Apollo Global Management Investor Day Presentation Deck

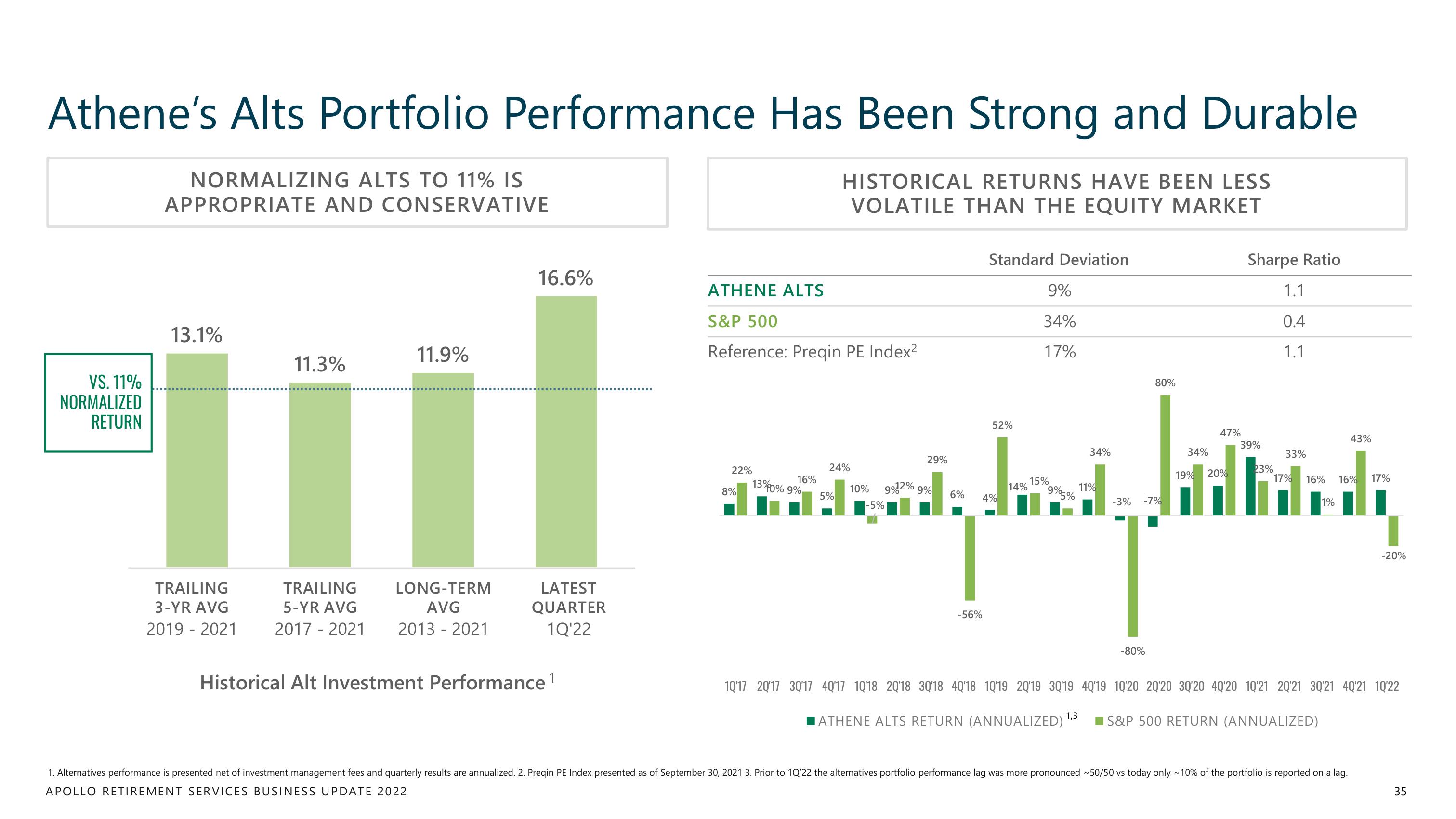

Athene's Alts Portfolio Performance Has Been Strong and Durable

NORMALIZING ALTS TO 11% IS

APPROPRIATE AND CONSERVATIVE

HISTORICAL RETURNS HAVE BEEN LESS

VOLATILE THAN THE EQUITY MARKET

VS. 11%

NORMALIZED

RETURN

13.1%

TRAILING

3-YR AVG

2019 - 2021

11.3%

TRAILING

5-YR AVG

2017 - 2021

11.9%

LONG-TERM

AVG

2013 - 2021

16.6%

LATEST

QUARTER

1Q'22

Historical Alt Investment Performance ¹

ATHENE ALTS

S&P 500

Reference: Preqin PE Index²

22%

8%

13%

Standard Deviation

-56%

52%

9%

34%

17%

34%

34%

29%

24%

19% 20%

16%

15%

14%

10% 9912% 9%

11%

°9%95%

10% 9%

5%

6% 4%

-3% -7%

-5%

amadead, dondguddhindi

endy dand

80%

-80%

47%

Sharpe Ratio

1.1

0.4

1.1

39%

23%

33%

43%

17% 16% 16%

1%

1. Alternatives performance is presented net of investment management fees and quarterly results are annualized. 2. Preqin PE Index presented as of September 30, 2021 3. Prior to 1Q'22 the alternatives portfolio performance lag was more pronounced ~50/50 vs today only ~10% of the portfolio is reported on a lag.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

17%

-20%

10'17 2017 30'17 4017 10'18 20'18 30'18 4018 10'19 2019 3019 4019 1020 2020 30'20 4020 10'21 20'21 30'21 40'21 10'22

■ATHENE ALTS RETURN (ANNUALIZED) 1,3 S&P 500 RETURN (ANNUALIZED)

35View entire presentation