Levi Strauss Investor Day Presentation Deck

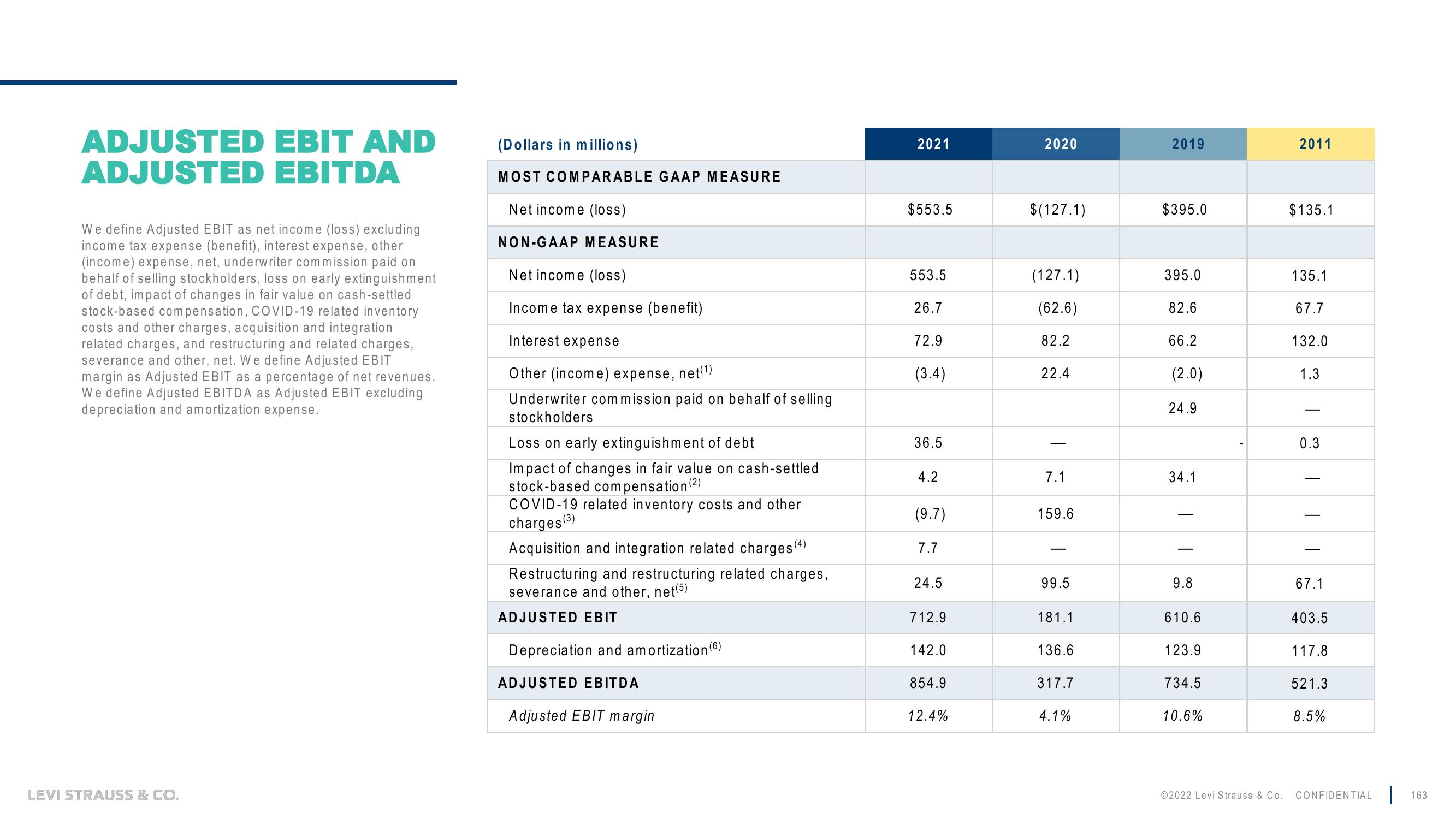

ADJUSTED EBIT AND

ADJUSTED EBITDA

We define Adjusted EBIT as net income (loss) excluding

income tax expense (benefit), interest expense, other

(income) expense, net, underwriter commission paid on

behalf of selling stockholders, loss on early extinguishment

of debt, impact of changes in fair value on cash-settled

stock-based compensation, COVID-19 related inventory

costs and other charges, acquisition and integration

related charges, and restructuring and related charges,

severance and other, net. We define Adjusted EBIT

margin as Adjusted EBIT as a percentage of net revenues.

We define Adjusted EBITDA as Adjusted EBIT excluding

depreciation and amortization expense.

LEVI STRAUSS & CO.

(Dollars in millions)

MOST COMPARABLE GAAP MEASURE

Net income (loss)

NON-GAAP MEASURE

Net income (loss)

Income tax expense (benefit)

Interest expense

Other (income) expense, net(¹)

Underwriter commission paid on behalf of selling

stockholders

Loss on early extinguishment of debt

Impact of changes in fair value on cash-settled

stock-based compensation (²)

COVID-19 related inventory costs and other

charges (³)

Acquisition and integration related charges (4)

Restructuring and restructuring related charges,

severance and other, net(5)

ADJUSTED EBIT

Depreciation and amortization (6)

ADJUSTED EBITDA

Adjusted EBIT margin

2021

$553.5

553.5

26.7

72.9

(3.4)

36.5

4.2

(9.7)

7.7

24.5

712.9

142.0

854.9

12.4%

2020

$(127.1)

(127.1)

(62.6)

82.2

22.4

7.1

159.6

99.5

181.1

136.6

317.7

4.1%

2019

$395.0

395.0

82.6

66.2

(2.0)

24.9

34.1

9.8

610.6

123.9

734.5

10.6%

2011

$135.1

135.1

67.7

132.0

1.3

0.3

| |

67.1

403.5

117.8

521.3

8.5%

©2022 Levi Strauss & Co. CONFIDENTIAL

163View entire presentation