HHR Investor Presentation Deck

1

2

3

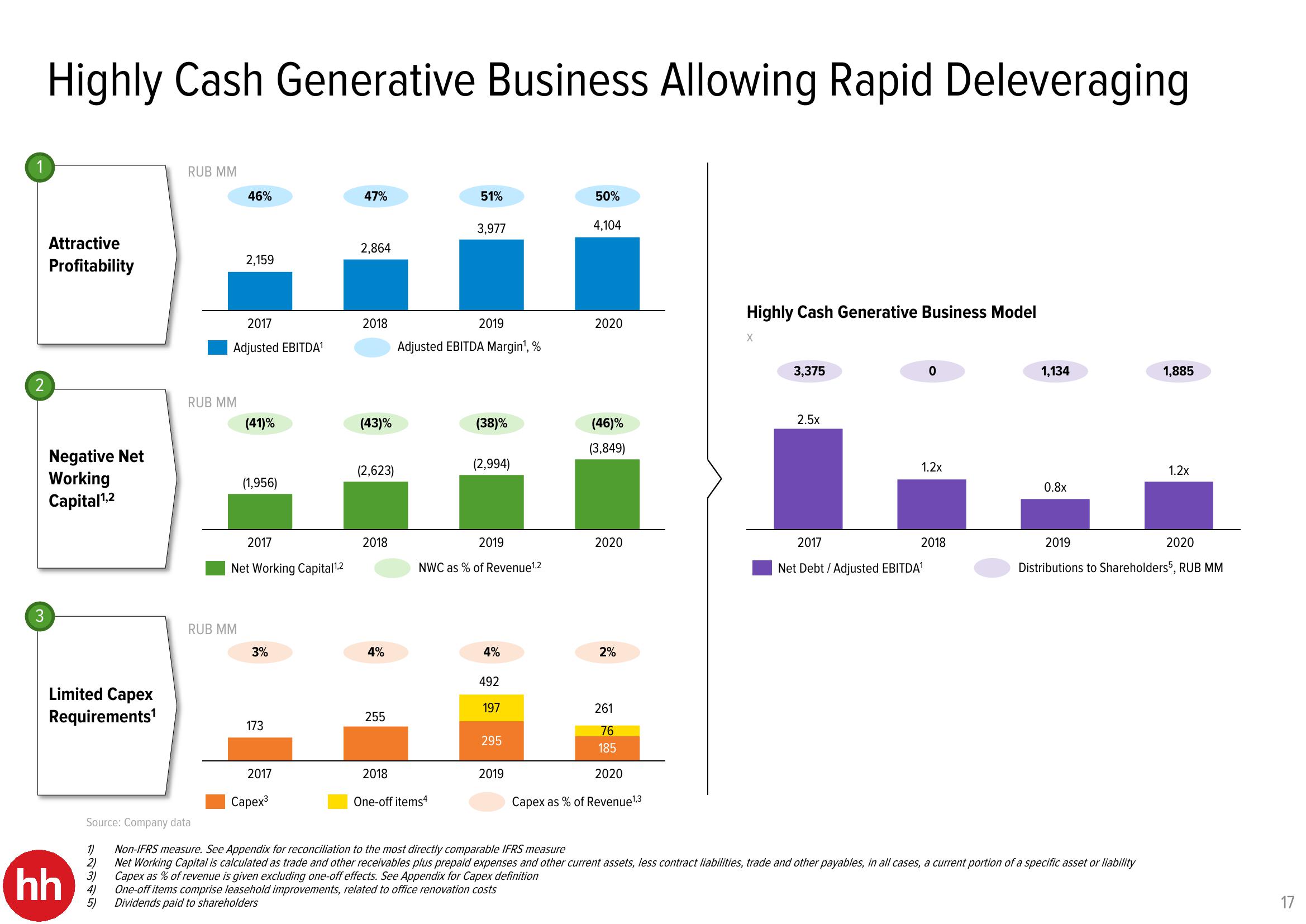

Highly Cash Generative Business Allowing Rapid Deleveraging

Attractive

Profitability

Negative Net

Working

Capital ¹,2

Limited Capex

Requirements¹

hh

12345

3)

RUB MM

5)

RUB MM

46%

2017

Adjusted EBITDA¹

2,159

RUB MM

(41)%

(1,956)

2017

Net Working Capital¹,2

3%

173

2017

Capex3

47%

2,864

2018

(43)%

(2,623)

2018

4%

255

51%

3,977

2019

Adjusted EBITDA Margin¹, %

2018

One-off items4

(38)%

(2,994)

2019

NWC as % of Revenue¹,2

4%

492

197

295

2019

4) One-off items comprise leasehold improvements, related to office renovation costs

Dividends paid to shareholders

50%

4,104

2020

(46)%

(3,849)

2020

2%

261

76

185

2020

Capex as % of Revenue ¹,3

Highly Cash Generative Business Model

X

3,375

2.5x

0

1.2x

2017

Net Debt / Adjusted EBITDA¹

2018

Source: Company data

Non-IFRS measure. See Appendix for reconciliation to the most directly comparable IFRS measure

2) Net Working Capital is calculated as trade and other receivables plus prepaid expenses and other current assets, less contract liabilities, trade and other payables, in all cases, a current portion of a specific asset or liability

Capex as % of revenue is given excluding one-off effects. See Appendix for Capex definition

1,134

0.8x

1,885

1.2x

2019

2020

Distributions to Shareholders5, RUB MM

17View entire presentation