OppFi Results Presentation Deck

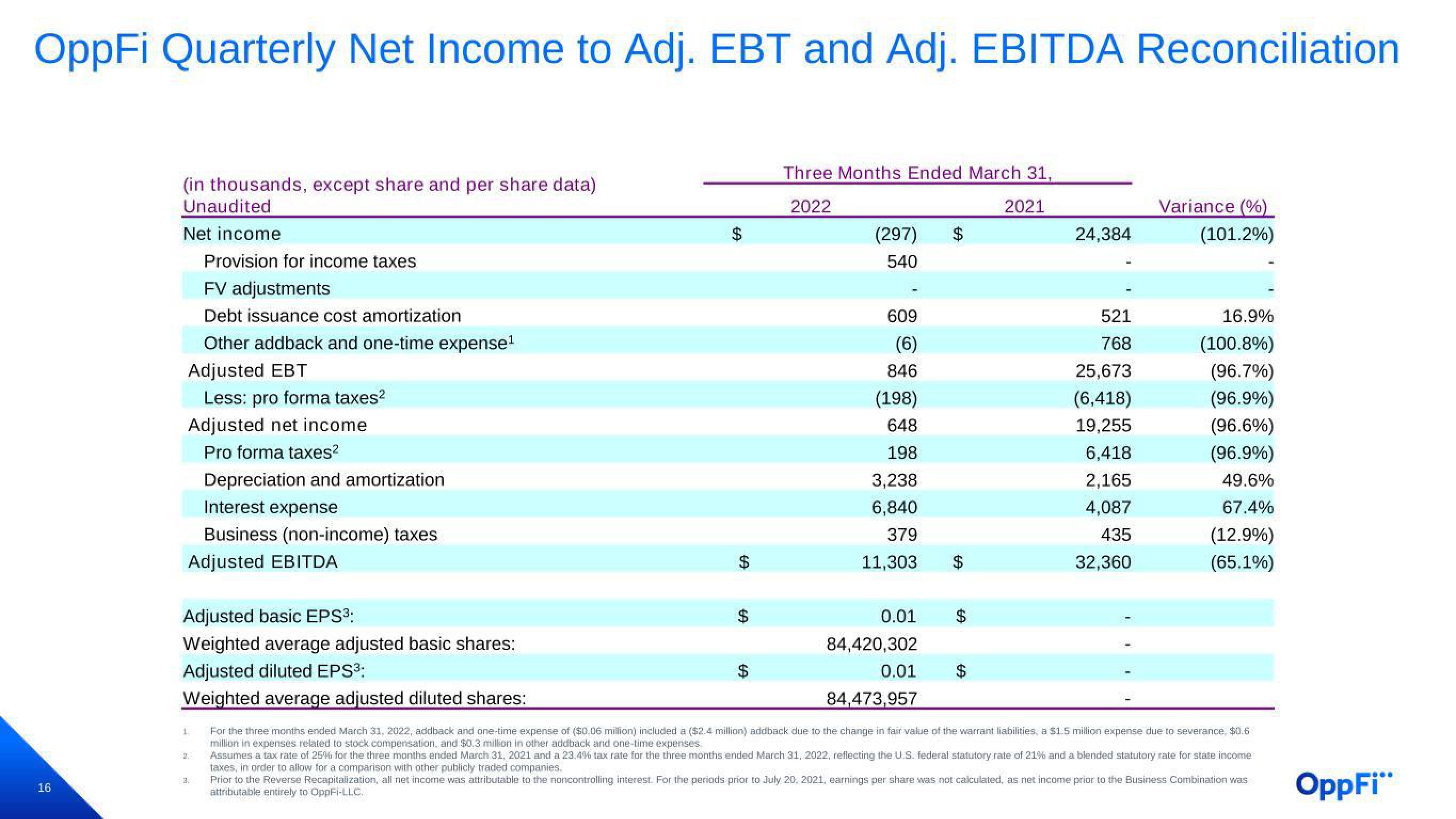

OppFi Quarterly Net Income to Adj. EBT and Adj. EBITDA Reconciliation

16

(in thousands, except share and per share data)

Unaudited

Net income

Provision for income taxes

FV adjustments

Debt issuance cost amortization

Other addback and one-time expense¹

Adjusted EBT

Less: pro forma taxes²

Adjusted net income

Pro forma taxes²

Depreciation and amortization

Interest expense

Business (non-income) taxes

Adjusted EBITDA

Adjusted basic EPS³:

Weighted average adjusted basic shares:

Adjusted diluted EPS³:

Weighted average adjusted diluted shares:

1.

2

$

69

GA

$

69

Three Months Ended March 31,

2022

2021

69

(297) $

540

609

(6)

846

(198)

648

198

3,238

6,840

379

11,303

0.01

$

$

24,384

$

521

768

25,673

(6,418)

19,255

6,418

2,165

4,087

435

32,360

Variance (%)

(101.2%)

84,420,302

0.01

84,473,957

For the three months ended March 31, 2022, addback and one-time expense of ($0.06 million) included a ($2.4 million) addback due to the change in fair value of the warrant liabilities, a $1.5 million expense due to severance, $0.6

million in expenses related to stock compensation, and $0.3 million in other addback and one-time expenses

Assumes a tax rate of 25% for the three months ended March 31, 2021 and a 23.4% tax rate for the three months ended March 31, 2022, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income

taxes, in order to allow for a comparison with other publicly traded companies.

Prior to the Reverse Recapitalization, all net income was attributable to the noncontrolling interest. For the periods prior to July 20, 2021, earnings per share was not calculated, as net income prior to the Business Combination was

attributable entirely to OppFi-LLC.

16.9%

(100.8%)

(96.7%)

(96.9%)

(96.6%)

(96.9%)

49.6%

67.4%

(12.9%)

(65.1%)

OppFi"View entire presentation