Silicon Valley Bank Results Presentation Deck

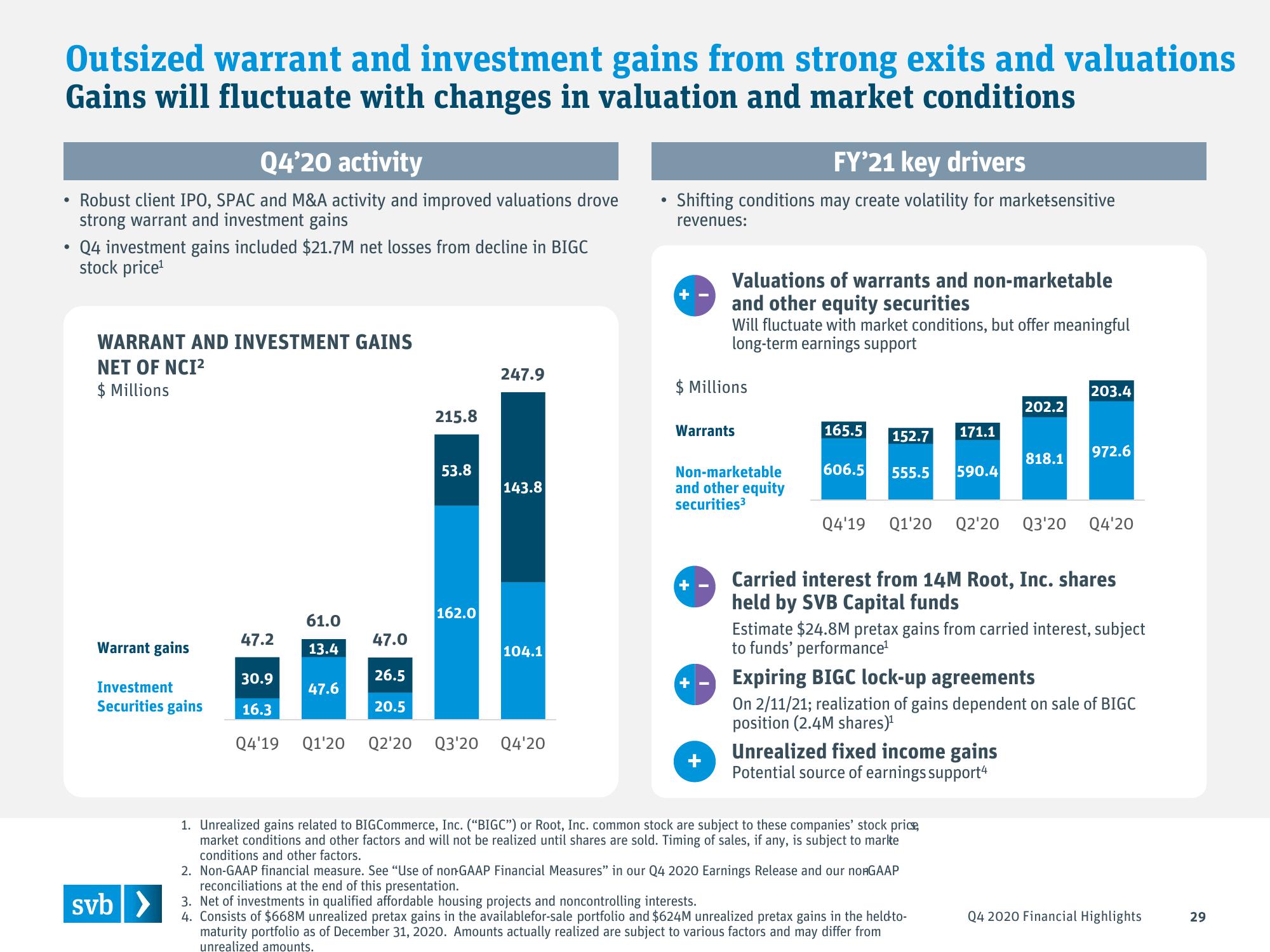

Outsized warrant and investment gains from strong exits and valuations

Gains will fluctuate with changes in valuation and market conditions

●

Q4'20 activity

Robust client IPO, SPAC and M&A activity and improved valuations drove

strong warrant and investment gains

Q4 investment gains included $21.7M net losses from decline in BIGC

stock price¹

WARRANT AND INVESTMENT GAINS

NET OF NCI²

$ Millions

Warrant gains

Investment

Securities gains

svb>

47.2

30.9

16.3

61.0

13.4

47.6

Q4'19 Q1'20

47.0

26.5

20.5

215.8

53.8

162.0

247.9

143.8

104.1

Q2'20 Q3'20 Q4'20

●

FY'21 key drivers

Shifting conditions may create volatility for marketsensitive

revenues:

+

$ Millions

Warrants

Valuations of warrants and non-marketable

and other equity securities

Will fluctuate with market conditions, but offer meaningful

long-term earnings support

Non-marketable

and other equity

securities³

+-

+

+

165.5 152.7 171.1

606.5

555.5 590.4

202.2

Q4'19 Q1'20 Q2'20 Q3'20 Q4'20

Unrealized fixed income gains

Potential source of earnings support4

818.1

Carried interest from 14M Root, Inc. shares

held by SVB Capital funds

1. Unrealized gains related to BIGCommerce, Inc. ("BIGC") or Root, Inc. common stock are subject to these companies' stock price

market conditions and other factors and will not be realized until shares are sold. Timing of sales, if any, is subject to marke

conditions and other factors.

203.4

Estimate $24.8M pretax gains from carried interest, subject

to funds' performance¹

2. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release and our noRGAAP

reconciliations at the end of this presentation.

972.6

Expiring BIGC lock-up agreements

On 2/11/21; realization of gains dependent on sale of BIGC

position (2.4M shares)¹

3. Net of investments in qualified affordable housing projects and noncontrolling interests.

4. Consists of $668M unrealized pretax gains in the availablefor-sale portfolio and $624M unrealized pretax gains in the held-to-

maturity portfolio as of December 31, 2020. Amounts actually realized are subject to various factors and may differ from

unrealized amounts.

Q4 2020 Financial Highlights

29View entire presentation