Kore SPAC Presentation Deck

Operational Benchmarking (cont'd)

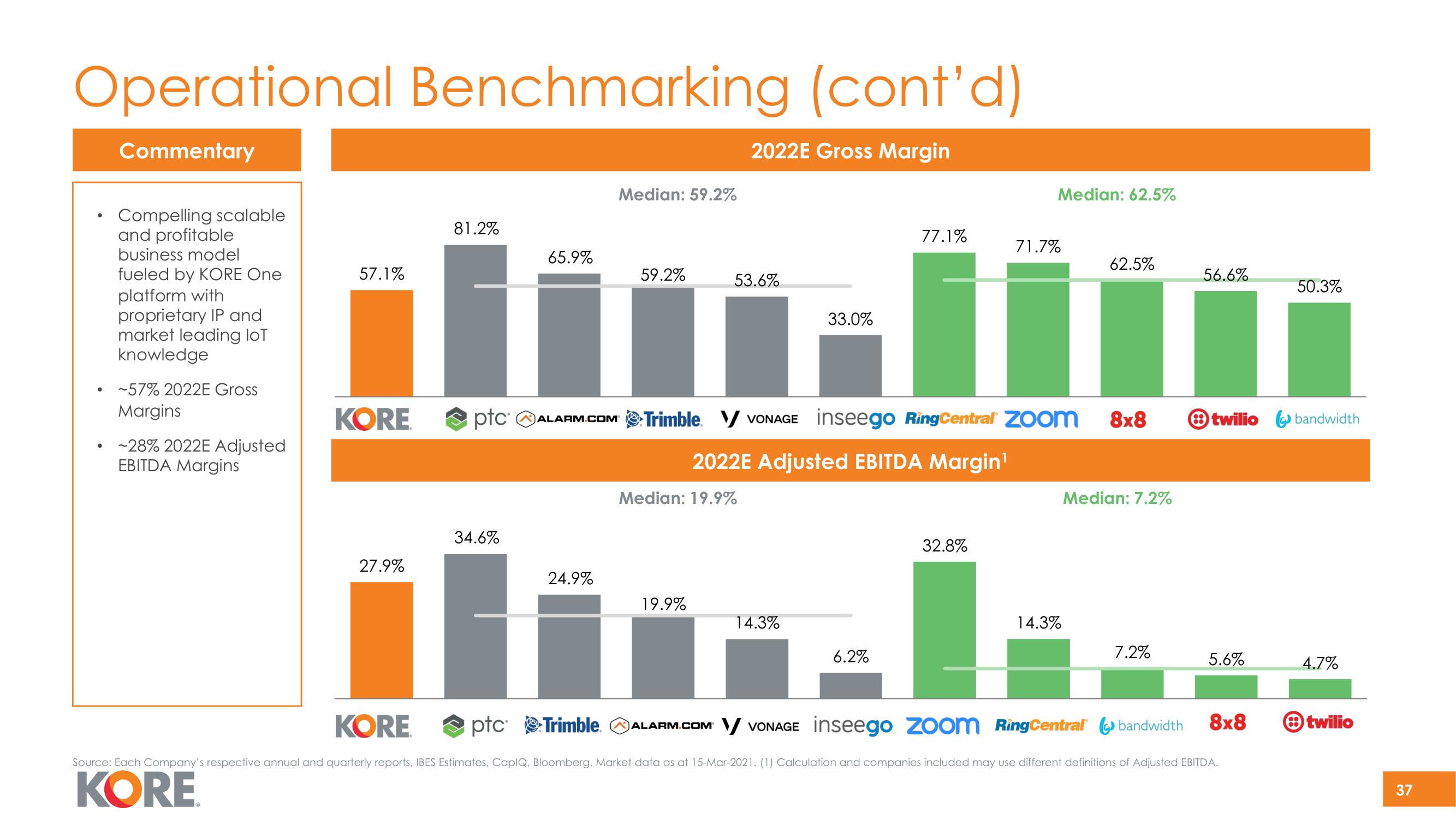

2022E Gross Margin

Commentary

Compelling scalable

and profitable

business model

fueled by KORE One

platform with

proprietary IP and

market leading loT

knowledge

~57% 2022E Gross

Margins

-28% 2022E Adjusted

EBITDA Margins

57.1%

KORE

27.9%

KORE

81.2%

I

ptc

34.6%

65.9%

ALARM.COM

24.9%

Median: 59.2%

59.2%

53.6%

Median: 19.9%

19.9%

33.0%

14.3%

77.1%

Trimble V VONAGE inseego Ring Central zoom 8x8

2022E Adjusted EBITDA Margin¹

6.2%

Median: 62.5%

32.8%

71.7%

62.5%

14.3%

Median: 7.2%

7.2%

56.6%

twilio

5.6%

ptc Trimble. ALARM.COM V VONAGE inseego Zoom RingCentral bandwidth 8x8

Source: Each Company's respective annual and quarterly reports, IBES Estimates, CapIQ, Bloomberg. Market data as at 15-Mar-2021. (1) Calculation and companies included may use different definitions of Adjusted EBITDA.

KORE

50.3%

bandwidth

4.7%

twilio

37View entire presentation