KKR Real Estate Finance Trust Investor Presentation Deck

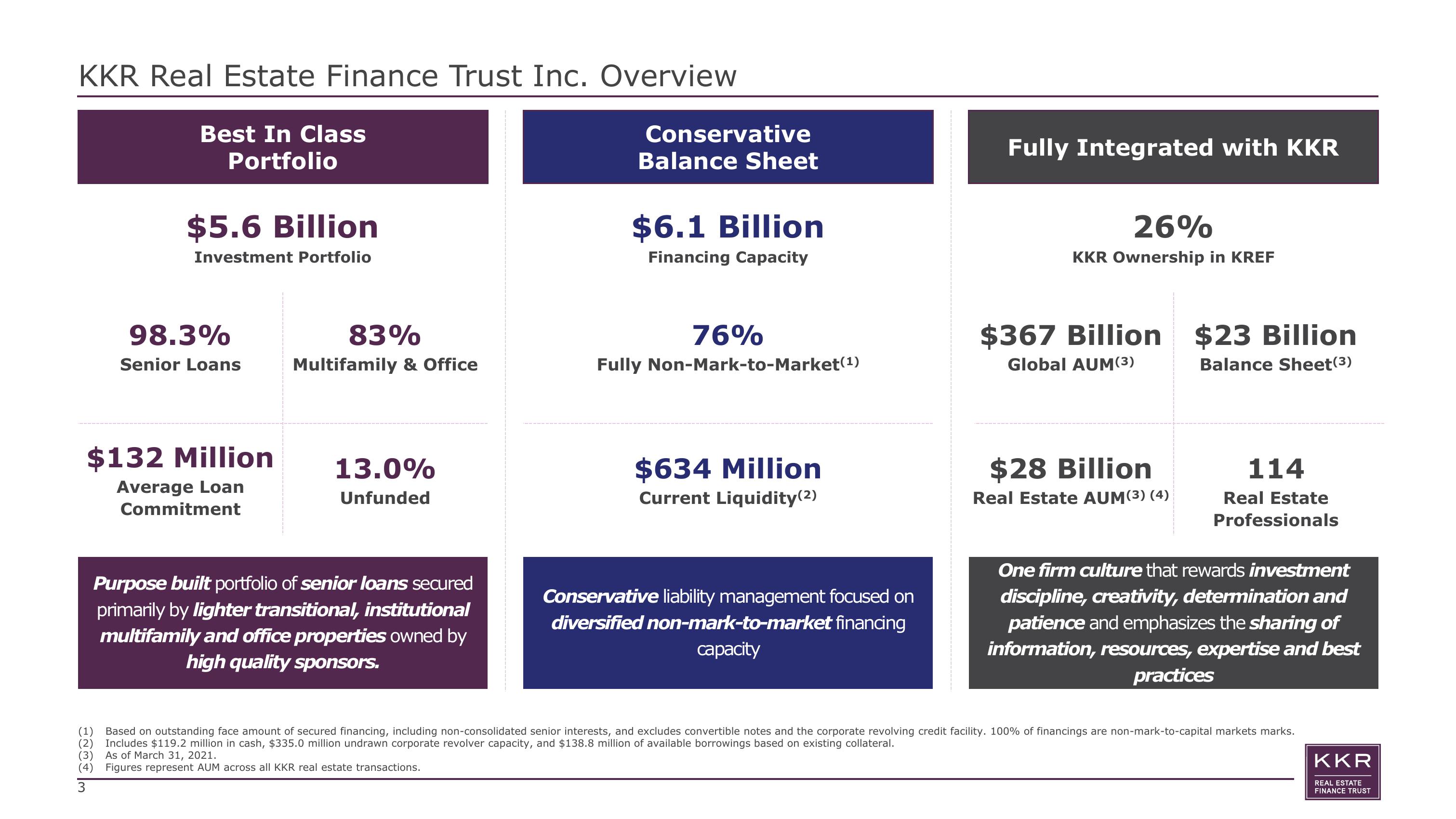

KKR Real Estate Finance Trust Inc. Overview

Best In Class

Portfolio

Im

$5.6 Billion

Investment Portfolio

3

98.3%

Senior Loans

$132 Million

Average Loan

Commitment

83%

Multifamily & Office

13.0%

Unfunded

Purpose built portfolio of senior loans secured

primarily by lighter transitional, institutional

multifamily and office properties owned by

high quality sponsors.

(3)

(4) Figures represent AUM across all KKR real estate transactions.

Conservative

Balance Sheet

$6.1 Billion

Financing Capacity

76%

Fully Non-Mark-to-Market (¹)

$634 Million

Current Liquidity (2)

Conservative liability management focused on

diversified non-mark-to-market financing

capacity

Fully Integrated with KKR

26%

KKR Ownership in KREF

$367 Billion $23 Billion

Global AUM(3)

Balance Sheet(³)

$28 Billion

Real Estate AUM(3) (4)

(1)

Based on outstanding face amount of secured financing, including non-consolidated senior interests, and excludes convertible notes and the corporate revolving credit facility. 100% of financings are non-mark-to-capital markets marks.

(2) Includes $119.2 million in cash, $335.0 million undrawn corporate revolver capacity, and $138.8 million of available borrowings based on existing collateral.

As of March 31, 2021.

114

Real Estate

Professionals

One firm culture that rewards investment

discipline, creativity, determination and

patience and emphasizes the sharing of

information, resources, expertise and best

practices

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation