Affirm Results Presentation Deck

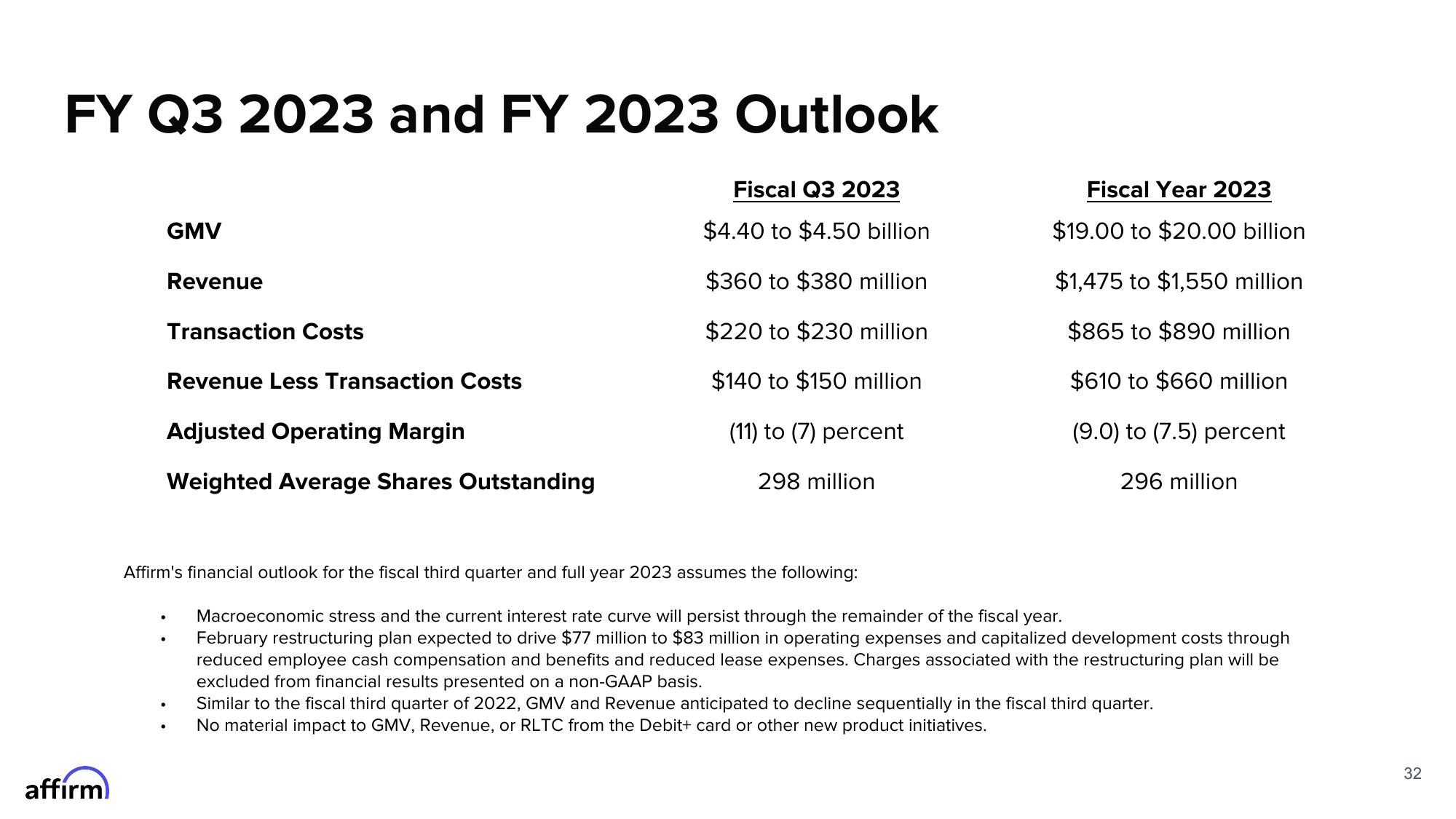

FY Q3 2023 and FY 2023 Outlook

Fiscal Q3 2023

$4.40 to $4.50 billion

$360 to $380 million

$220 to $230 million

$140 to $150 million

(11) to (7) percent

affirm

GMV

Revenue

Transaction Costs

Revenue Less Transaction Costs

Adjusted Operating Margin

Weighted Average Shares Outstanding

298 million

Fiscal Year 2023

$19.00 to $20.00 billion

$1,475 to $1,550 million

$865 to $890 million

$610 to $660 million

(9.0) to (7.5) percent

296 million

Affirm's financial outlook for the fiscal third quarter and full year 2023 assumes the following:

Macroeconomic stress and the current interest rate curve will persist through the remainder of the fiscal year.

February restructuring plan expected to drive $77 million to $83 million in operating expenses and capitalized development costs through

reduced employee cash compensation and benefits and reduced lease expenses. Charges associated with the restructuring plan will be

excluded from financial results presented on a non-GAAP basis.

Similar to the fiscal third quarter of 2022, GMV and Revenue anticipated to decline sequentially in the fiscal third quarter.

No material impact to GMV, Revenue, or RLTC from the Debit+ card or other new product initiatives.

32View entire presentation