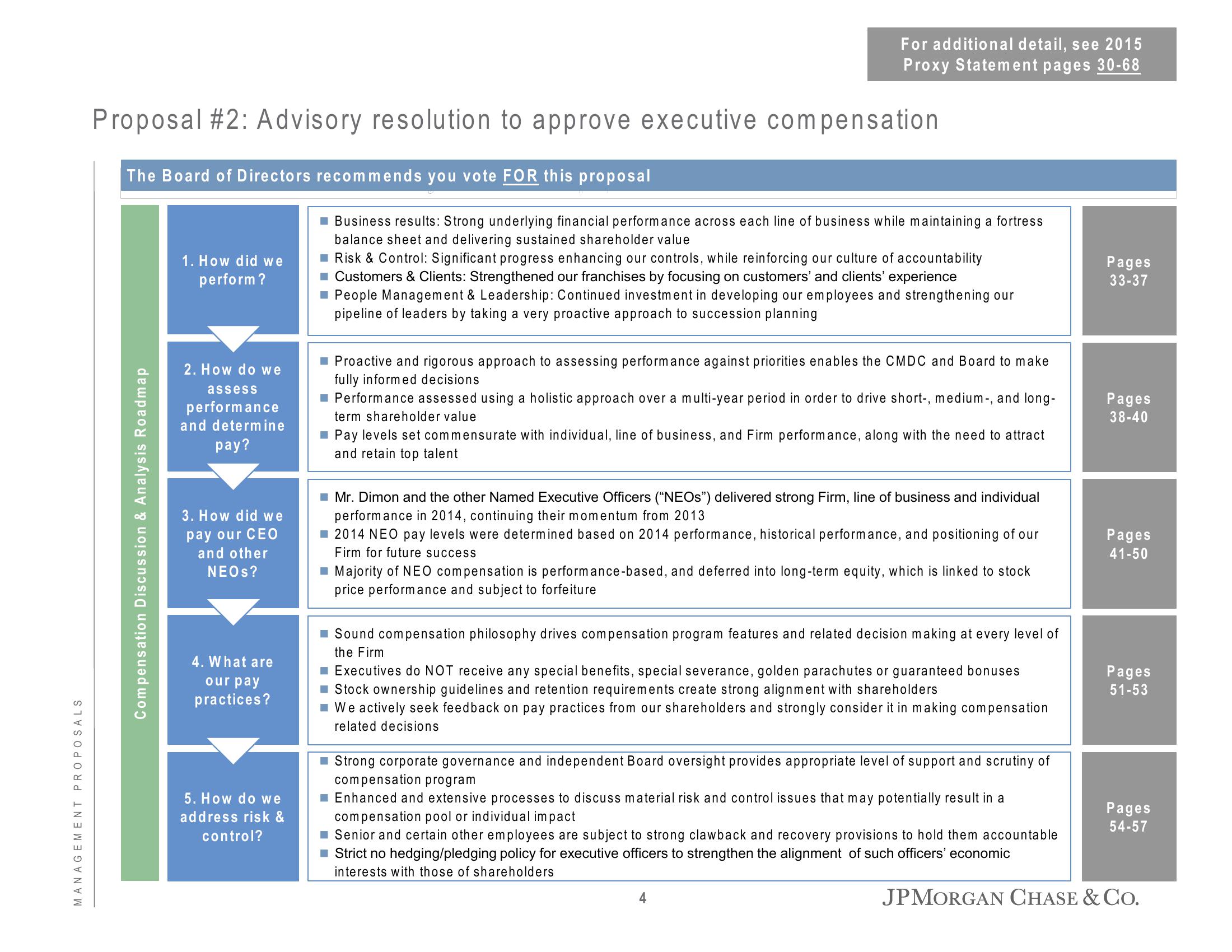

Proposal #2: Advisory resolution to approve executive compensation

The Board of Directors recommends you vote FOR this proposal

Compensation Discussion & Analysis Roadmap

1. How did we

perform?

2. How do we

assess

performance

and determine

pay?

3. How did we

pay our CEO

and other

NEOS?

4. What are

our pay

practices?

5. How do we

address risk &

control?

For additional detail, see 2015

Proxy Statement pages 30-68

Business results: Strong underlying financial performance across each line of business while maintaining a fortress

balance sheet and delivering sustained shareholder value

■ Risk & Control: Sig cant progress enhancing our controls, while reinforcing our culture of accountability

■ Customers & Clients: Strengthened our franchises by focusing on customers' and clients' experience

■ People Management & Leadership: Continued investment in developing our employees and strengthening our

pipeline of leaders by taking a very proactive approach to succession planning

Proactive and rigorous approach to assessing performance against priorities enables the CMDC and Board to make

fully informed decisions

■ Performance assessed using a holistic approach over a multi-year period in order to drive short-, medium-, and long-

term shareholder value

■ Pay levels set commensurate with individual, line of business, and Firm performance, along with the need to attract

and retain top talent

■ Mr. Dimon and the other Named Executive Officers ("NEOS") delivered strong Firm, line of business and individual

performance in 2014, continuing their momentum from 2013

■2014 NEO pay levels were determined based on 2014 performance, historical performance, and positioning of our

Firm for future success

Majority of NEO compensation is performance-based, and deferred into long-term equity, which is linked to stock

price performance and subject to forfeiture

■ Sound compensation philosophy drives compensation program features and related decision making at every level of

the Firm

■ Executives do NOT receive any special benefits, special severance, golden parachutes or guaranteed bonuses

■ Stock ownership guidelines and retention requirements create strong alignment with shareholders

■ We actively seek feedback on pay practices from our shareholders and strongly consider it in making compensation

related decisions

■ Strong corporate governance and independent Board oversight provides appropriate level of support and scrutiny of

compensation program

■ Enhanced and extensive processes to discuss material risk and control issues that may potentially result in a

compensation pool or individual impact

■ Senior and certain other employees are subject to strong clawback and recovery provisions to hold them accountable

■ Strict no hedging/pledging policy for executive officers to strengthen the alignment of such officers' economic

interests with those of shareholders

4

Pages

33-37

Pages

38-40

Pages

41-50

Pages

51-53

Pages

54-57

JPMORGAN CHASE & Co.View entire presentation