Kinnevik Results Presentation Deck

Intro

Net Asset Value

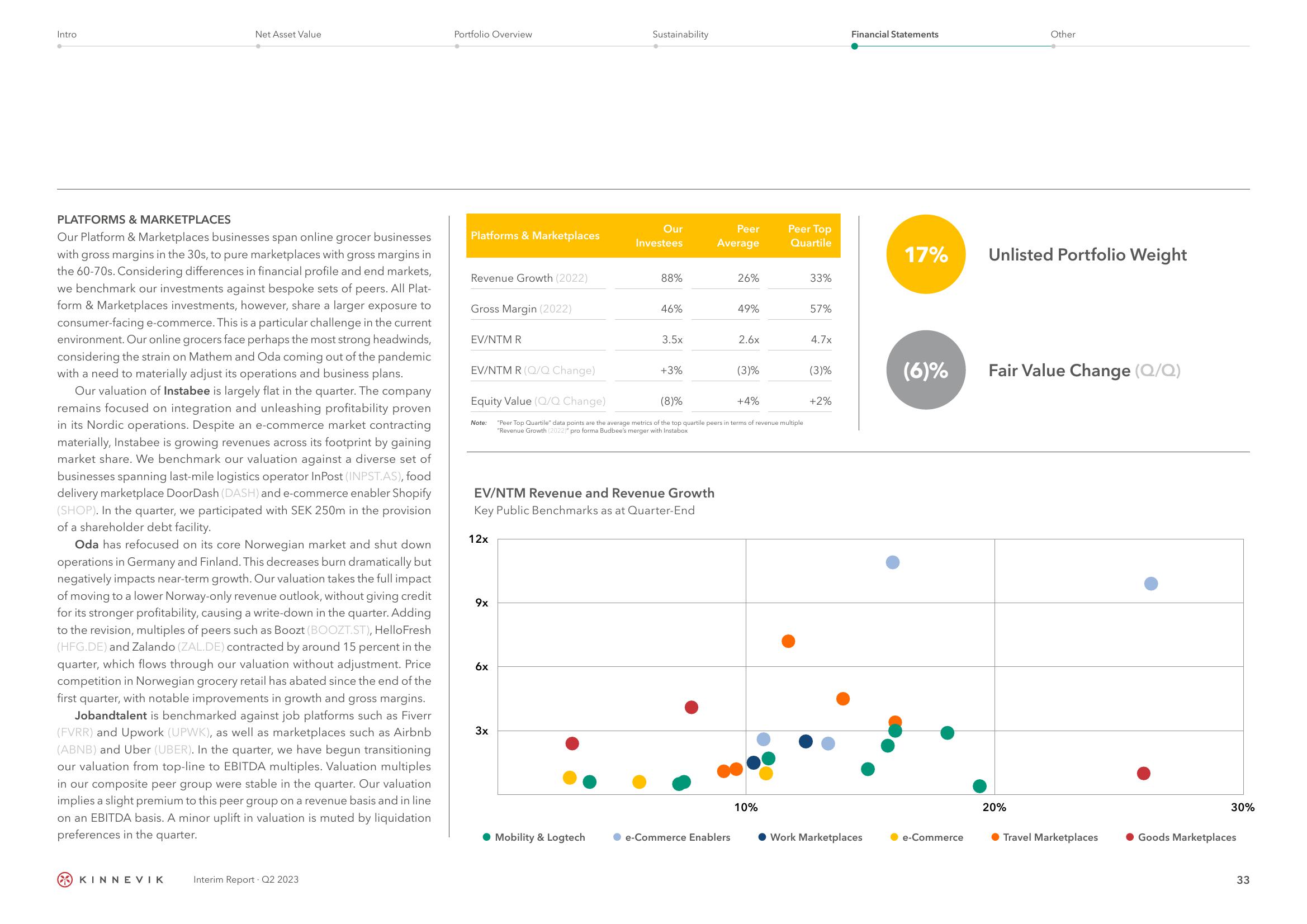

PLATFORMS & MARKETPLACES

Our Platform & Marketplaces businesses span online grocer businesses

with gross margins in the 30s, to pure marketplaces with gross margins in

the 60-70s. Considering differences in financial profile and end markets,

we benchmark our investments against bespoke sets of peers. All Plat-

form & Marketplaces investments, however, share a larger exposure to

consumer-facing e-commerce. This is a particular challenge in the current

environment. Our online grocers face perhaps the most strong headwinds,

considering the strain on Mathem and Oda coming out of the pandemic

with a need to materially adjust its operations and business plans.

Our valuation of Instabee is largely flat in the quarter. The company

remains focused on integration and unleashing profitability proven

in its Nordic operations. Despite an e-commerce market contracting

materially, Instabee is growing revenues across its footprint by gaining

market share. We benchmark our valuation against a diverse set of

businesses spanning last-mile logistics operator InPost (INPST.AS), food

delivery marketplace DoorDash (DASH) and e-commerce enabler Shopify

(SHOP). In the quarter, we participated with SEK 250m in the provision

of a shareholder debt facility.

Oda has refocused on its core Norwegian market and shut down

operations in Germany and Finland. This decreases burn dramatically but

negatively impacts near-term growth. Our valuation takes the full impact

of moving to a lower Norway-only revenue outlook, without giving credit

for its stronger profitability, causing a write-down in the quarter. Adding

to the revision, multiples of peers such as Boozt (BOOZT.ST), HelloFresh

(HFG.DE) and Zalando (ZAL.DE) contracted by around 15 percent in the

quarter, which flows through our valuation without adjustment. Price

competition in Norwegian grocery retail has abated since the end of the

first quarter, with notable improvements in growth and gross margins.

Jobandtalent is benchmarked against job platforms such as Fiverr

(FVRR) and Upwork (UPWK), as well as marketplaces such as Airbnb

(ABNB) and Uber (UBER). In the quarter, we have begun transitioning

our valuation from top-line to EBITDA multiples. Valuation multiples

in our composite peer group were stable in the quarter. Our valuation

implies a slight premium to this peer group on a revenue basis and in line

on an EBITDA basis. A minor uplift in valuation is muted by liquidation

preferences in the quarter.

KINNEVIK

Interim Report Q2 2023

Portfolio Overview

Platforms & Marketplaces

Revenue Growth (2022)

Gross Margin (2022)

EV/NTM R

EV/NTM R (Q/Q Change)

Note:

12x

9x

6x

Sustainability

3x

Our

Investees

● Mobility & Logtech

88%

EV/NTM Revenue and Revenue Growth

Key Public Benchmarks as at Quarter-End

46%

3.5x

+3%

Equity Value (Q/Q Change)

(8)%

"Peer Top Quartile" data points are the average metrics of the top quartile peers in terms of revenue multiple

"Revenue Growth (2022)" pro forma Budbee's merger with Instabox

Peer

Average

26%

e-Commerce Enablers

49%

2.6x

(3)%

+4%

Peer Top

Quartile

10%

33%

57%

4.7x

(3)%

+2%

Financial Statements

Work Marketplaces

17% Unlisted Portfolio Weight

(6)%

e-Commerce

Other

Fair Value Change (Q/Q)

20%

Travel Marketplaces

30%

Goods Marketplaces

33View entire presentation