IBEX IPO Presentation Deck

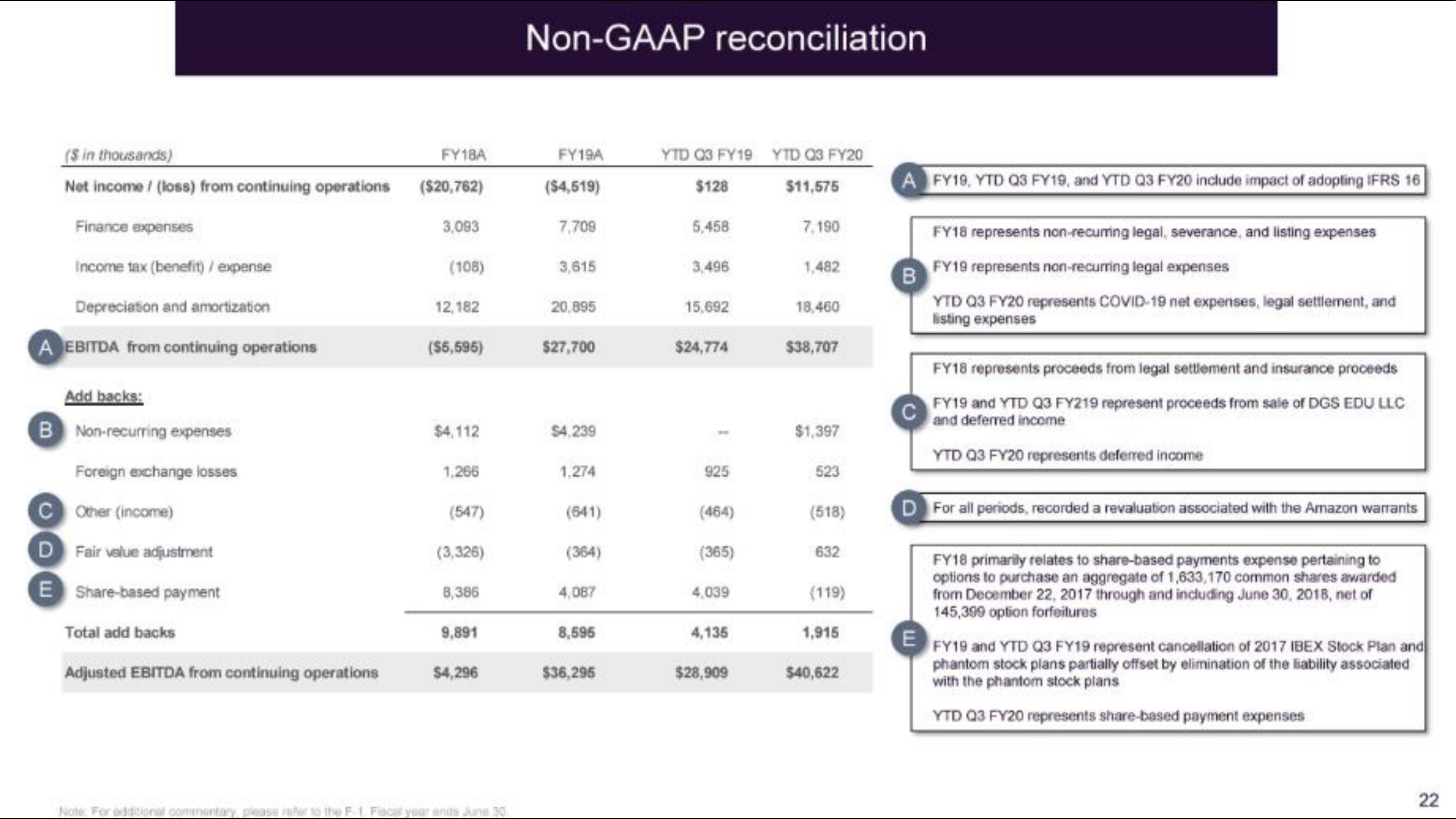

($ in thousands)

Net income / (loss) from continuing operations

Finance expenses

Income tax (benefit) / expense

Depreciation and amortization

A EBITDA from continuing operations

Add backs:

B Non-recurring expenses

Foreign exchange losses

Other (income)

D Fair value adjustment

E Share-based payment

Total add backs

Adjusted EBITDA from continuing operations

CD

FY18A

($20,762)

3,093

(108)

12,182

($5,595)

$4,112

1,266

(547)

(3,326)

8,386

9,891

$4,296

Note: For additional commentary, please refer to the F-1. Fiscal year ends June 30

Non-GAAP reconciliation

FY19A

($4,519)

7,709

3,615

20,895

$27,700

$4,239

1,274

(641)

(364)

4,087

8,595

$36,295

YTD Q3 FY19

$128

5,458

3,496

15,692

$24,774

1

925

(464)

(365)

4,039

4,135

$28,909

YTD Q3 FY20

$11,575

7,190

1,482

18,460

$38,707

$1,397

523

(518)

632

(119)

1,915

$40,622

A FY19, YTD Q3 FY19, and YTD Q3 FY20 include impact of adopting IFRS 16

FY18 represents non-recurring legal, severance, and listing expenses

BFY19 represents non-recurring legal expenses

YTD Q3 FY20 represents COVID-19 net expenses, legal settlement, and

listing expenses

FY18 represents proceeds from legal settlement and insurance proceeds

C

FY19 and YTD Q3 FY219 represent proceeds from sale of DGS EDU LLC

and deferred income

YTD Q3 FY20 represents deferred income

D For all periods, recorded a revaluation associated with the Amazon warrants

FY18 primarily relates to share-based payments expense pertaining to

options to purchase an aggregate of 1,633,170 common shares awarded

from December 22, 2017 through and including June 30, 2018, net of

145,399 option forfeitures

E

FY19 and YTD Q3 FY19 represent cancellation of 2017 IBEX Stock Plan and

phantom stock plans partially offset by elimination of the liability associated

with the phantom stock plans

YTD Q3 FY20 represents share-based payment expenses

22View entire presentation