Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

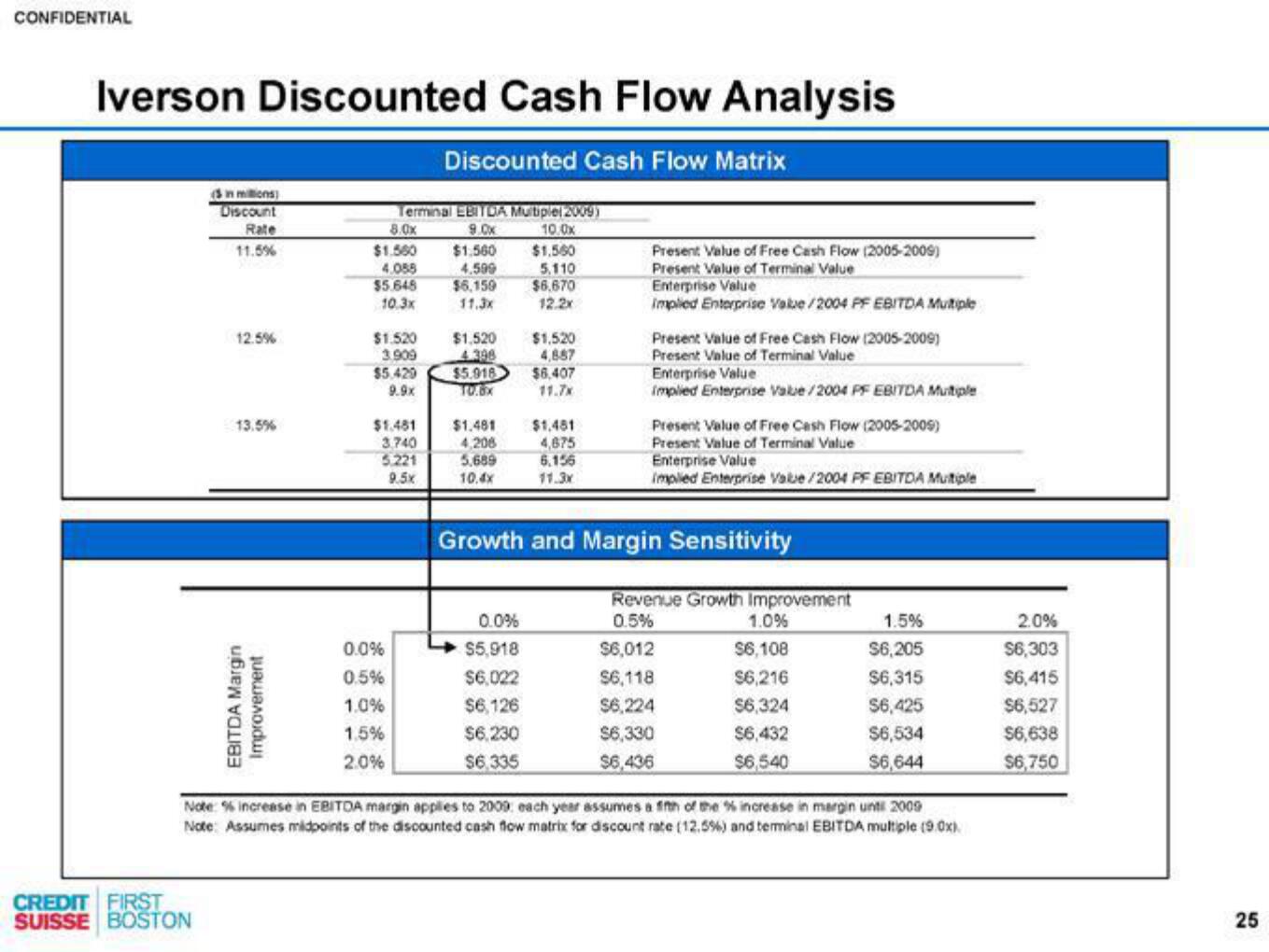

Iverson Discounted Cash Flow Analysis

Discounted Cash Flow Matrix

(in millions)

Discount

Rate

11.5%

CREDIT FIRST

SUISSE BOSTON

12.5%

13.5%

EBITDA Margin

Improvement

Terminal EBITDA Multiplel 2009)

9.0x

8.0x

$1.500

4.055

$5.648

10.3x

$1.520

3.909

$5,429

9.9x

$1.481

3.740

5.221

9.5x

0.0%

0.5%

1.0%

1.5%

2.0%

$1,560

4.599

$6,159

11.3x

$1,520

4.398

$5.918

10.8x

$1.481

4,206

5,689

10.4x

10.0x

$1,560

5.110

$6.670

12.2x

0.0%

$5,918

$6,022

$6,126

$6,230

$6,335

$1,520

4,857

$6,407

$1,481

4,675

6,156

11.3x

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

Implied Enterprise Value/2004 PF EBITDA Multiple

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

implied Enterprise Value/2004 PF EBITDA Multiple

Present Value of Free Cash Flow (2005-2005)

Present Value of Terminal Value

Enterprise Value

implied Enterprise Value/2004 PF EBITDA Multiple

Growth and Margin Sensitivity

Revenue Growth Improvement

0.5%

$6,012

$6,118

$6,224

$6,330

$6,436

1.0%

$6,108

$6,216

$6,324

$6,432

$6,540

1.5%

$6,205

$6,315

$6,425

$6,534

$6,644

Note: % increase in EBITDA margin applies to 2009: each year assumes a fifth of the % increase in margin until 2009

Note: Assumes midpoints of the discounted cash flow matrix for discount rate (12,5%) and terminal EBITDA multiple (9.0x).

2.0%

$6,303

$6,415

$6,527

$6,638

$6,750

25View entire presentation