Lion Electric Investor Presentation Deck

Appendix C - Non-IFRS Measures and Other Performance Metrics

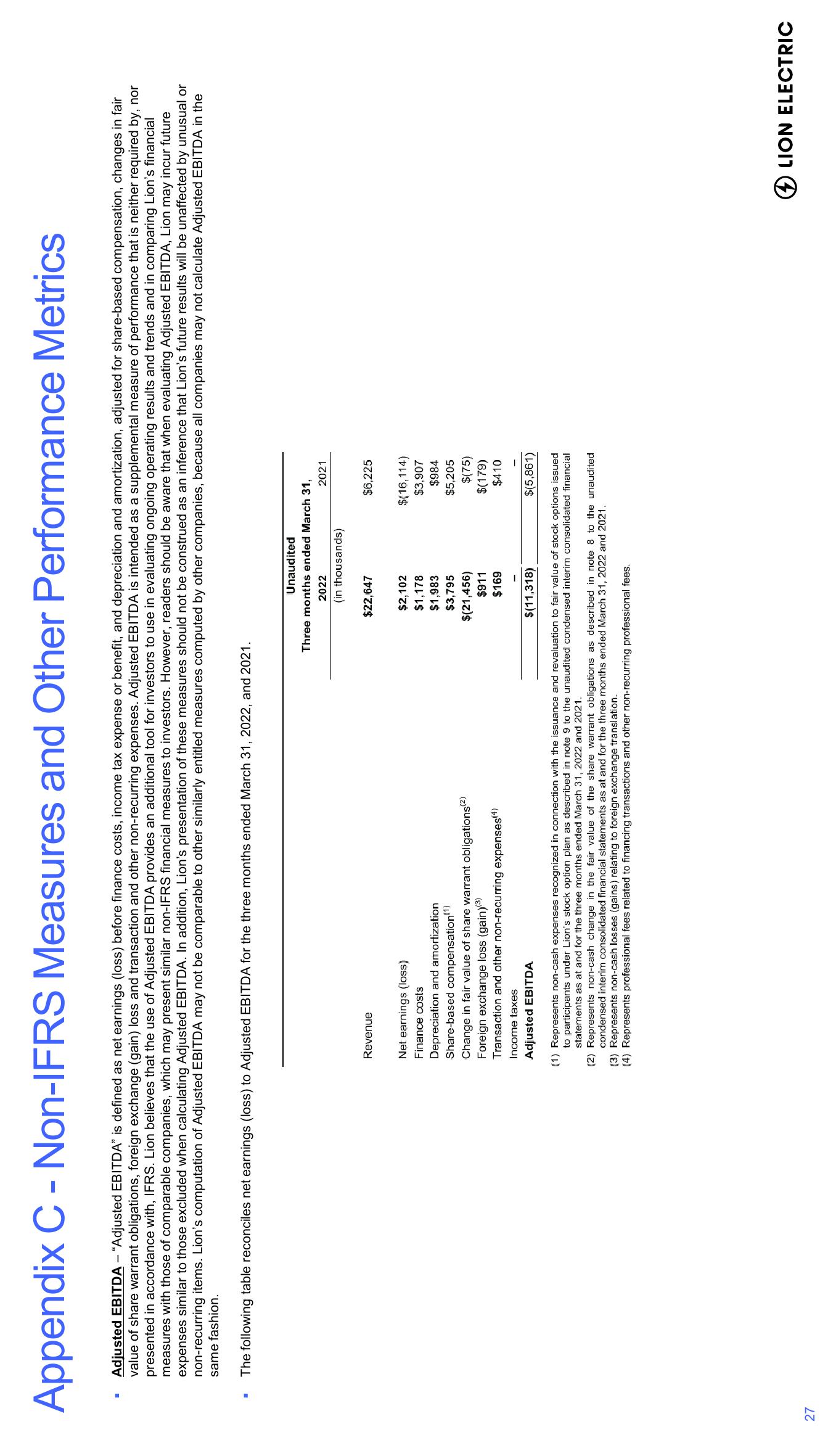

Adjusted EBITDA - "Adjusted EBITDA" is defined as net earnings (loss) before finance costs, income tax expense or benefit, and depreciation and amortization, adjusted for share-based compensation, changes in fair

value of share warrant obligations, foreign exchange (gain) loss and transaction and other non-recurring expenses. Adjusted EBITDA is intended as a supplemental measure of performance that is neither required by, nor

presented in accordance with, IFRS. Lion believes that the use of Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing Lion's financial

measures with those of comparable companies, which may present similar non-IFRS financial measures to investors. However, readers should be aware that when evaluating Adjusted EBITDA, Lion may incur future

expenses similar to those excluded when calculating Adjusted EBITDA. In addition, Lion's presentation of these measures should not be construed as an inference that Lion's future results will be unaffected by unusual or

non-recurring items. Lion's computation of Adjusted EBITDA may not be comparable to other similarly entitled measures computed by other companies, because all companies may not calculate Adjusted EBITDA in the

same fashion.

The following table reconciles net earnings (loss) to Adjusted EBITDA for the three months ended March 31, 2022, and 2021.

27

■

.

Revenue

Net earnings (loss)

Finance costs

Depreciation and amortization

Share-based compensation(¹)

Change in fair value of share warrant obligations(²)

Foreign exchange loss (gain)(3)

Transaction and other non-recurring expenses(4)

Income taxes

Adjusted EBITDA

Unaudited

Three months ended March 31,

2022

(in thousands)

$22,647

$2,102

$1,178

$1,983

$3,795

$(21,456)

$911

$169

2021

$6,225

$(16,114)

$3,907

$984

$5,205

$(75)

$(179)

$410

$(11,318)

$(5,861)

(1) Represents non-cash expenses recognized in connection with the issuance and revaluation to fair value of stock options issued

to participants under Lion's stock option plan as described in note 9 to the unaudited condensed interim consolidated financial

statements as at and for the three months ended March 31, 2022 and 2021.

(2) Represents non-cash change in the fair value of the share warrant obligations as described in note 8 to the unaudited

condensed interim consolidated financial statements as at and for the three months ended March 31, 2022 and 2021.

(3) Represents non-cash losses (gains) relating to foreign exchange translation.

(4) Represents professional fees related to financing transactions and other non-recurring professional fees.

LION ELECTRICView entire presentation