Melrose Results Presentation Deck

Engines: results

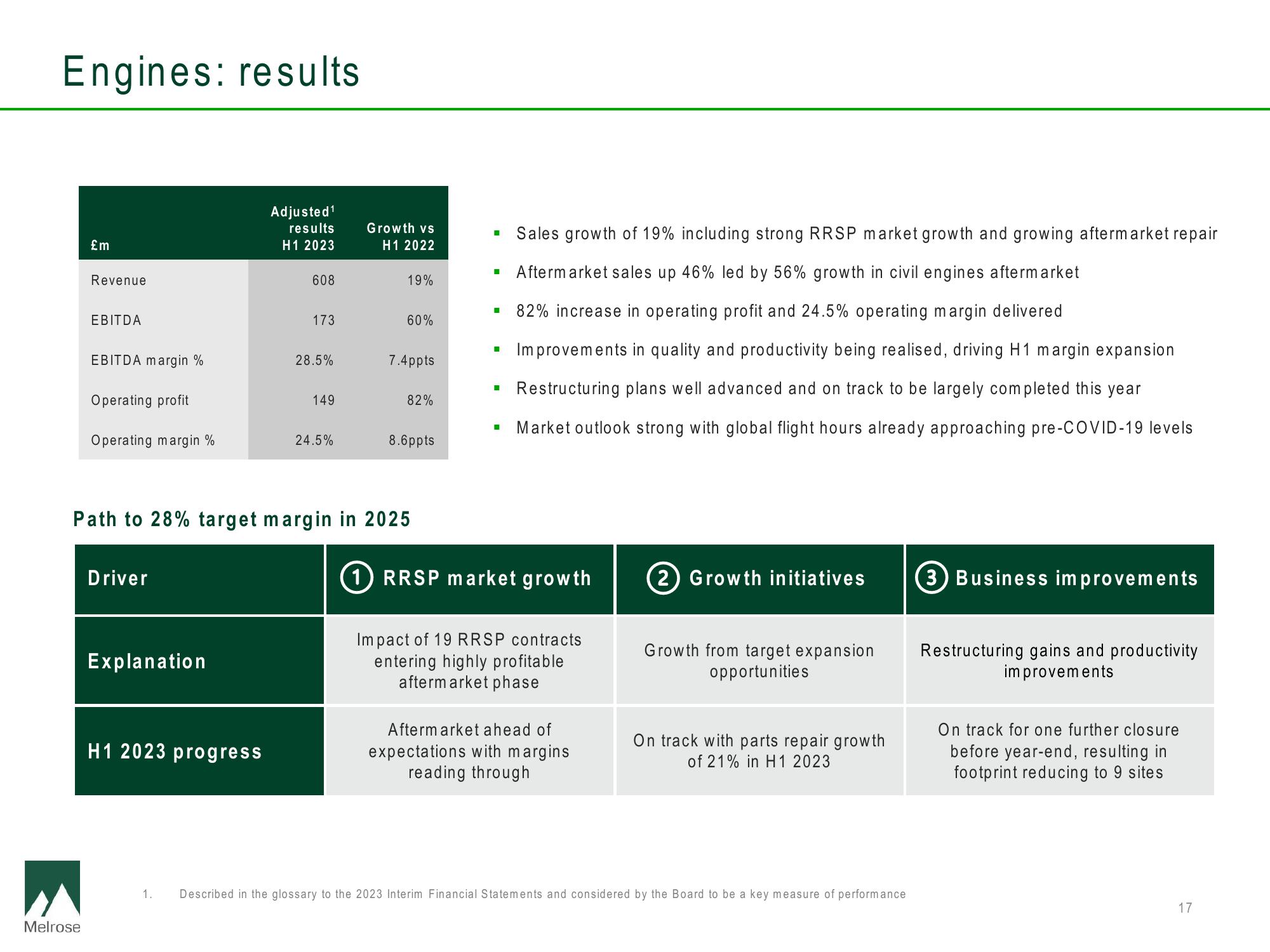

£m

Melrose

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

Driver

Explanation

Adjusted¹

results

H1 2023

H1 2023 progress

608

173

28.5%

149

24.5%

Growth vs

H1 2022

19%

60%

Path to 28% target margin in 2025

7.4ppts

82%

8.6ppts

■

■

E

■

I

Sales growth of 19% including strong RRSP market growth and growing aftermarket repair

Aftermarket sales up 46% led by 56% growth in civil engines aftermarket

82% increase in operating profit and 24.5% operating margin delivered

Improvements in quality and productivity being realised, driving H1 margin expansion

Restructuring plans well advanced and on track to be largely completed this year

Market outlook strong with global flight hours already approaching pre-COVID-19 levels

(1) RRSP market growth

Impact of 19 RRSP contracts

entering highly profitable

aftermarket phase

Aftermarket ahead of

expectations with margins

reading through

2) Growth initiatives

Growth from target expansion

opportunities

On track with parts repair growth

of 21% in H1 2023

1. Described in the glossary to the 2023 Interim Financial Statements and considered by the Board to be a key measure of performance

3 Business improvements

Restructuring gains and productivity

improvements

On track for one further closure

before year-end, resulting in

footprint reducing to 9 sites

17View entire presentation