Kinnevik Results Presentation Deck

Intro

Net Asset Value

less significant impact on profitable or low-burn companies relative to

high-burn companies. These parameters, paired together with our com-

panies' operational performance, financial strength and reliance on the

near-term funding climate, have all been taken into consideration when

valuing our unlisted companies.

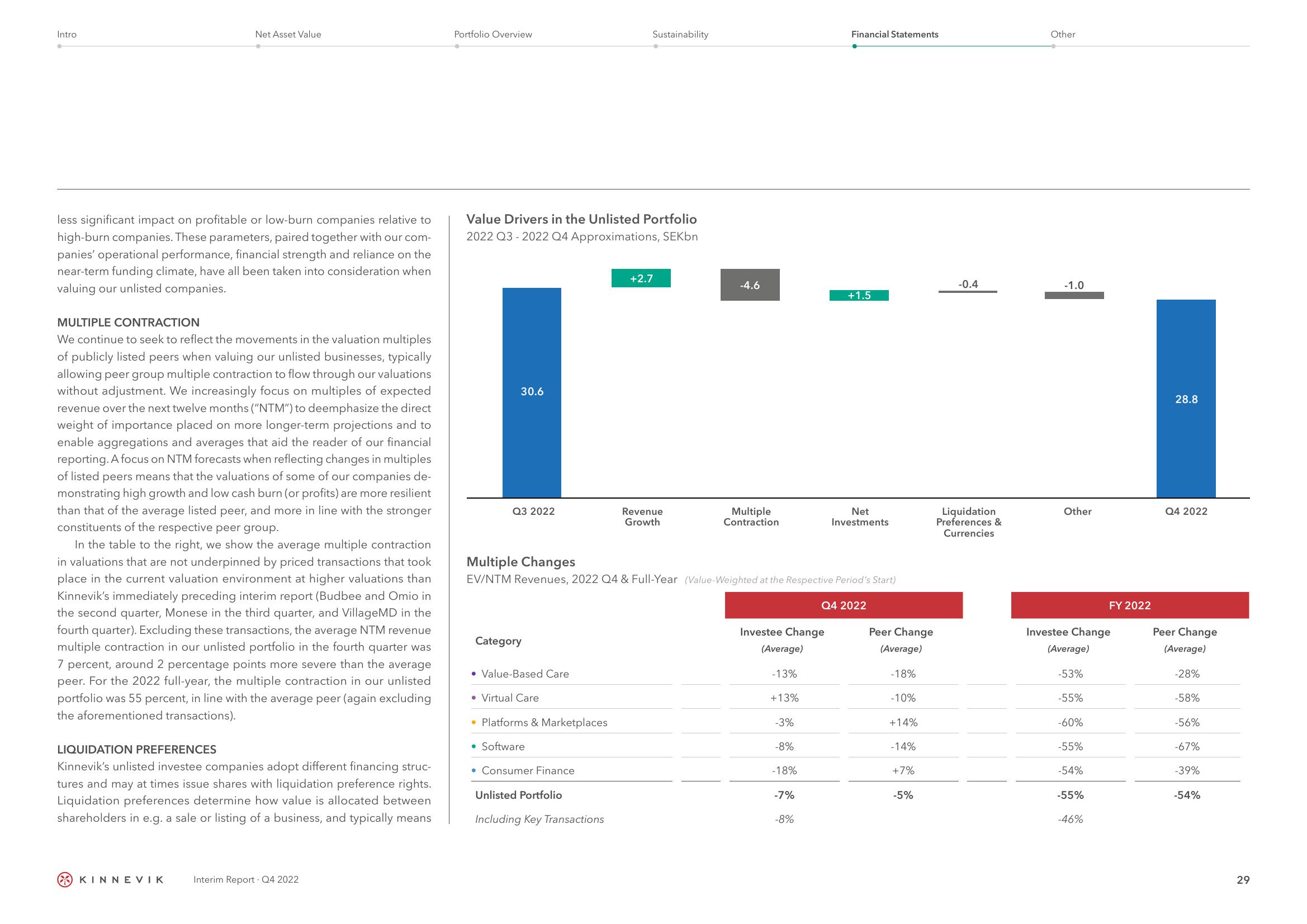

MULTIPLE CONTRACTION

We continue to seek to reflect the movements in the valuation multiples

of publicly listed peers when valuing our unlisted businesses, typically

allowing peer group multiple contraction to flow through our valuations

without adjustment. We increasingly focus on multiples of expected

revenue over the next twelve months ("NTM") to deemphasize the direct

weight of importance placed on more longer-term projections and to

enable aggregations and averages that aid the reader of our financial

reporting. A focus on NTM forecasts when reflecting changes in multiples

of listed peers means that the valuations of some of our companies de-

monstrating high growth and low cash burn (or profits) are more resilient

than that of the average listed peer, and more in line with the stronger

constituents of the respective peer group.

In the table to the right, we show the average multiple contraction

in valuations that are not underpinned by priced transactions that took

place in the current valuation environment at higher valuations than

Kinnevik's immediately preceding interim report (Budbee and Omio in

the second quarter, Monese in the third quarter, and VillageMD in the

fourth quarter). Excluding these transactions, the average NTM revenue

multiple contraction in our unlisted portfolio in the fourth quarter was

7 percent, around 2 percentage points more severe than the average

peer. For the 2022 full-year, the multiple contraction in our unlisted

portfolio was 55 percent, in line with the average peer (again excluding

the aforementioned transactions).

LIQUIDATION PREFERENCES

Kinnevik's unlisted investee companies adopt different financing struc-

tures and may at times issue shares with liquidation preference rights.

Liquidation preferences determine how value is allocated between

shareholders in e.g. a sale or listing of a business, and typically means

KINNEVIK

Interim Report Q4 2022

Portfolio Overview

Value Drivers in the Unlisted Portfolio

2022 Q3-2022 Q4 Approximations, SEKbn

Q3 2022

T

30.6

Category

• Value-Based Care

• Virtual Care

Sustainability

• Platforms & Marketplaces

• Software

• Consumer Finance

+2.7

Unlisted Portfolio

Including Key Transactions

Revenue

Growth

-4.6

Multiple Changes

EV/NTM Revenues, 2022 Q4 & Full-Year (Value-Weighted at the Respective Period's Start)

Multiple

Contraction

Investee Change

(Average)

-13%

+13%

-3%

-8%

-18%

-7%

Financial Statements

-8%

+1.5

Net

Investments

Q4 2022

Peer Change

(Average)

-18%

-10%

+14%

-14%

+7%

-5%

-0.4

Liquidation

Preferences &

Currencies

Other

-1.0

Other

Investee Change

(Average)

-53%

-55%

-60%

-55%

-54%

-55%

FY 2022

-46%

28.8

Q4 2022

Peer Change

(Average)

-28%

-58%

-56%

-67%

-39%

-54%

29View entire presentation