Bank of America Results Presentation Deck

Consumer Banking

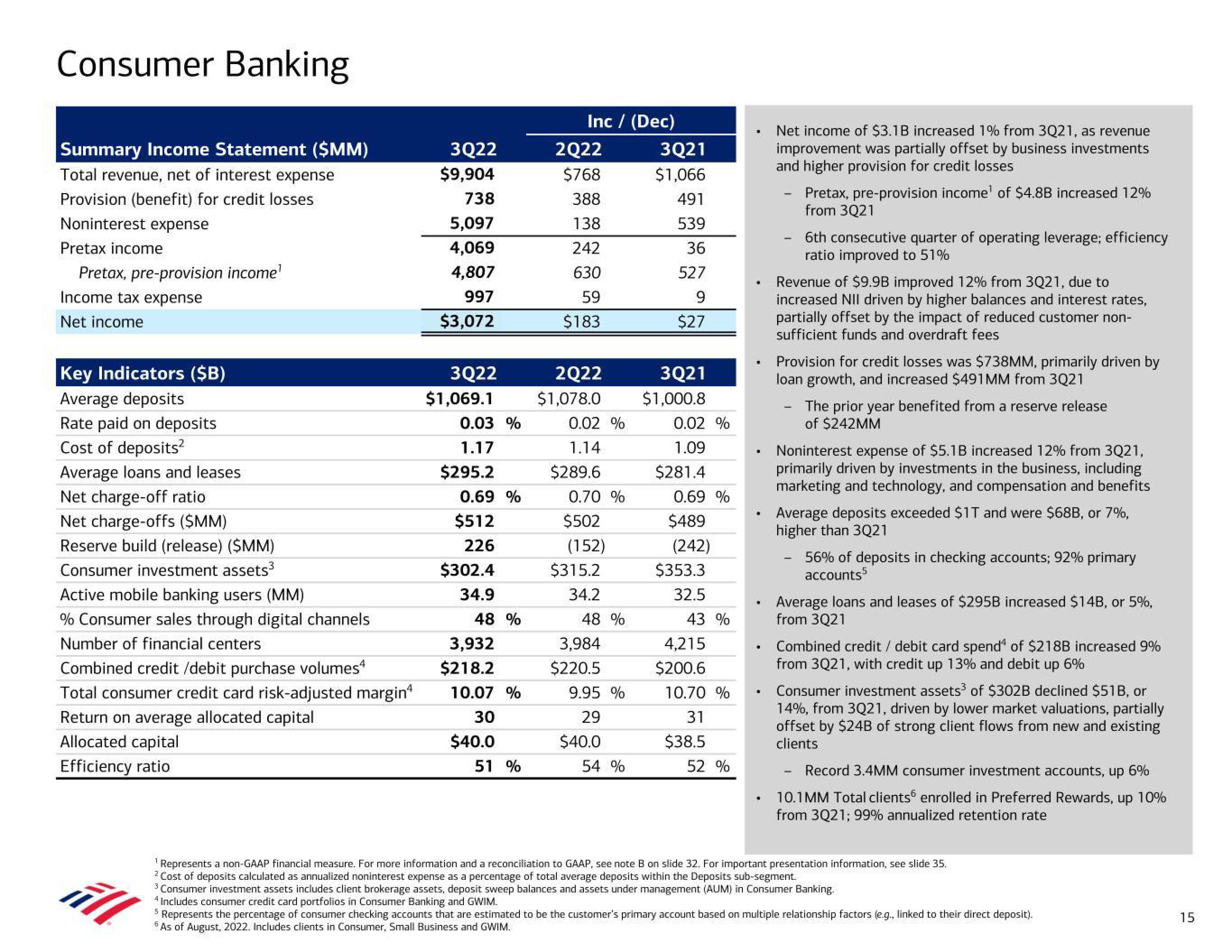

Summary Income Statement ($MM)

Total revenue, net of interest expense

Provision (benefit) for credit losses

Noninterest expense

Pretax income

Pretax, pre-provision income¹

Income tax expense

Net income

Key Indicators ($B)

Average deposits

Rate paid on deposits

Cost of deposits²

Average loans and leases

Net charge-off ratio

Net charge-offs ($MM)

Reserve build (release) ($MM)

Consumer investment assets³

Active mobile banking users (MM)

% Consumer sales through digital channels

Number of financial centers

Combined credit/debit purchase volumes¹

Total consumer credit card risk-adjusted margin¹

Return on average allocated capital

Allocated capital

Efficiency ratio

3Q22

$9,904

738

5,097

4,069

4,807

997

$3,072

3Q22

$1,069.1

0.03 %

1.17

$295.2

0.69%

$512

226

$302.4

34.9

48 %

3,932

$218.2

10.07 %

30

$40.0

51 %

Inc / (Dec)

2Q22

$768

388

138

242

630

59

$183

2Q22

$1,078.0

0.02 %

1.14

$289.6

0.70%

$502

(152)

$315.2

34.2

48 %

3,984

$220.5

9.95 %

29

$40.0

54 %

3Q21

$1,066

491

539

36

527

9

$27

3Q21

$1,000.8

0.02 %

1.09

$281.4

0.69 %

$489

(242)

$353.3

32.5

43 %

4,215

$200.6

10.70 %

31

$38.5

52 %

.

.

.

Net income of $3.1B increased 1% from 3Q21, as revenue

improvement was partially offset by business investments

and higher provision for credit losses

Pretax, pre-provision income¹ of $4.8B increased 12%

from 3Q21

6th consecutive quarter of operating leverage; efficiency

ratio improved to 51%

Revenue of $9.9B improved 12% from 3Q21, due to

increased NII driven by higher balances and interest rates,

partially offset by the impact of reduced customer non-

sufficient funds and overdraft fees

Provision for credit losses was $738MM, primarily driven by

loan growth, and increased $491MM from 3Q21

-

The prior year benefited from a reserve release

of $242MM

Noninterest expense of $5.1B increased 12% from 3Q21,

primarily driven by investments in the business, including

marketing and technology, and compensation and benefits

Average deposits exceeded $1T and were $68B, or 7%,

higher than 3Q21

56% of deposits in checking accounts; 92% primary

accounts5

Average loans and leases of $295B increased $14B, or 5%,

from 3Q21

Combined credit/debit card spend of $218B increased 9%

from 3Q21, with credit up 13% and debit up 6%

Consumer investment assets³ of $302B declined $51B, or

14%, from 3Q21, driven by lower market valuations, partially

offset by $24B of strong client flows from new and existing

clients

Record 3.4MM consumer investment accounts, up 6%

10.1 MM Total clients enrolled in Preferred Rewards, up 10%

from 3Q21; 99% annualized retention rate

¹Represents a non-GAAP financial measure. For more information and a reconciliation to GAAP, see note B on slide 32. For important presentation information, see slide 35.

2 Cost of deposits calculated as annualized noninterest expense as a percentage of total average deposits within the Deposits sub-segment.

3

All

³ Consumer investment assets includes client brokerage assets, deposit sweep balances and assets under management (AUM) in Consumer Banking.

4 Includes consumer credit card portfolios in Consumer Banking and GWIM.

5 Represents the percentage of consumer checking accounts that are estimated to be the customer's primary account based on multiple relationship factors (e.g., linked to their direct deposit).

6 As of August, 2022. Includes clients in Consumer, Small Business and GWIM.

15View entire presentation