Deutsche Bank Results Presentation Deck

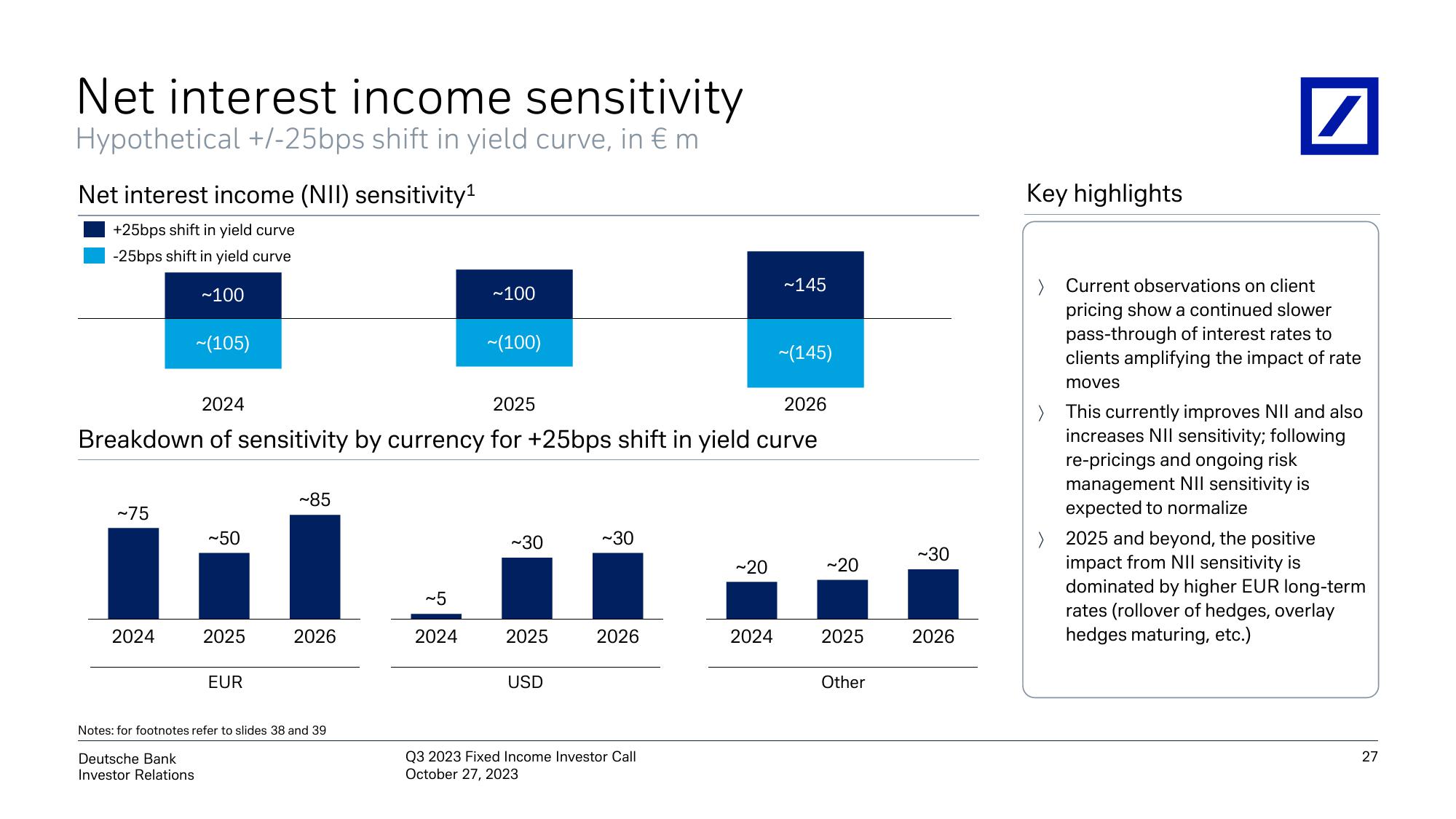

Net interest income sensitivity

Hypothetical +/-25bps shift in yield curve, in € m

Net interest income (NII) sensitivity¹

+25bps shift in yield curve

-25bps shift in yield curve

~100

~75

2024

~(105)

Deutsche Bank

Investor Relations

2024

2025

2026

Breakdown of sensitivity by currency for +25bps shift in yield curve

~50

2025

EUR

~85

2026

Notes: for footnotes refer to slides 38 and 39

~100

~5

2024

~(100)

~30

2025

USD

~30

20

Q3 2023 Fixed Income Investor Call

October 27, 2023

~20

~145

2024

~(145)

~20

2025

Other

~30

2026

Key highlights

/

Current observations on client

pricing show a continued slower

pass-through of interest rates to

clients amplifying the impact of rate

moves

> This currently improves NII and also

increases NII sensitivity; following

re-pricings and ongoing risk

management NII sensitivity is

expected to normalize

2025 and beyond, the positive

impact from NII sensitivity is

dominated by higher EUR long-term

rates (rollover of hedges, overlay

hedges maturing, etc.)

27View entire presentation