J.P.Morgan Investment Banking

APPENDIX

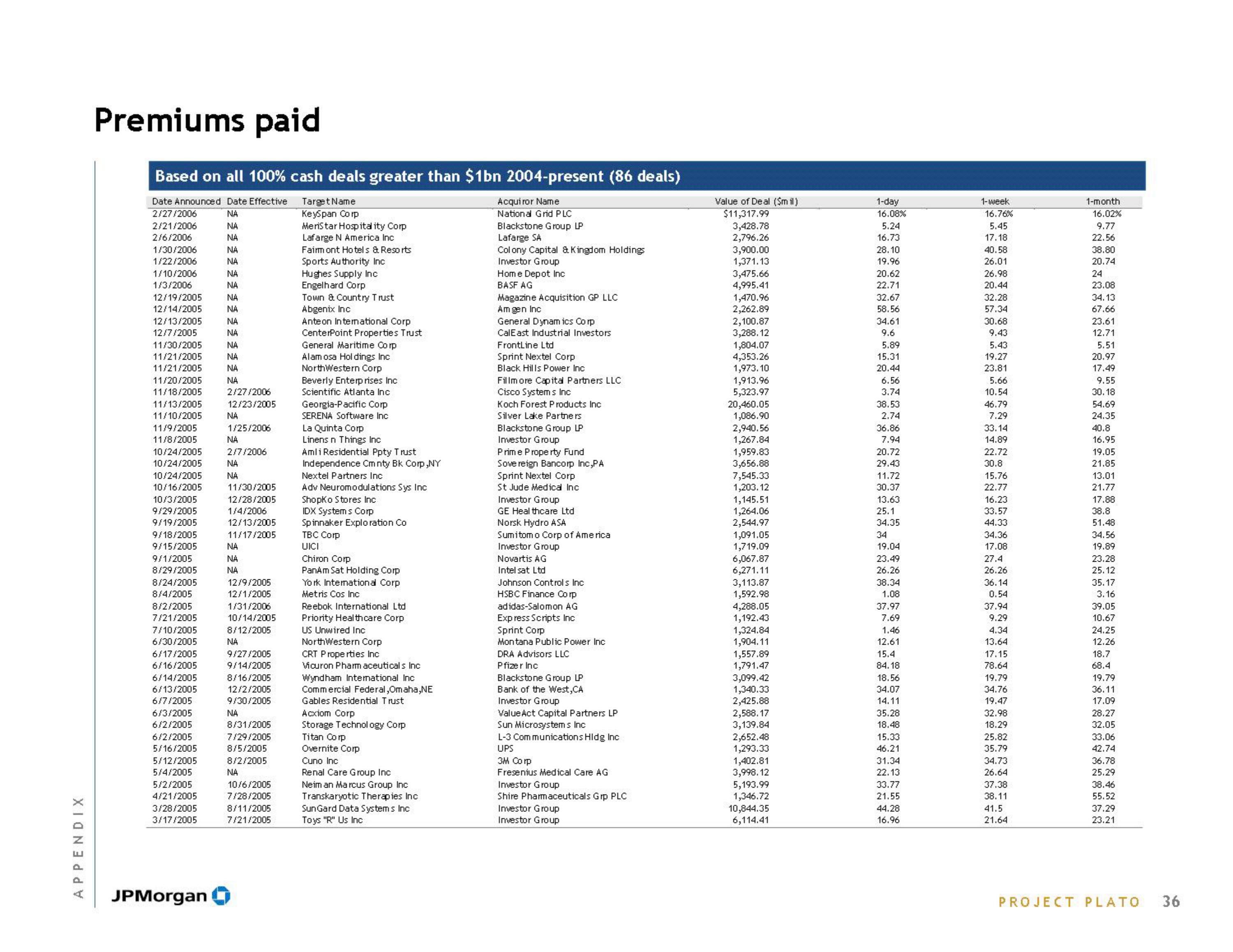

Premiums paid

Based on all 100% cash deals greater than $1bn 2004-present (86 deals)

