Marti Investor Presentation Deck

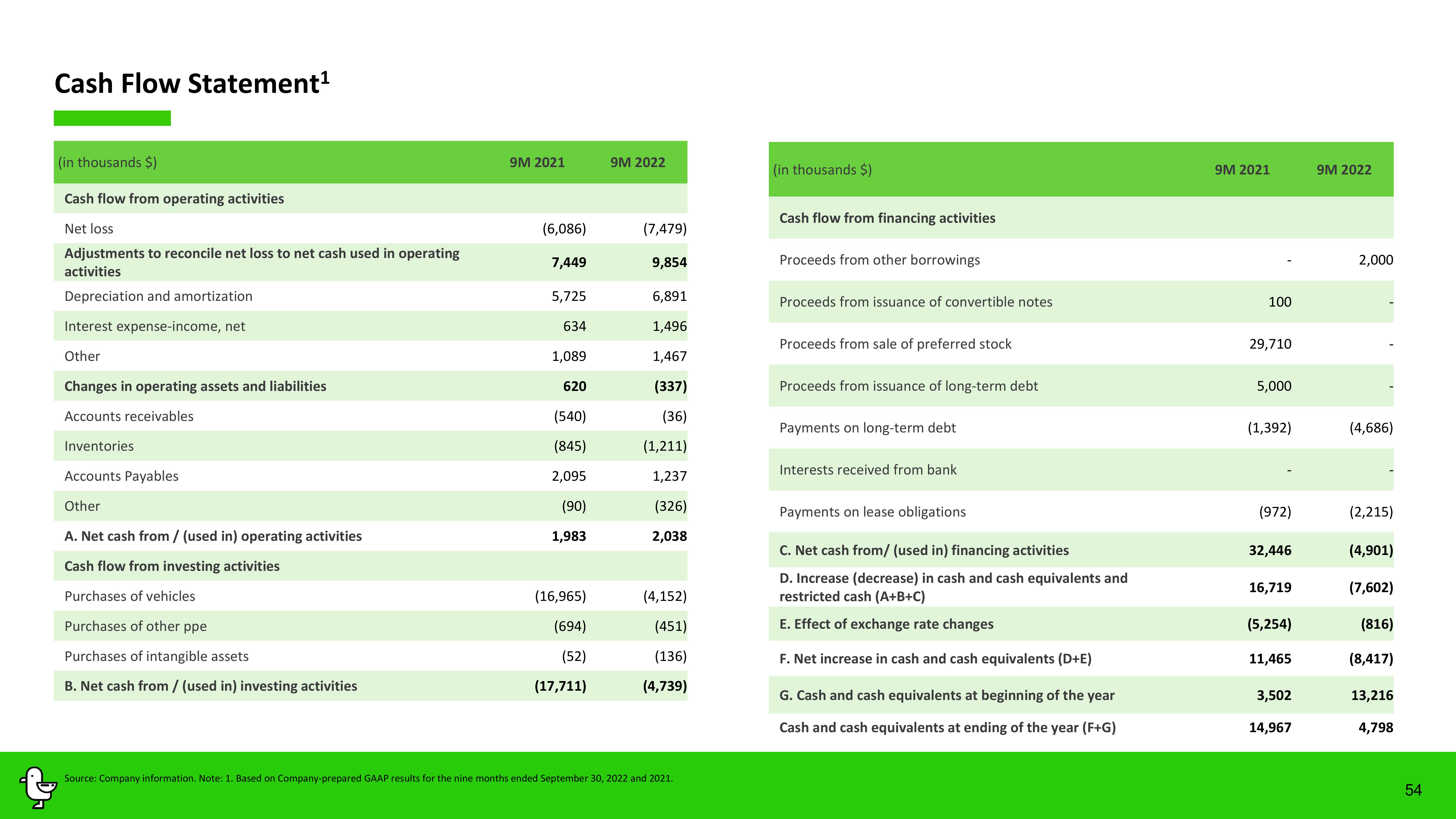

Cash Flow Statement¹

(in thousands $)

Cash flow from operating activities

Net loss

Adjustments to reconcile net loss to net cash used in operating

activities

Depreciation and amortization

Interest expense-income, net

Other

Changes in operating assets and liabilities

Accounts receivables

Inventories

Accounts Payables

Other

A. Net cash from / (used in) operating activities

Cash flow from investing activities

Purchases of vehicles

Purchases of other ppe

Purchases of intangible assets

B. Net cash from / (used in) investing activities

9M 2021

(6,086)

7,449

5,725

634

1,089

620

(540)

(845)

2,095

(90)

1,983

(16,965)

(694)

(52)

(17,711)

9M 2022

(7,479)

9,854

6,891

1,496

1,467

(337)

(36)

(1,211)

1,237

(326)

2,038

(4,152)

(451)

(136)

(4,739)

Source: Company information. Note: 1. Based on Company-prepared GAAP results for the nine months ended September 30, 2022 and 2021.

(in thousands $)

Cash flow from financing activities

Proceeds from other borrowings

Proceeds from issuance of convertible notes

Proceeds from sale of preferred stock

Proceeds from issuance of long-term debt

Payments on long-term debt

Interests received from bank

Payments on lease obligations

C. Net cash from/ (used in) financing activities

D. Increase (decrease) in cash and cash equivalents and

restricted cash (A+B+C)

E. Effect of exchange rate changes

F. Net increase in cash and cash equivalents (D+E)

G. Cash and cash equivalents at beginning of the year

Cash and cash equivalents at ending of the year (F+G)

9M 2021

100

29,710

5,000

(1,392)

(972)

32,446

16,719

(5,254)

11,465

3,502

14,967

9M 2022

2,000

(4,686)

(2,215)

(4,901)

(7,602)

(816)

(8,417)

13,216

4,798

54View entire presentation