Paysafe SPAC Presentation Deck

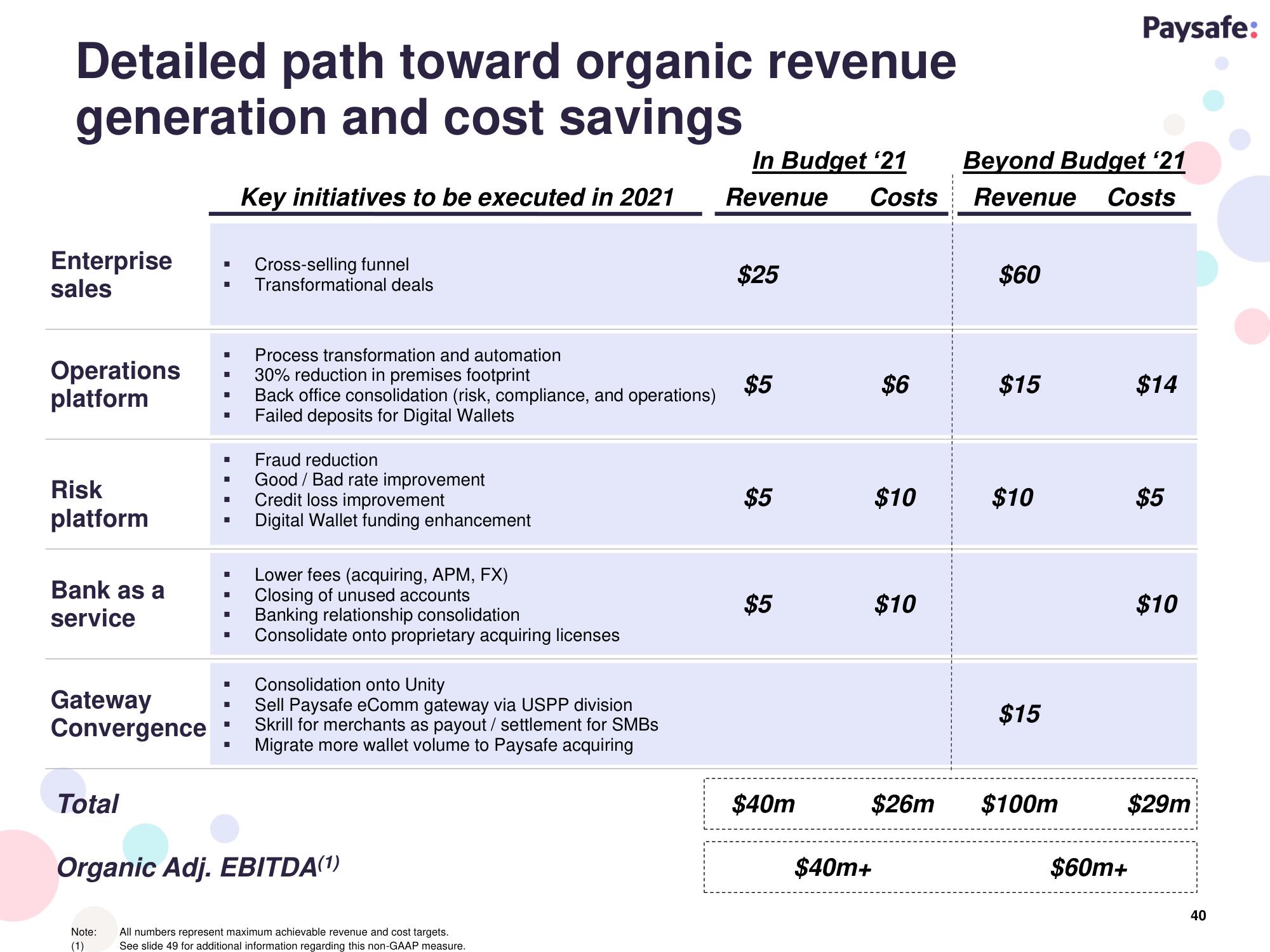

Detailed path toward organic revenue

generation and cost savings

Key initiatives to be executed in 2021

Enterprise

sales

Operations

platform

Risk

platform

Bank as a

service

Gateway

Convergence

Total

■

Note:

(1)

■

■ Process transformation and automation

30% reduction in premises footprint

Back office consolidation (risk, compliance, and operations)

Failed deposits for Digital Wallets

■

■

■

■

■

I

■

■

■

■

Cross-selling funnel

Transformational deals

■

Fraud reduction

Good / Bad rate improvement

Credit loss improvement

Digital Wallet funding enhancement

Lower fees (acquiring, APM, FX)

Closing of unused accounts

Banking relationship consolidation

Consolidate onto proprietary acquiring licenses

Consolidation onto Unity

Sell Paysafe eComm gateway via USPP division

Skrill for merchants as payout / settlement for SMBs

Migrate more wallet volume to Paysafe acquiring

Organic Adj. EBITDA(1)

All numbers represent maximum achievable revenue and cost targets.

See slide 49 for additional information regarding this non-GAAP measure.

In Budget '21

Revenue Costs

$25

$5

$5

$5

$40m

$40m+

$6

$10

$10

Beyond Budget '21

Revenue Costs

$60

$15

$10

$15

$26m $100m

Paysafe:

$60m+

$14

$5

$10

$29m

40View entire presentation