HPS Specialty Loan Fund VI

HPS is an Established Market Leader in Alternative Credit

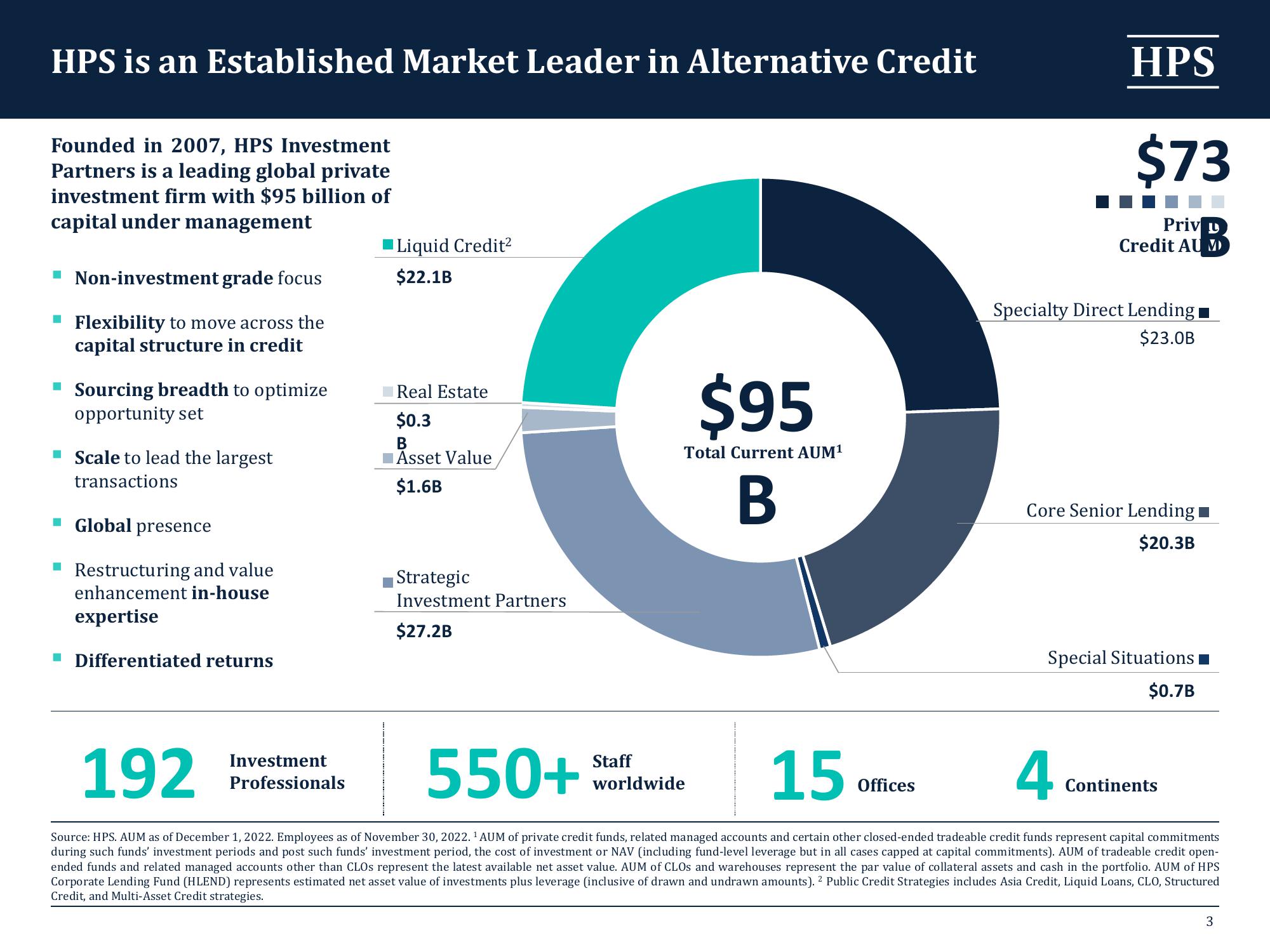

Founded in 2007, HPS Investment

Partners is a leading global private

investment firm with $95 billion of

capital under management

Non-investment grade focus

Flexibility to move across the

capital structure in credit

Sourcing breadth to optimize

opportunity set

Scale to lead the largest

transactions

■ Global presence

Restructuring and value

enhancement in-house

expertise

Differentiated returns

Liquid Credit²

$22.1B

Investment

Professionals

Real Estate

$0.3

B

Asset Value

$1.6B

Strategic

Investment Partners

$27.2B

$95

Total Current AUM¹

B

Staff

worldwide

HPS

Offices

$73

Priv D

Credit AU M

Specialty Direct Lending

$23.0B

192

550+

15

4

Source: HPS. AUM as of December 1, 2022. Employees as of November 30, 2022. ¹ AUM of private credit funds, related managed accounts and certain other closed-ended tradeable credit funds represent capital commitments

during such funds' investment periods and post such funds' investment period, the cost of investment or NAV (including fund-level leverage but in all cases capped at capital commitments). AUM of tradeable credit open-

ended funds and related managed accounts other than CLOs represent the latest available net asset value. AUM of CLOs and warehouses represent the par value of collateral assets and cash in the portfolio. AUM of HPS

Corporate Lending Fund (HLEND) represents estimated net asset value of investments plus leverage (inclusive of drawn and undrawn amounts). 2 Public Credit Strategies includes Asia Credit, Liquid Loans, CLO, Structured

Credit, and Multi-Asset Credit strategies.

Core Senior Lending

$20.3B

Special Situations

$0.7B

Continents

3View entire presentation