HSBC Investor Event Presentation Deck

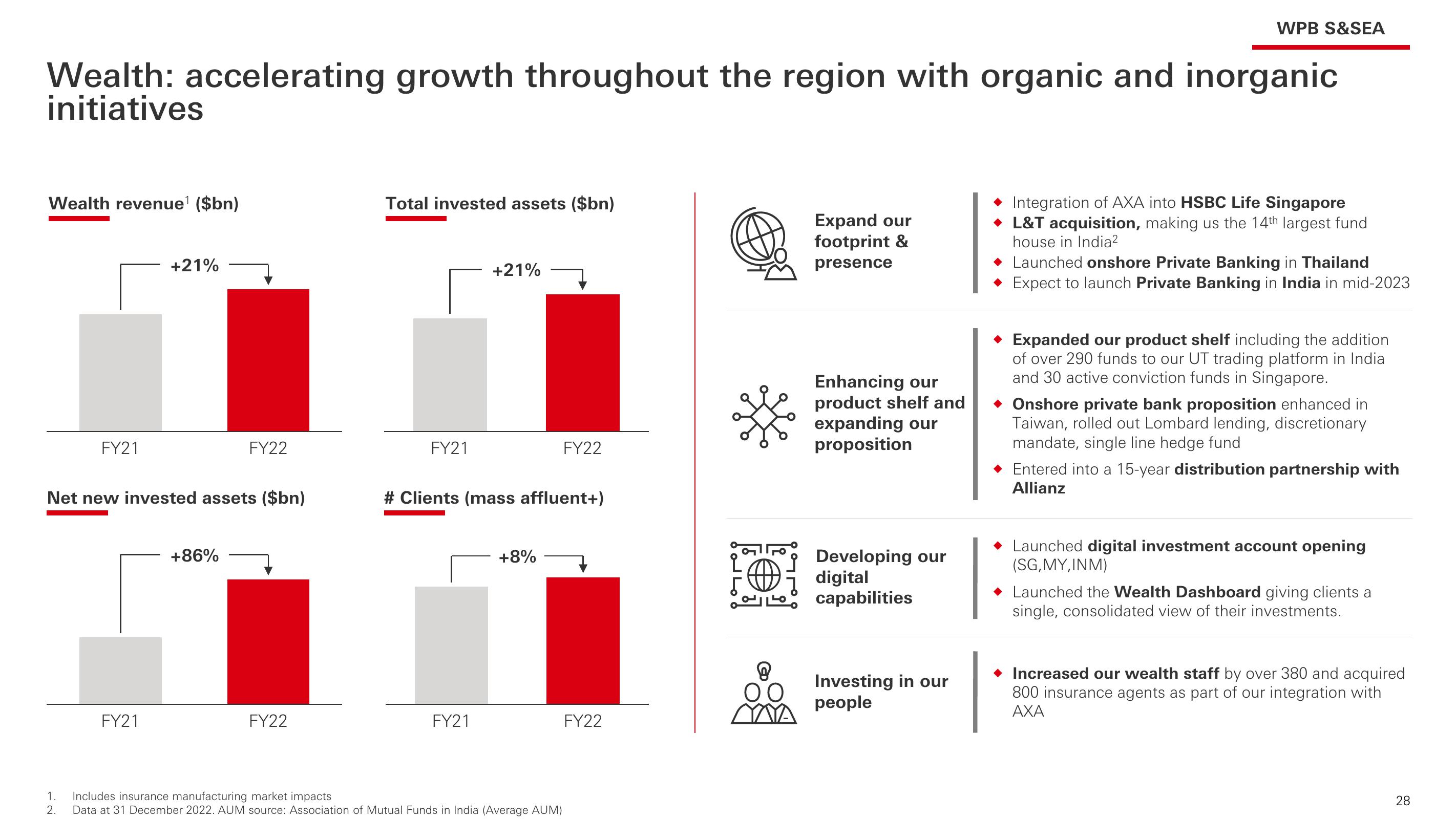

Wealth: accelerating growth throughout the region with organic and inorganic

initiatives

Wealth revenue¹ ($bn)

r

FY21

+21%

FY21

Net new invested assets ($bn)

FY22

+86%

FY22

Total invested assets ($bn)

FY21

+21%

FY21

# Clients (mass affluent+)

+8%

FY22

1. Includes insurance manufacturing market impacts

2. Data at 31 December 2022. AUM source: Association of Mutual Funds in India (Average AUM)

FY22

!

OO

Expand our

footprint &

presence

Enhancing our

product shelf and

expanding our

proposition

Developing our

digital

capabilities

WPB S&SEA

Investing in our

people

Integration of AXA into HSBC Life Singapore

◆ L&T acquisition, making us the 14th largest fund

house in India²

Launched onshore Private Banking in Thailand

Expect to launch Private Banking in India in mid-2023

◆ Expanded our product shelf including the addition

of over 290 funds to our UT trading platform in India

and 30 active conviction funds in Singapore.

◆

Onshore private bank proposition enhanced in

Taiwan, rolled out Lombard lending, discretionary

mandate, single line hedge fund

◆ Entered into a 15-year distribution partnership with

Allianz

Launched digital investment account opening

(SG, MY, INM)

◆ Launched the Wealth Dashboard giving clients a

single, consolidated view of their investments.

◆ Increased our wealth staff by over 380 and acquired

800 insurance agents as part of our integration with

AXA

28View entire presentation