Deliveroo Results Presentation Deck

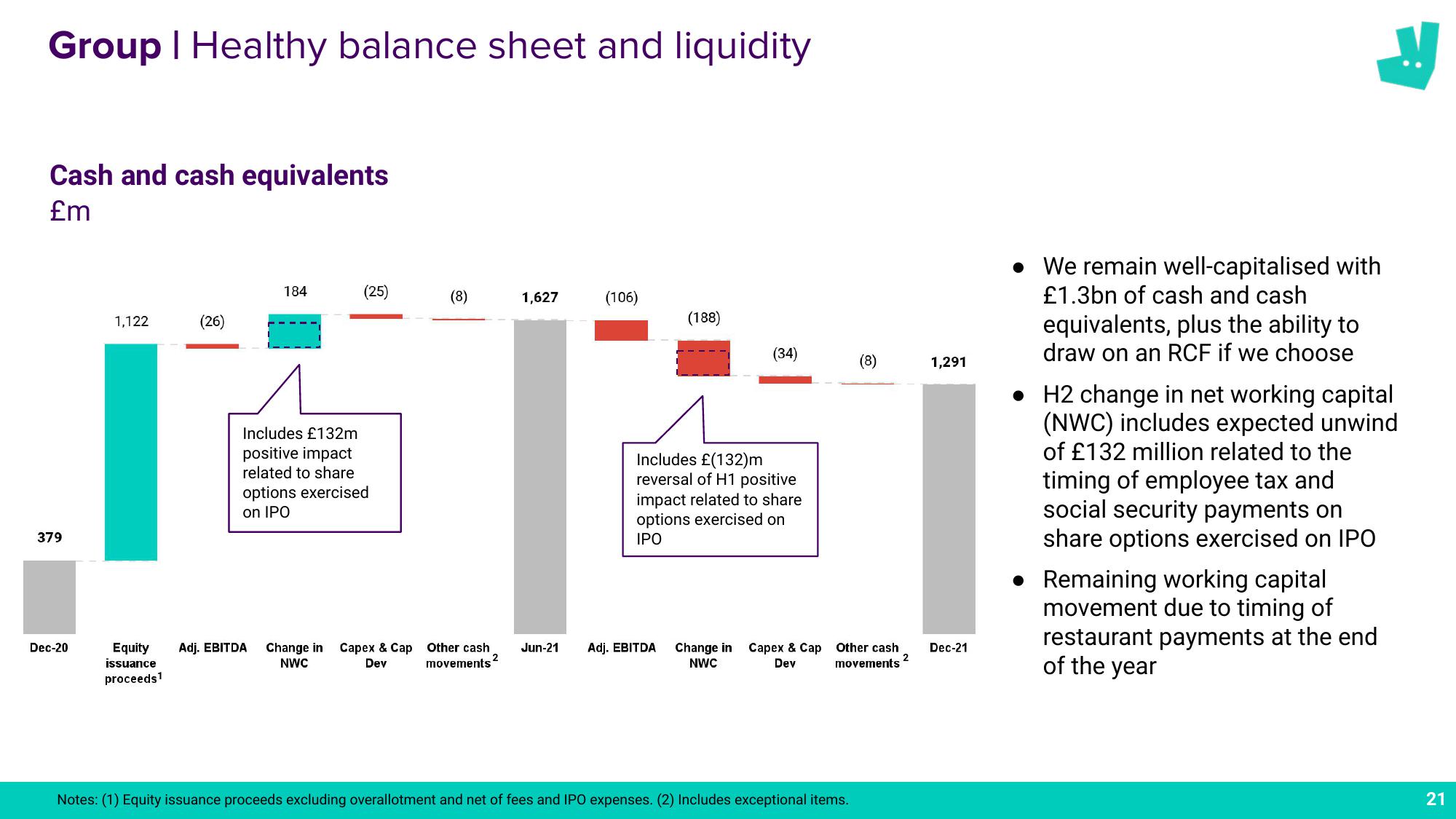

Group | Healthy balance sheet and liquidity

Cash and cash equivalents

£m

379

Dec-20

1,122

Equity

issuance

proceeds ¹

(26)

184

Adj. EBITDA

(25)

Includes £132m

positive impact

related to share

options exercised

on IPO

Change in Capex & Cap

NWC

Dev

(8)

Other cash

movements

2

1,627

(106)

(188)

(34)

Includes £(132)m

reversal of H1 positive

Jun-21 Adj. EBITDA

impact related to share

options exercised on

IPO

(8)

Change in Capex & Cap Other cash

movements 2

NWC

Dev

Notes: (1) Equity issuance proceeds excluding overallotment and net of fees and IPO expenses. (2) Includes exceptional items.

1,291

Dec-21

• We remain well-capitalised with

£1.3bn of cash and cash

equivalents, plus the ability to

draw on an RCF if we choose

• H2 change in net working capital

(NWC) includes expected unwind

of £132 million related to the

timing of employee tax and

social security payments on

share options exercised on IPO

• Remaining working capital

movement due to timing of

restaurant payments at the end

of the year

21View entire presentation