Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

MAERSK

DRILLING

Contents

Maersk Drilling delivered a profit of USD 184m (USD 192m)

generating a ROIC of 9.0% (10.7%), positively affected by fleet

growth, cost savings and strong operational performance,

but negatively affected by increased idle time. The result was

further affected by an additional gain of USD 9m (USD 73m) re-

lated to the sale of the Venezuela business in 2014. The underly-

ing profit was USD 172m (USD 118m).

The economic utilisation of the fleet was 85% (89%) adversely

affected by increased idle time and Mærsk Deliverer on yard

stay. The average operational uptime was 97% (97%) for the

jack-up rigs and 98% (96%) for the floating rigs.

Though at significantly lower day rates compared to previous

contracts, the new contracts and extensions signed in Q3 added

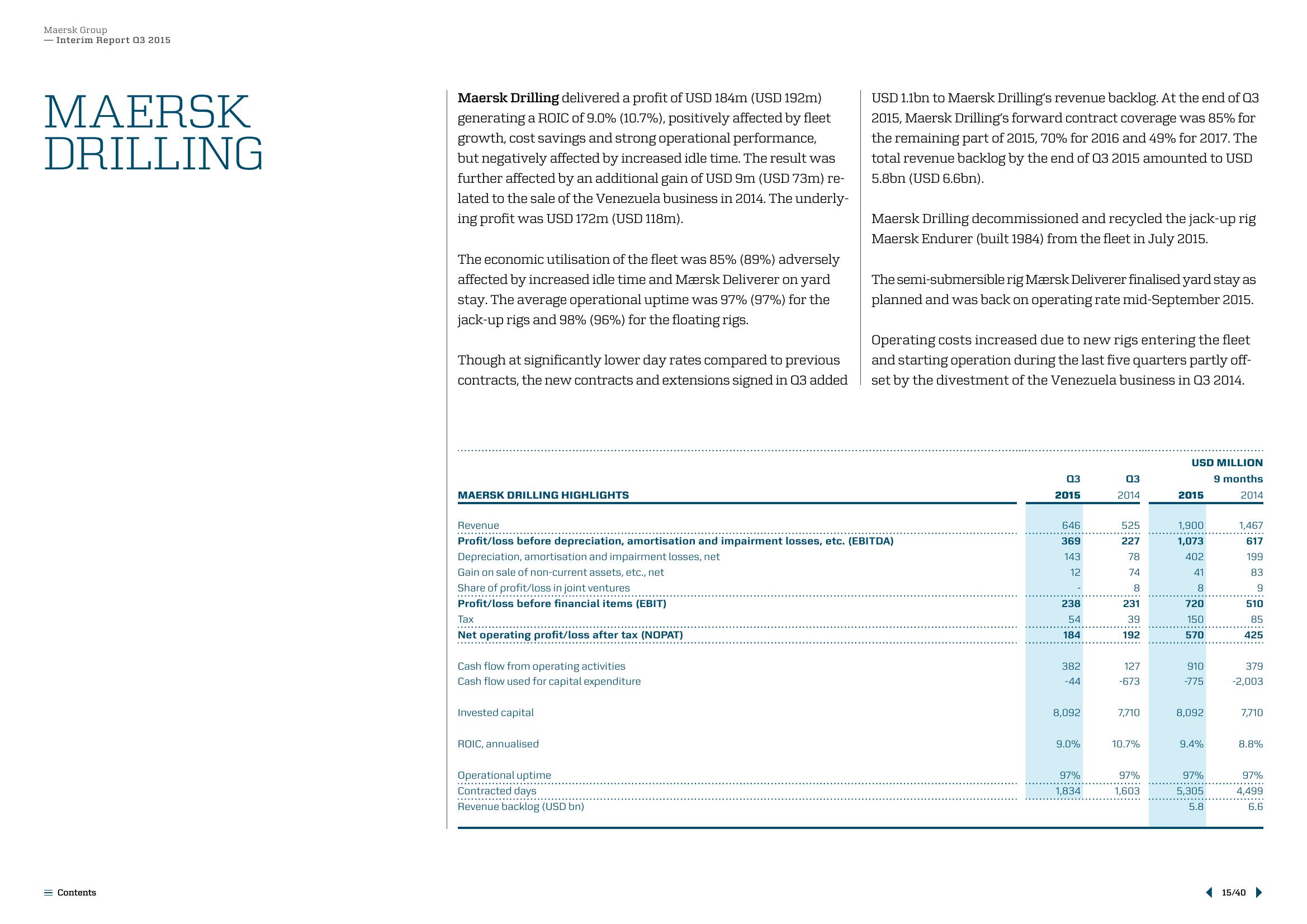

MAERSK DRILLING HIGHLIGHTS

Revenue

**********.

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Profit/loss before financial items (EBIT)

ROIC, annualised

USD 1.1bn to Maersk Drilling's revenue backlog. At the end of Q3

2015, Maersk Drilling's forward contract coverage was 85% for

the remaining part of 2015, 70% for 2016 and 49% for 2017. The

total revenue backlog by the end of Q3 2015 amounted to USD

5.8bn (USD 6.6bn).

Operational uptime

....…....

Contracted days

Revenue backlog (USD bn)

Maersk Drilling decommissioned and recycled the jack-up rig

Maersk Endurer (built 1984) from the fleet in July 2015.

The semi-submersible rig Mærsk Deliverer finalised yard stay as

planned and was back on operating rate mid-September 2015.

Operating costs increased due to new rigs entering the fleet

and starting operation during the last five quarters partly off-

set by the divestment of the Venezuela business in Q3 2014.

03

2015

646

369

143

12

238

54

184

382

-44

8,092

9.0%

97%

1,834

03

2014

525

227

78

74

8

231

39

192

127

-673

7,710

10.7%

97%

1,603

USD MILLION

9 months

2014

2015

1,900

1,073

402

41

8

720

150

570

910

-775

8,092

9.4%

97%

5,305

5.8

1,467

617

199

83

9

510

85

425

379

-2,003

7,710

8.8%

97%

4,499

6.6

15/40View entire presentation