Hexagon Purus Results Presentation Deck

18

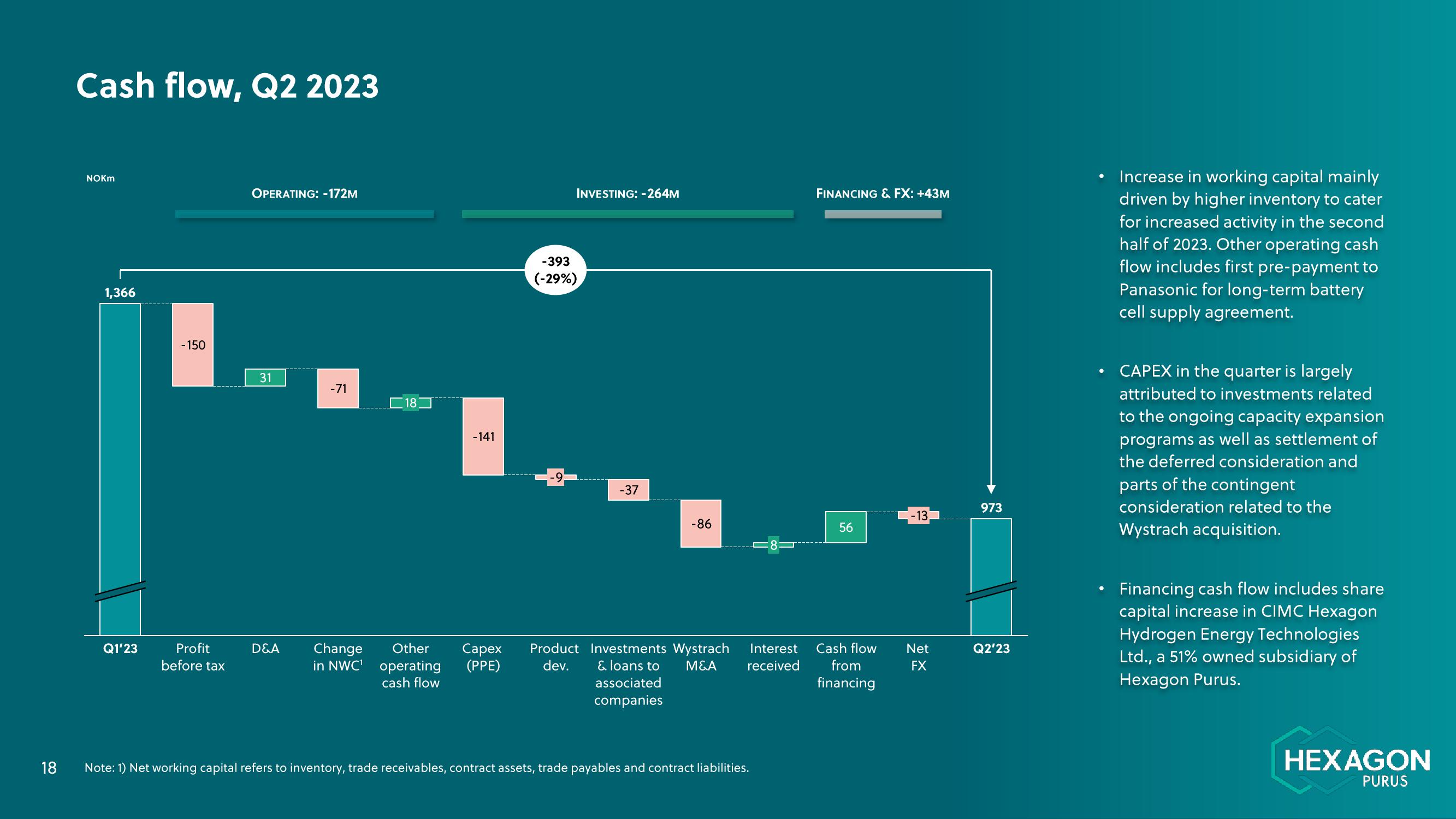

Cash flow, Q2 2023

NOKm

1,366

Q1'23

- 150

Profit

before tax

OPERATING: -172M

31

D&A

-71

|

18

-141

-393

(-29%)

INVESTING: -264M

6

U

-37

-86

Change Other Capex Product Investments Wystrach Interest

in NWC' operating (PPE)

M&A received

dev.

cash flow

& loans to

associated

companies

Note: 1) Net working capital refers to inventory, trade receivables, contract assets, trade payables and contract liabilities.

FINANCING & FX: +43M

56

Cash flow

from

financing

-13

Net

FX

973

Q2'23

●

Increase in working capital mainly

driven by higher inventory to cater

for increased activity in the second

half of 2023. Other operating cash

flow includes first pre-payment to

Panasonic for long-term battery

cell supply agreement.

CAPEX in the quarter is largely

attributed to investments related

to the ongoing capacity expansion

programs as well as settlement of

the deferred consideration and

parts of the contingent

consideration related to the

Wystrach acquisition.

Financing cash flow includes share

capital increase in CIMC Hexagon

Hydrogen Energy Technologies

Ltd., a 51% owned subsidiary of

Hexagon Purus.

HEXAGON

PURUSView entire presentation