Q2 2018 Fixed Income Investor Conference Call

Minimum Requirement for Own Funds and Eligible

Liabilities (MREL) (1)

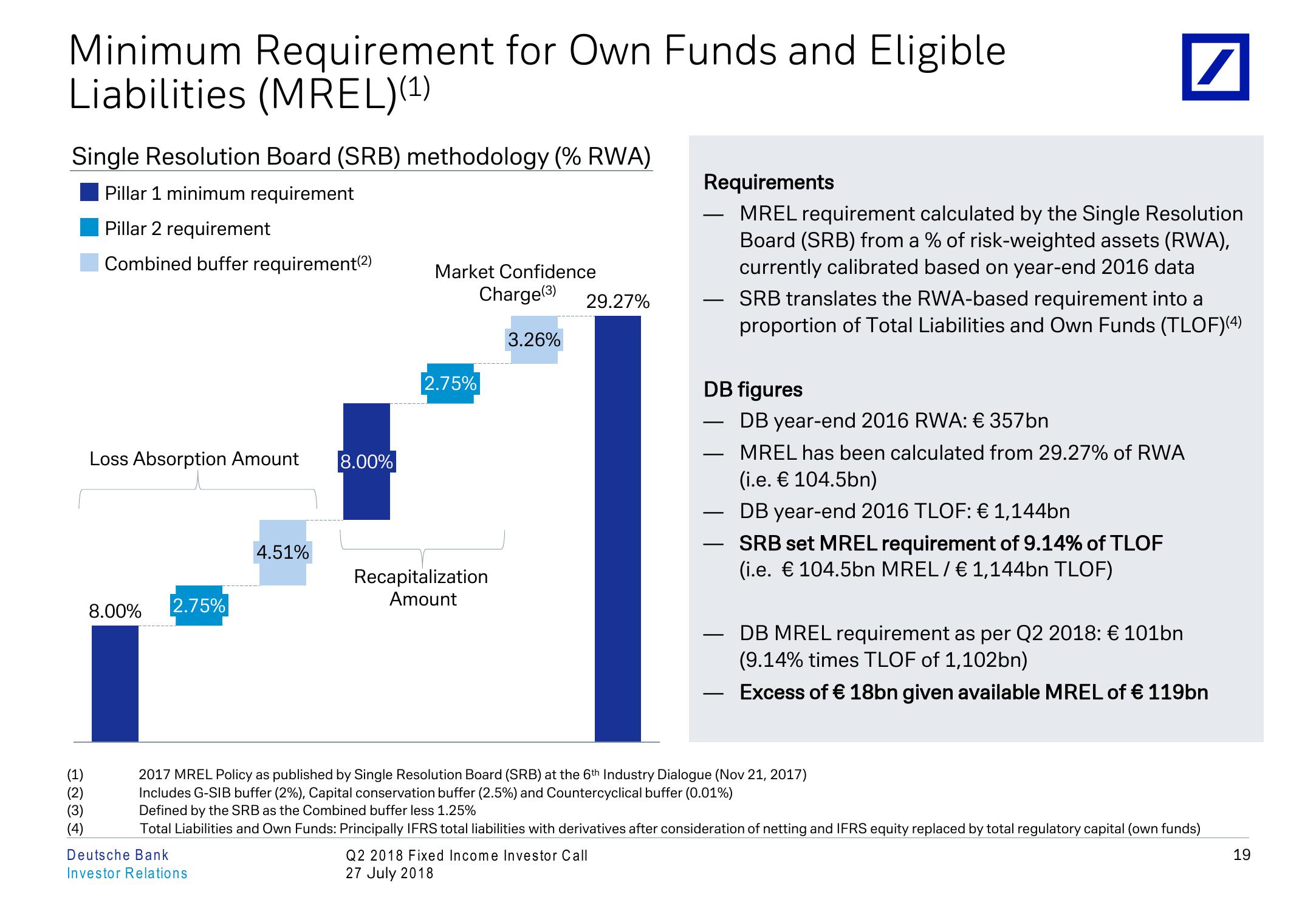

Single Resolution Board (SRB) methodology (% RWA)

Pillar 1 minimum requirement

Pillar 2 requirement

Requirements

Combined buffer requirement (2)

Market Confidence

Charge(3)

29.27%

-

Loss Absorption Amount

8.00%

8.00%

2.75%

2.75%

4.51%

Recapitalization

Amount

3.26%

MREL requirement calculated by the Single Resolution

Board (SRB) from a % of risk-weighted assets (RWA),

currently calibrated based on year-end 2016 data

SRB translates the RWA-based requirement into a

proportion of Total Liabilities and Own Funds (TLOF) (4)

DB figures

-

DB year-end 2016 RWA: € 357bn

MREL has been calculated from 29.27% of RWA

(i.e. € 104.5bn)

DB year-end 2016 TLOF: € 1,144bn

SRB set MREL requirement of 9.14% of TLOF

(i.e. € 104.5bn MREL / € 1,144bn TLOF)

DB MREL requirement as per Q2 2018: € 101bn

(9.14% times TLOF of 1,102bn)

-

Excess of € 18bn given available MREL of € 119bn

(1)

(2)

(3)

(4)

2017 MREL Policy as published by Single Resolution Board (SRB) at the 6th Industry Dialogue (Nov 21, 2017)

Includes G-SIB buffer (2%), Capital conservation buffer (2.5%) and Countercyclical buffer (0.01%)

Defined by the SRB as the Combined buffer less 1.25%

Total Liabilities and Own Funds: Principally IFRS total liabilities with derivatives after consideration of netting and IFRS equity replaced by total regulatory capital (own funds)

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

19View entire presentation