AstraZeneca Results Presentation Deck

AstraZeneca: 2022-2025

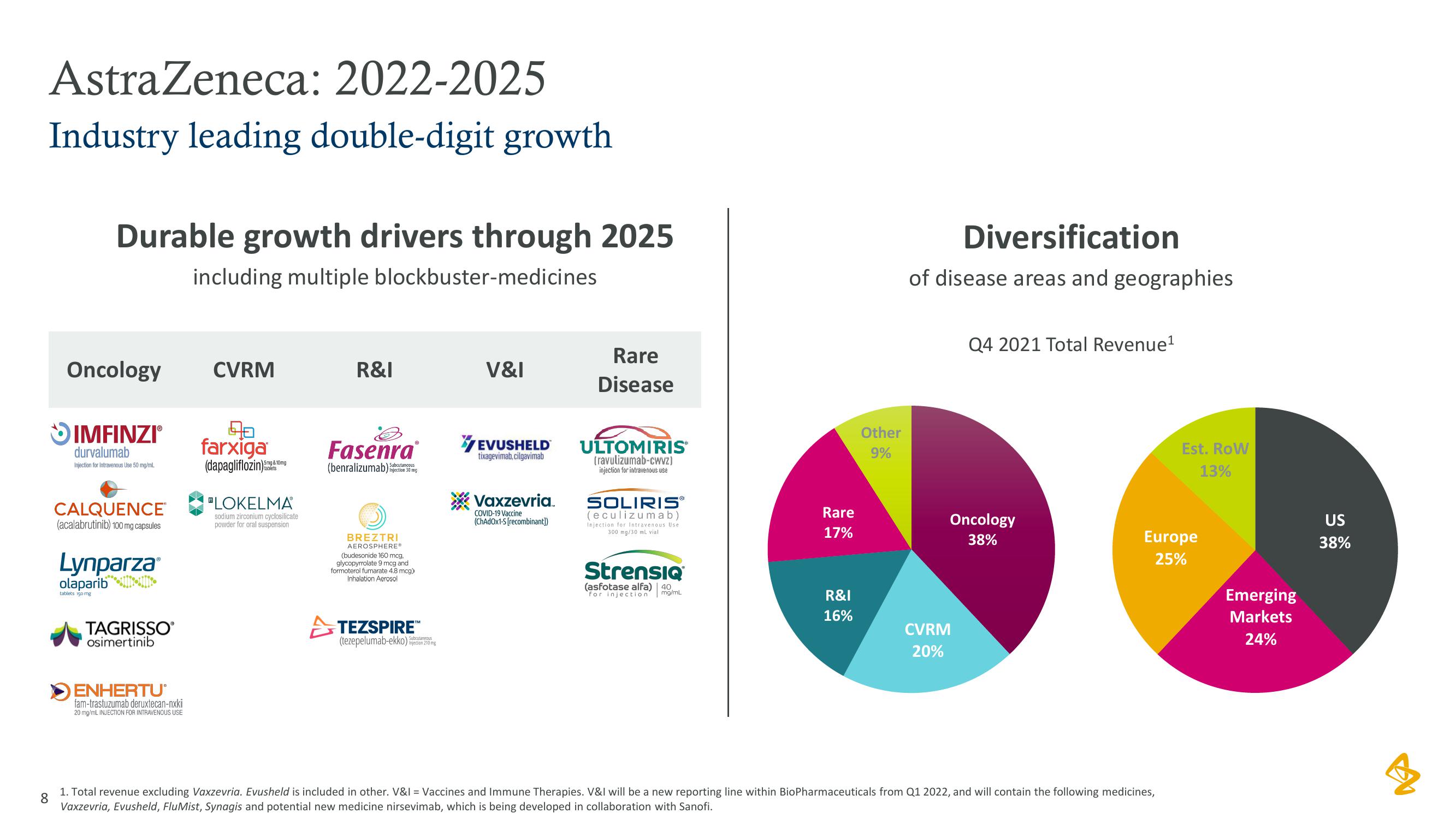

Industry leading double-digit growth

Durable growth drivers through 2025

including multiple blockbuster-medicines

Oncology

SIMFINZIⓇ

durvalumab

Injection for Intravenous Use 50 mg/ml

CALQUENCE®

(acalabrutinib) 100 mg capsules

Lynparza®

olaparib

tablets 150 mg

TAGRISSOⓇ

osimertinib

ENHERTU

fam-trastuzumab deruxtecan-nxki

20 mg/mL INJECTION FOR INTRAVENOUS USE

CVRM

19.0

farxiga

(dapagliflozin)

5mg & 10mg

LOKELMA

sodium zirconium cyclosilicate

powder for oral suspension

R&I

Fasenra

(benralizumab) injection 30 mg

BREZTRI

AEROSPHERE®

(budesonide 160 mcg.

glycopyrrolate 9 mcg and

formoterol fumarate 4.8 mcg)

Inhalation Aerosol

TEZSPIRE™

(tezepelumab-ekko) in 210 mg

V&I

EVUSHELD

tixagevimab, cilgavimab

Vaxzevria

COVID-19 Vaccine

(ChAdOx1-S [recombinant])

Rare

Disease

ULTOMIRIS

[ravulizumab-cwvZ)

injection for intravenous use

SOLIRIS

(eculizumab).

Injection for Intravenous Use

300 mg/30 mL vial

Strensiq

(asfotase alfa) 40,

for injection

mg/mL

Rare

17%

R&I

16%

Other

9%

Diversification

of disease areas and geographies

Q4 2021 Total Revenue¹

Oncology

38%

CVRM

20%

Est. Row

13%

Europe

25%

8

1. Total revenue excluding Vaxzevria. Evusheld is included in other. V&I = Vaccines and Immune Therapies. V&I will be a new reporting line within BioPharmaceuticals from Q1 2022, and will contain the following medicines,

Vaxzevria, Evusheld, FluMist, Synagis and potential new medicine nirsevimab, which is being developed in collaboration with Sanofi.

Emerging

Markets

24%

US

38%

BView entire presentation