FaZe SPAC Presentation Deck

TRANSACTION OVERVIEW(1)

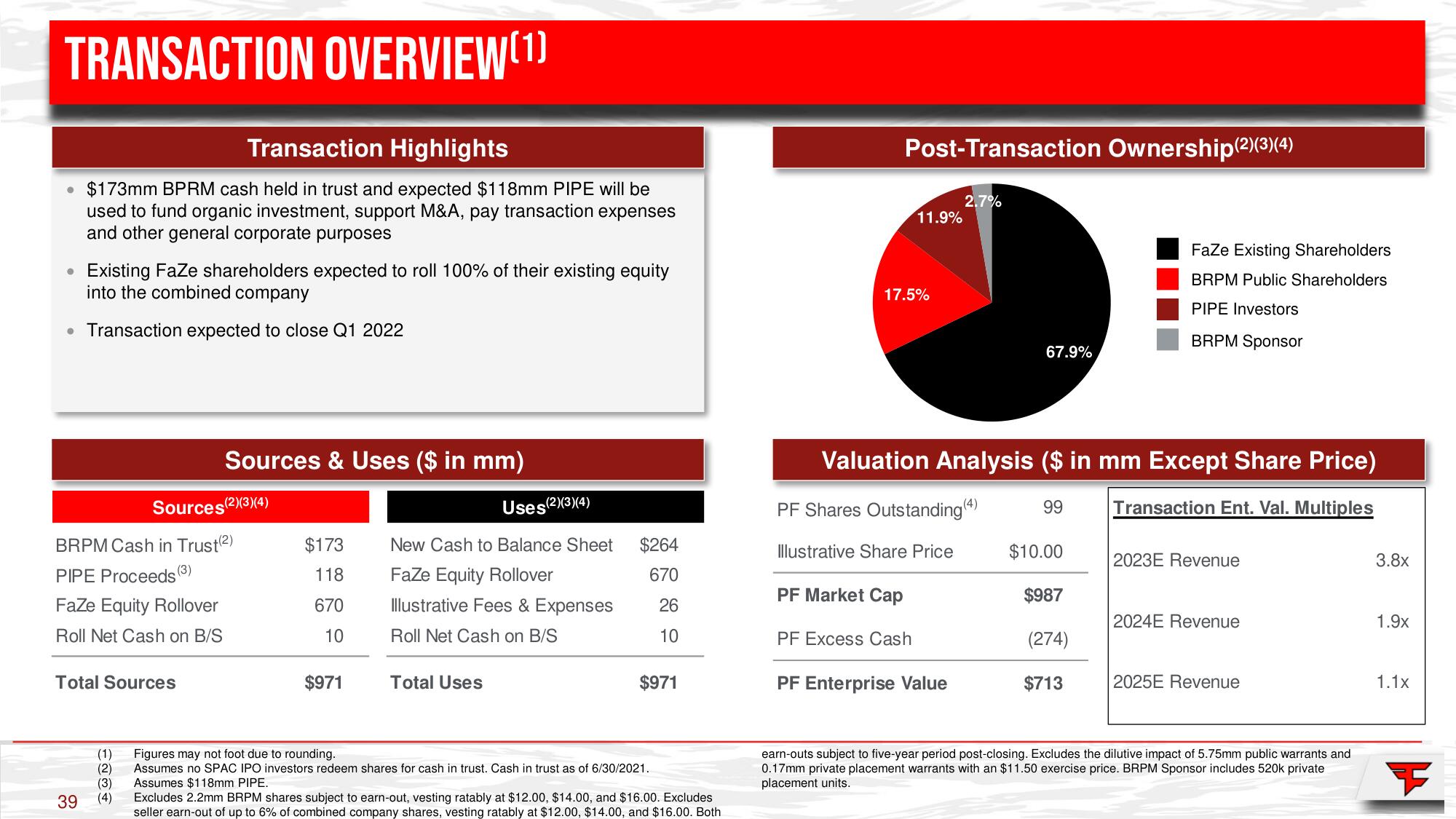

Transaction Highlights

• $173mm BPRM cash held in trust and expected $118mm PIPE will be

used to fund organic investment, support M&A, pay transaction expenses

and other general corporate purposes

Existing FaZe shareholders expected to roll 100% of their existing equity

into the combined company

• Transaction expected to close Q1 2022

●

BRPM Cash in Trust (2)

PIPE Proceeds (3)

FaZe Equity Rollover

Roll Net Cash on B/S

Total Sources

39

Sources & Uses ($ in mm)

Sources(2)(3)(4)

(1)

(3)

(4)

$173

118

670

10

$971

Uses(2)(3)(4)

New Cash to Balance Sheet $264

FaZe Equity Rollover

670

Illustrative Fees & Expenses 26

Roll Net Cash on B/S

10

Total Uses

$971

Figures may not foot due to rounding.

Assumes no SPAC IPO investors redeem shares for cash in trust. Cash in trust as of 6/30/2021.

Assumes $118mm PIPE.

Excludes 2.2mm BRPM shares subject to earn-out, vesting ratably at $12.00, $14.00, and $16.00. Excludes

seller earn-out of up to 6% of combined company shares, vesting ratably at $12.00, $14.00, and $16.00. Both

Post-Transaction Ownership(2)(3)(4)

11.9%

17.5%

Illustrative Share Price

PF Market Cap

PF Excess Cash

2.7%

Valuation Analysis ($ in mm Except Share Price)

PF Shares Outstanding (4)

99

Transaction Ent. Val. Multiples

PF Enterprise Value

67.9%

FaZe Existing Shareholders

BRPM Public Shareholders

PIPE Investors

BRPM Sponsor

$10.00

$987

(274)

$713

2023E Revenue

2024E Revenue

2025E Revenue

earn-outs subject to five-year period post-closing. Excludes the dilutive impact of 5.75mm public warrants and

0.17mm private placement warrants with an $11.50 exercise price. BRPM Sponsor includes 520k private

placement units.

3.8x

1.9x

1.1xView entire presentation