First Quarter 2017 Financial Review

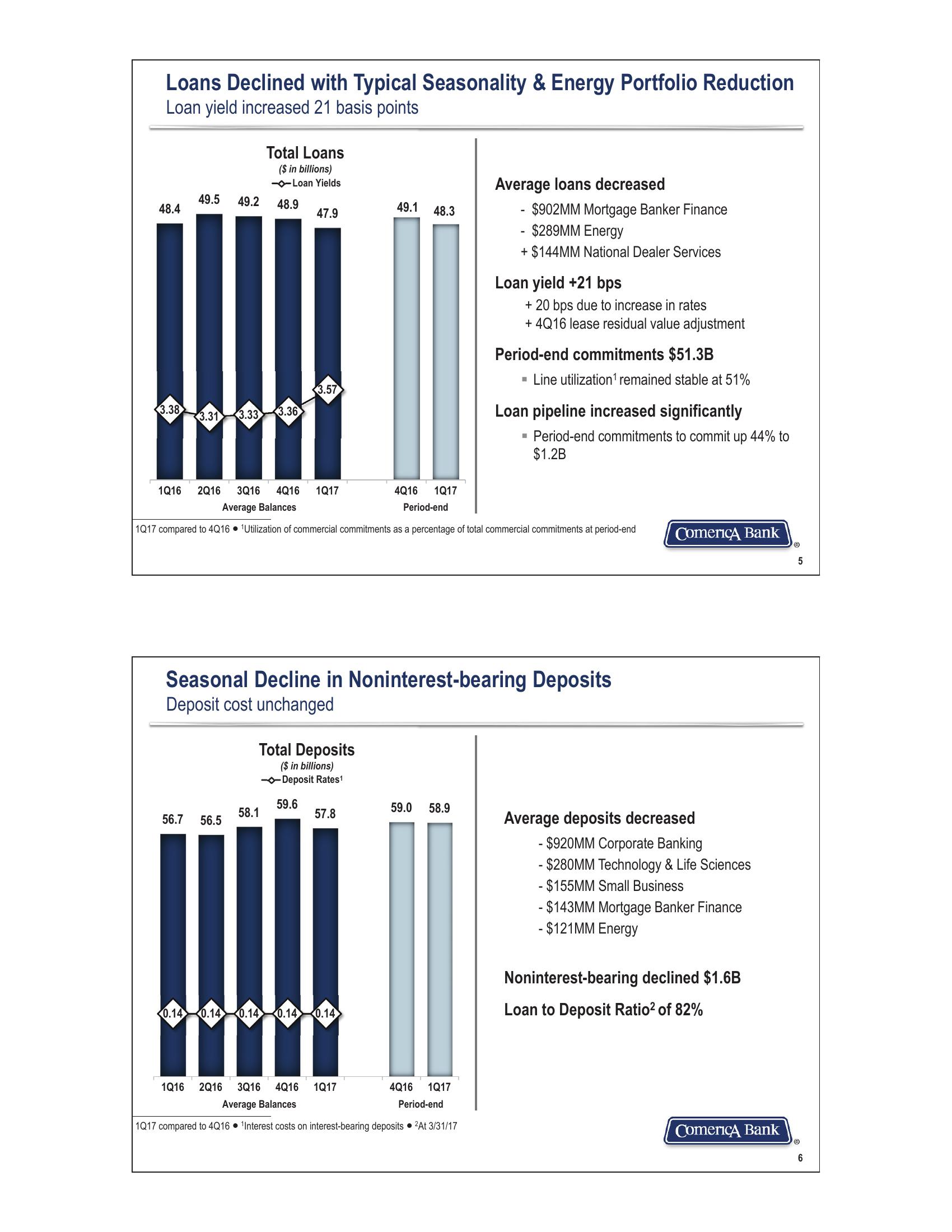

Loans Declined with Typical Seasonality & Energy Portfolio Reduction

Loan yield increased 21 basis points

Total Loans

($ in billions)

-Loan Yields

49.5 49.2

48.9

48.4

49.1

47.9

48.3

3.57

3.38

3.31 3.33

3.36

1Q16

2Q16 3Q16 4Q16 1Q17

Average Balances

4Q16

1Q17

Period-end

Average loans decreased

$902MM Mortgage Banker Finance

$289MM Energy

+$144MM National Dealer Services

Loan yield +21 bps

+ 20 bps due to increase in rates

+4Q16 lease residual value adjustment

Period-end commitments $51.3B

■ Line utilization¹ remained stable at 51%

Loan pipeline increased significantly

■ Period-end commitments to commit up 44% to

$1.2B

1Q17 compared to 4Q16 1Utilization of commercial commitments as a percentage of total commercial commitments at period-end

Seasonal Decline in Noninterest-bearing Deposits

Deposit cost unchanged

Total Deposits

($ in billions)

Deposit Rates1

Comerica Bank

5

59.6

59.0 58.9

58.1

57.8

56.7

56.5

Average deposits decreased

0.14

0.14 0.14 0.14 0.14

1Q16 2Q16 3Q16 4Q16 1Q17

Average Balances

4Q16

1917

Period-end

1Q17 compared to 4Q16 1Interest costs on interest-bearing deposits 2At 3/31/17

- $920MM Corporate Banking

-$280MM Technology & Life Sciences

- $155MM Small Business

-$143MM Mortgage Banker Finance

- $121MM Energy

Noninterest-bearing declined $1.6B

Loan to Deposit Ratio² of 82%

Comerica Bank

6View entire presentation