Date Announced Date Effective

2/27/2006

Target Name

KeySpan Corp

NA

NA

MeriStar Hospitality Corp

NA

Lafarge N America Inc

2/21/2006

2/6/2006

1/30/2006

1/22/2006

1/10/2006

1/3/2006

12/19/2005

12/14/2005

12/13/2005

12/7/2005

11/30/2005

11/21/2005

11/21/2005

11/20/2005

11/18/2005

11/13/2005

11/10/2005

11/9/2005

11/8/2005

10/24/2005

10/24/2005

10/24/2005

10/16/2005

10/3/2005

9/29/2005

9/19/2005

9/18/2005

9/15/2005

9/1/2005

8/29/2005

8/24/2005

8/4/2005

8/2/2005

7/21/2005

7/10/2005

6/30/2005

6/17/2005

6/16/2005

6/14/2005

6/13/2005

6/7/2005

6/3/2005

6/2/2005

6/2/2005

5/16/2005

5/12/2005

5/4/2005

5/2/2005

4/21/2005

3/28/2005

3/17/2005

JPMorgan

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

2/27/2006

12/23/2005

NA

1/25/2006

NA

2/7/2006

NA

NA

11/30/2005

12/28/2005

1/4/2006

12/13/2005

11/17/2005

NA

NA

NA

12/9/2005

12/1/2005

1/31/2006

10/14/2005

8/12/2005

NA

9/27/2005

9/14/2005

8/16/2005

12/2/2005

9/30/2005

NA

8/31/2005

7/29/2005

8/5/2005

8/2/2005

NA

10/6/2005

7/28/2005

8/11/2005

7/21/2005

Fairm ont Hotels & Resorts

Sports Authority Inc

Hughes Supply Inc

Engelhard Corp

Town & Country Trust

Abgenix Inc

Anteon International Corp

CenterPoint Properties Trust

General Maritime Corp

Alam osa Holdings Inc

NorthWestern Corp

Beverly Enterprises Inc

Scientific Atlanta Inc

Georgia-Pacific Corp

SERENA Software Inc

La Quinta Corp

Linens n Things Inc

Amli Residential Ppty Trust

Independence Cmnty Bk Corp,NY

Nextel Partners Inc

Adv Neuromodulations Sys Inc

Shopko Stores Inc.

IDX Systems Corp

Spinnaker Exploration Co

TBC Corp

UICI

Chiron Corp

PanAm Sat Holding Corp

York International Corp

Metris Cos Inc

Reebok International Ltd

Priority Healthcare Corp

US Unwired Inc

NorthWestern Corp

CRT Properties Inc

Vicuron Pharmaceuticals Inc

Wyndham International Inc

Commercial Federal,Omaha, NE

Gables Residential Trust

Acxiom Corp

Storage Technology Corp

Titan Corp

Overnite Corp

Cuno Inc

Renal Care Group Inc

Neim an Marcus Group Inc

Transkaryotic Therapies Inc

Sun Gard Data Systems Inc

Toys "R" Us Inc

Acquiror Name

National Grid PLC

Blackstone Group LP

Lafarge SA

Colony Capital & Kingdom Holdings

Investor Group

Home Depot Inc

BASF AG

Magazine Acquisition GP LLC

Amgen Inc

General Dynamics Corp

CalEast Industrial Investors

FrontLine Ltd

Sprint Nextel Corp.

Black Hills Power Inc

Fillmore Capital Partners LLC

Cisco Systems Inc

Koch Forest Products Inc

Silver Lake Partners

Blackstone Group LP

Investor Group

Prime Property Fund

Sovereign Bancorp Inc,PA

Sprint Nextel Corp

St Jude Medical Inc

Investor Group

GE Healthcare Ltd

Norsk Hydro ASA

Sumitom o Corp of America

Investor Group

Novartis AG

Intelsat Ltd

Johnson Controls Inc

HSBC Finance Corp

adidas-Salomon AG

Express Scripts Inc

Sprint Corp

Montana Public Power Inc

DRA Advisors LLC

Pfizer Inc

Blackstone Group LP

Bank of the West, CA

Investor Group

Value Act Capital Partners LP

Sun Microsystems Inc

L-3 Communications Hldg Inc

UPS

3M Corp

Fresenius Medical Care AG

Investor Group

Shire Pharmaceuticals Grp PLC

Investor Group

Investor Group

Value of Deal (Smil)

$11,317.99

3,428.78

2,796.26

3,900.00

1,371.13

3,475.66

4,995.4

1,470.96

2,262.89

2,100.87

3,288.12

1,804.07

4,353.26

1,973.10

1,913.96

5,323.97

20,460.05

1,086.90

2,940.56

1,267.84

1,959.83

3,656.88

7,545.33

1,203.12

1,145.51

1,264.06

2,544.97

1,091.05

1,719.09

6,067.87

6,271.11

3,113.87

1,592.98

4,288.05

1,192.43

1,324.84

1,904.11

1,557.89

1,791.47

3,099.42

1,340.33

2,425.88

2,588.17

3,139.84

2,652.48

1,293.33

1,402.81

3,998.12

5,193.99

1,346.72

10,844.35

6,114.41

1-day

16.08%

5.24

16.73

28.10

19.96

20.62

2.71

32.67

58.56

34.61

9.6

5.89

15.31

20.44

6.56

3.74

38.53

2.74

36.86

7.94

20.72

29.43

11.72

30.37

13.63

25.1

34.35

34

19.04

23.49

26.26

38.34

1.08

37.97

7.69

1.46

12.61

15.4

84.18

18.56

34.07

14.11

35.28

18.48

15.33

46.21

31.34

22.13

33.77

21.55

44.28

16.96

1-week

16.76%

5.45

17.18

40.58

26.01

26.98

20.44

32.28

57.34

30.68

9.43

5.43

19.27

23.81

5.66

10.54

46.79

7.29

33.14

14.89

22.72

30.8

15.76

22.77

16.23

33.57

44.33

34.36

17.08

27.4

26.26

36.14

0.54

37.94

9.29

4.34

13.64

17.15

78.64

19.79

34.76

19.47

32.98

18.29

25.82

35.79

34.73

26.64

37.38

38.11

41.5

21.64

1-month

16.02%

9.77

22.56

38.80

20.74

24

23.08

34.13

67.66

23.61

12.71

5.51

20.97

17.49

9.55

30.18

54.69

24.35

40.8

16.95

19.05

21.85

13.01

21.77

17.88

38.8

51.48

34.56

19.89

23.28

25.12

35.17

3.16

39.05

10.67

24.25

12.26

18.7

68.4

19.79

36.11

17.09

28.27

32.05

33.06

42.74

36.78

25.29

38.46

55.52

37.29

23.21

PROJECT PLATO

36View entire presentation