FY 2023 Second Quarter Earnings Call

Bor: A case study in effective, cost-efficient restructuring

ADIENT

///

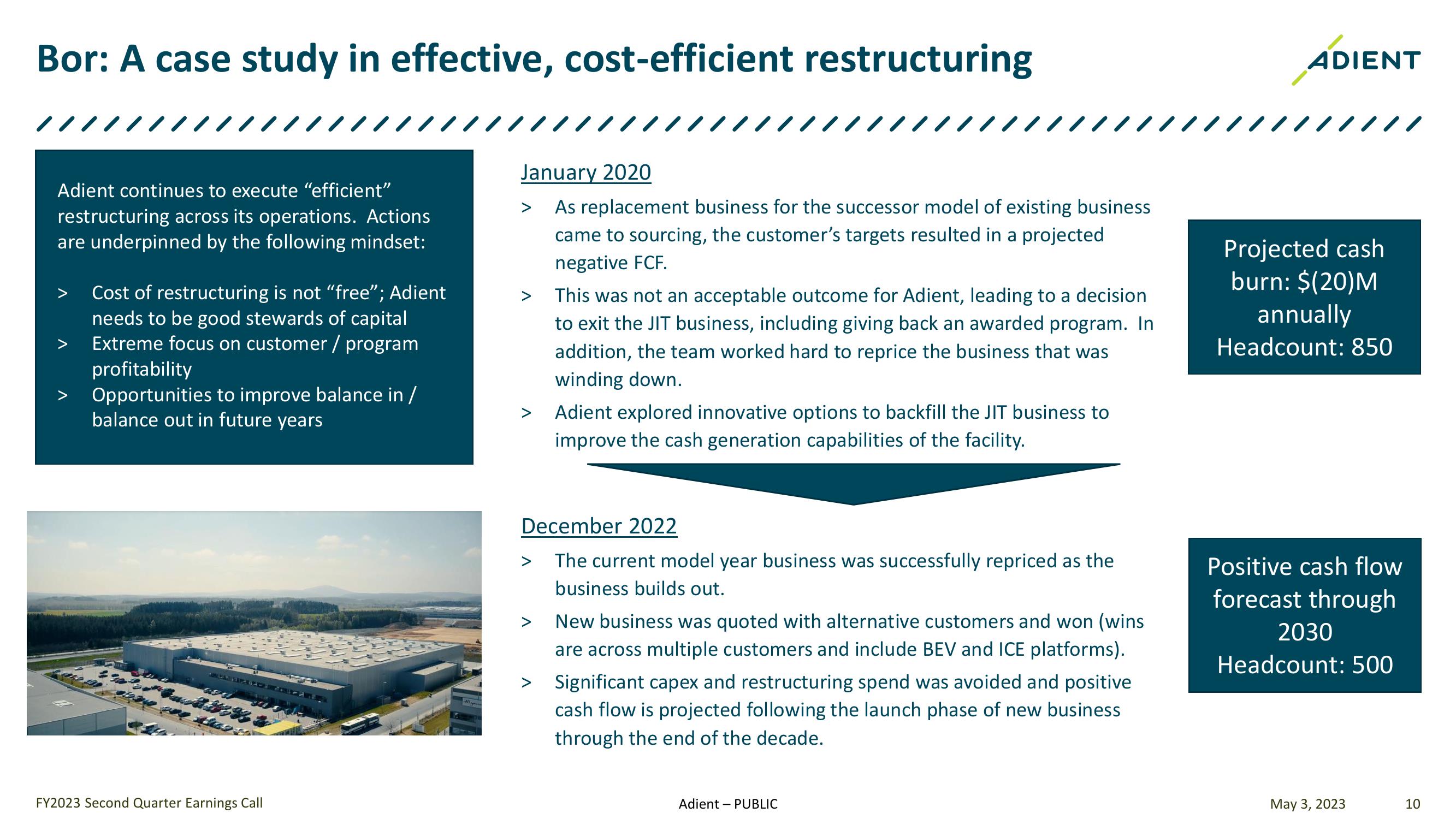

Adient continues to execute "efficient"

restructuring across its operations. Actions

are underpinned by the following mindset:

Cost of restructuring is not "free"; Adient

needs to be good stewards of capital

Extreme focus on customer / program

profitability

Opportunities to improve balance in /

balance out in future years

January 2020

> As replacement business for the successor model of existing business

came to sourcing, the customer's targets resulted in a projected

negative FCF.

>

>

This was not an acceptable outcome for Adient, leading to a decision

to exit the JIT business, including giving back an awarded program. In

addition, the team worked hard to reprice the business that was

winding down.

Adient explored innovative options to backfill the JIT business to

improve the cash generation capabilities of the facility.

Projected cash

burn: $(20)M

annually

Headcount: 850

FY2023 Second Quarter Earnings Call

December 2022

>

>

>

The current model year business was successfully repriced as the

business builds out.

New business was quoted with alternative customers and won (wins

are across multiple customers and include BEV and ICE platforms).

Significant capex and restructuring spend was avoided and positive

cash flow is projected following the launch phase of new business

through the end of the decade.

Positive cash flow

forecast through

2030

Headcount: 500

Adient PUBLIC

May 3, 2023

10View entire presentation