Ford Investor Conference

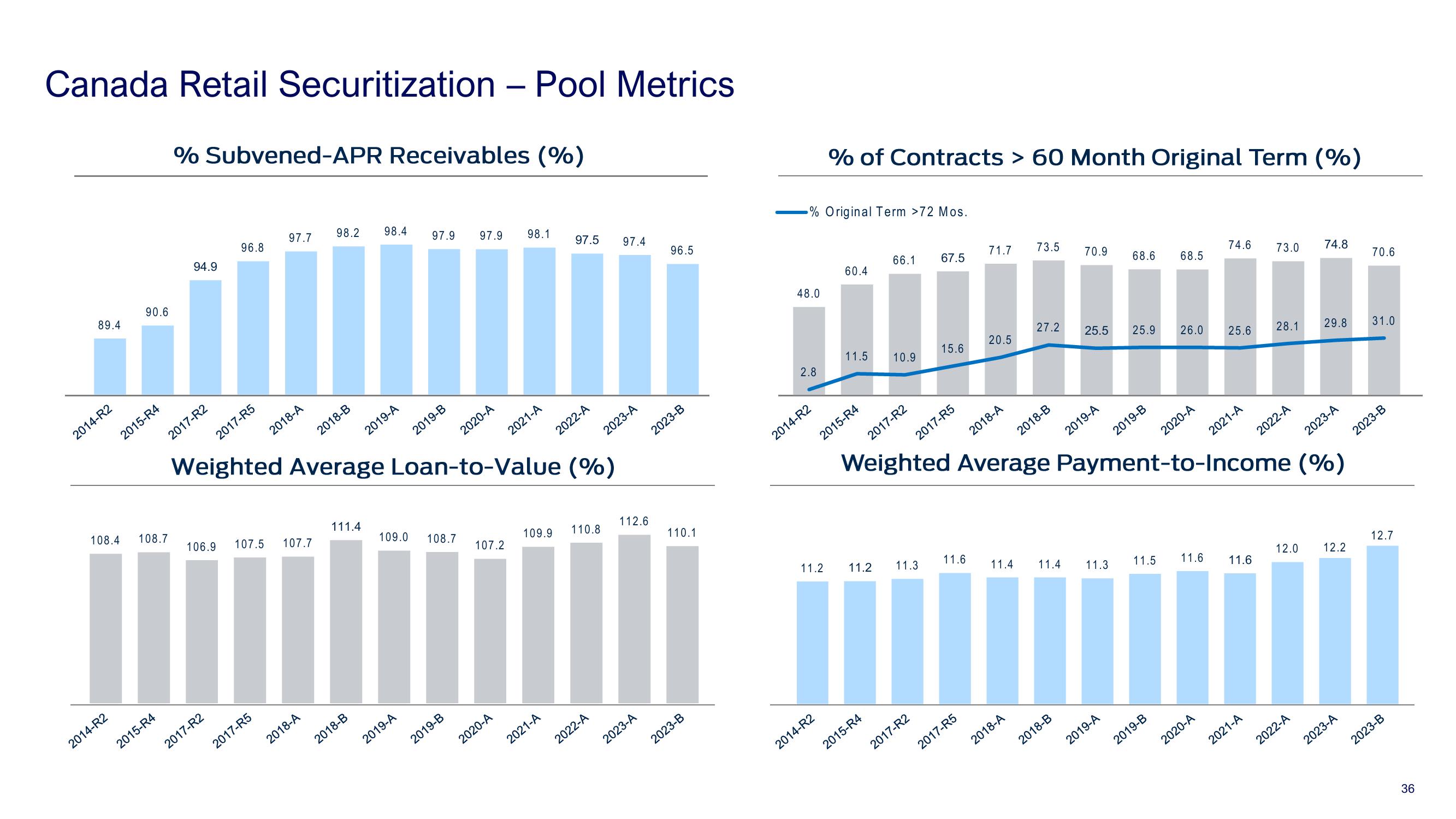

Canada Retail Securitization - Pool Metrics

89.4

2014-R2

90.6

2014-R2

2015-R4

108.4 108.7

2015-R4

% Subvened-APR Receivables (%)

94.9

2017-R2

96.8

2017-R5

2017-R2

97.7

2018-A

106.9 107.5 107.7

2017-R5

98.2 98.4

2018-A

2018-B

111.4

2019-A

2018-B

97.9 97.9 98.1

Weighted Average Loan-to-Value (%)

2019-B

2019-A

109.0 108.7

2020-A

2019-B

107.2

2021-A

2020-A

97.5 97.4

2022-A

2021-A

109.9 110.8

2023-A

2022-A

112.6

2023-A

96.5

2023-B

110.1

2023-B

% Original Term >72 Mos.

48.0

2.8

2014-R2

% of Contracts > 60 Month Original Term (%)

11.2

2014-R2

60.4

2015-R4

11.5

66.1

10.9

2017-R2

2015-R4

11.2 11.3

67.5

2017-R5

15.6

2017-R2

11.6

73.5

71.7

2017-R5

20.5

2018-A

27.2

2018-B

2018-A

11.4 11.4

70.9

2018-B

2019-A

68.6

11.3

25.5 25.9 26.0 25.6 28.1

2019-A

2019-B

Weighted Average Payment-to-Income (%)

68.5

11.5

2019-B

2020-A

74.6

2021-A

2020-A

11.6 11.6

73.0

2021-A

2022-A

74.8

29.8

2022-A

2023-A

12.0 12.2

2023-A

70.6

31.0

2023-B

12.7

2023-B

36View entire presentation