Allego Investor Presentation Deck

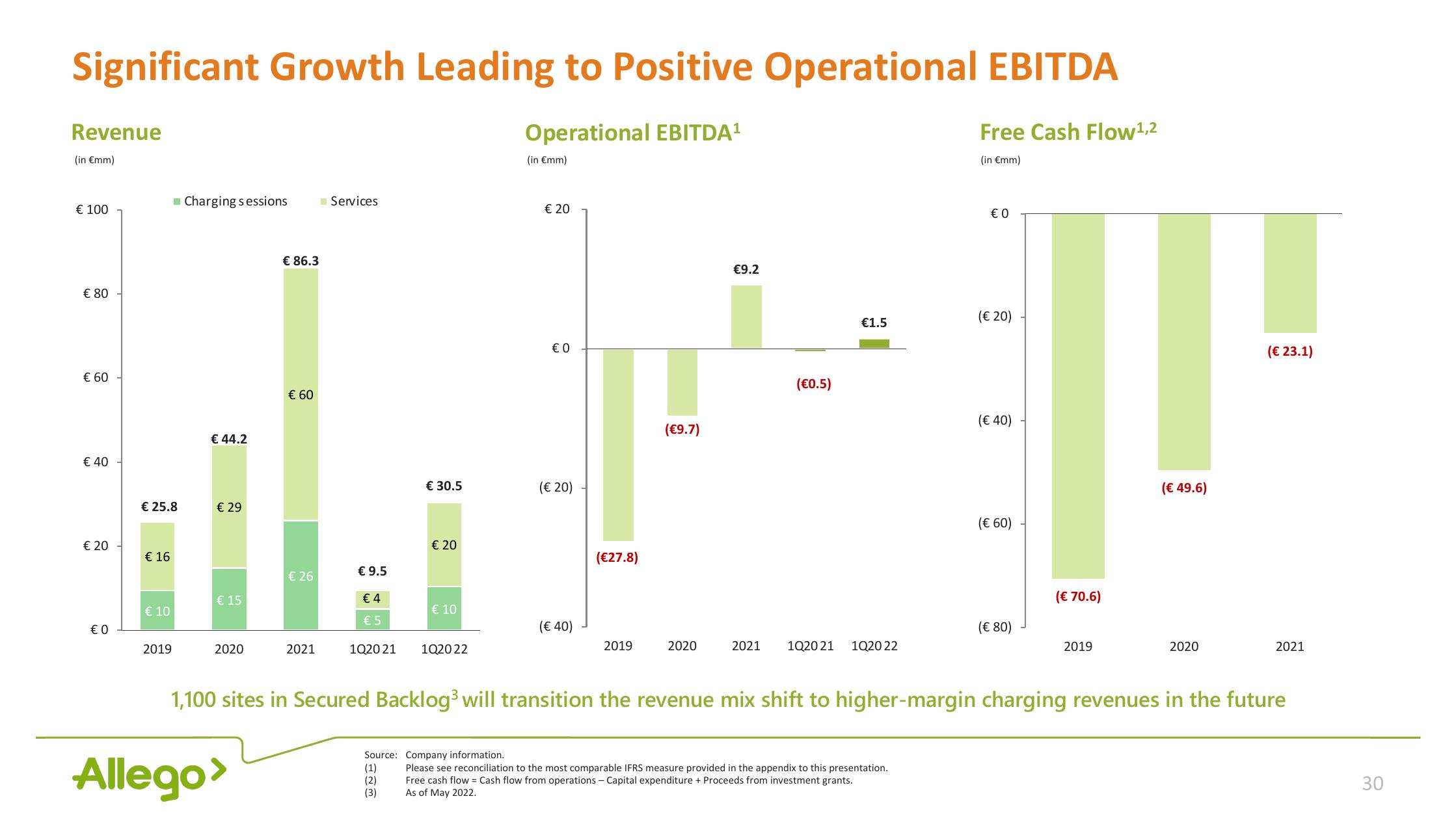

Significant Growth Leading to Positive Operational EBITDA

Operational EBITDA¹

Revenue

(in €mm)

€ 100

€ 80

€ 60

€ 40

€ 20

€ 0

€ 25.8

€ 16

€ 10

2019

Charging sessions

€ 44.2

€ 29

€ 15

2020

€ 86.3

Allego>

€ 60

€ 26

2021

Services

€ 9.5

€ 4

€ 5

1Q20 21

€ 30.5

€ 20

(1)

(2)

(3)

€ 10

102022

(in €mm)

€ 20

€ 0

(€ 20)

(€ 40)

(€27.8)

2019

(€9.7)

2020

€9.2

(€0.5)

€1.5

2021 1Q20 21 1020 22

Source: Company information.

Please see reconciliation to the most comparable IFRS measure provided in the appendix to this presentation.

Free cash flow = Cash flow from operations - Capital expenditure + Proceeds from investment grants.

As of May 2022.

Free Cash Flow ¹,2

(in €mm)

€ 0

(€ 20)

(€ 40)

(€ 60)

(€ 80)

(€ 70.6)

2019

(€ 49.6)

2020

1,100 sites in Secured Backlog³ will transition the revenue mix shift to higher-margin charging revenues in the future

(€ 23.1)

2021

30View entire presentation