Nikola SPAC Presentation Deck

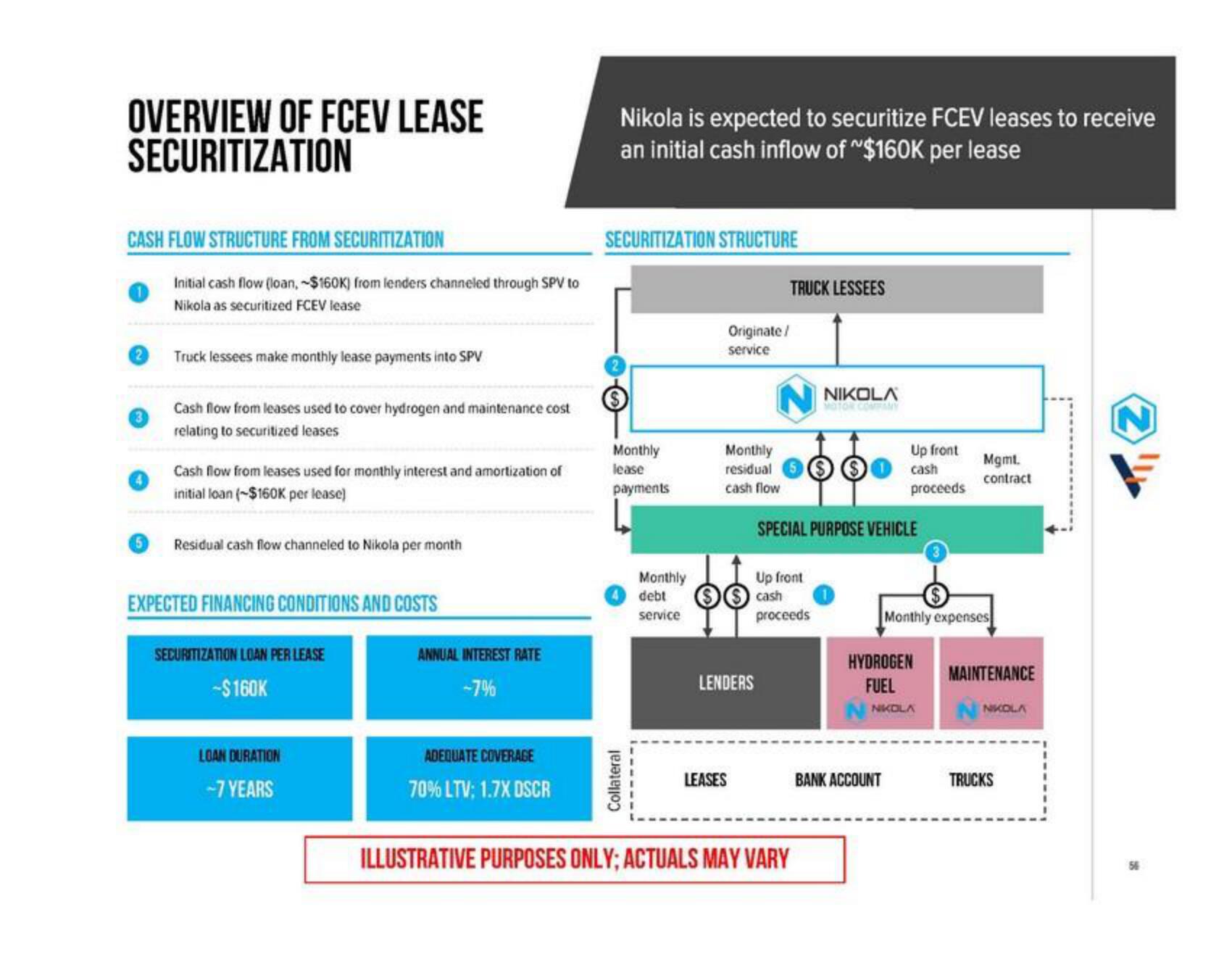

OVERVIEW OF FCEV LEASE

SECURITIZATION

CASH FLOW STRUCTURE FROM SECURITIZATION

Initial cash flow (loan, -$160K) from lenders channeled through SPV to

Nikola as securitized FCEV lease

Truck lessees make monthly lease payments into SPV

Cash flow from leases used to cover hydrogen and maintenance cost

relating to securitized leases

Cash flow from leases used for monthly interest and amortization of

initial loan (-$160K per lease)

Residual cash flow channeled to Nikola per month

EXPECTED FINANCING CONDITIONS AND COSTS

SECURITIZATION LOAN PER LEASE

-$160K

LOAN DURATION

-7 YEARS

ANNUAL INTEREST RATE

-7%

ADEQUATE COVERAGE

70% LTV; 1.7X DSCR

Nikola is expected to securitize FCEV leases to receive

an initial cash inflow of ~$160K per lease

SECURITIZATION STRUCTURE

Monthly

lease

payments

Collateral

Monthly

debt

service

Monthly

residual

cash flow

Originate/

service

LEASES

TRUCK LESSEES

LENDERS

Up front

cash

proceeds

NIKOLA

MOTOR COMPANY

SPECIAL PURPOSE VEHICLE

ILLUSTRATIVE PURPOSES ONLY; ACTUALS MAY VARY

Up front

cash

proceeds

Monthly expenses

HYDROGEN

FUEL

NIKOLA

BANK ACCOUNT

Mgmt.

contract

MAINTENANCE

NIKOLA

TRUCKSView entire presentation