Paysafe Results Presentation Deck

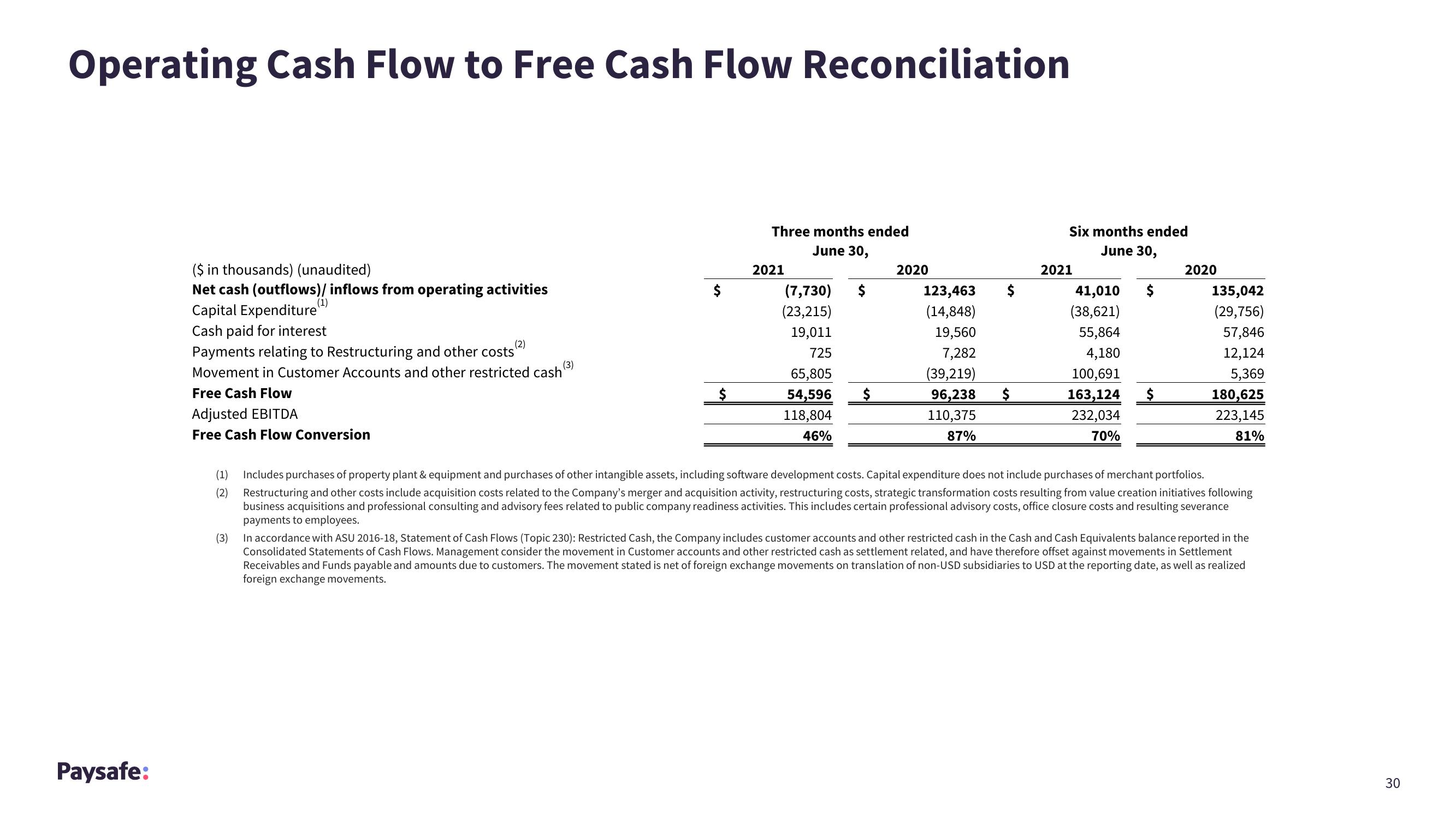

Operating Cash Flow to Free Cash Flow Reconciliation

Paysafe:

($ in thousands) (unaudited)

Net cash (outflows)/ inflows from operating activities

Capital Expenditure

Cash paid for interest

(1)

(2)

Payments relating to Restructuring and other costs

Movement in Customer Accounts and other restricted cash

(3)

Free Cash Flow

Adjusted EBITDA

Free Cash Flow Conversion

$

Three months ended

June 30,

2021

(7,730) $

(23,215)

19,011

725

65,805

54,596

118,804

46%

$

2020

123,463

(14,848)

19,560

7,282

(39,219)

96,238

110,375

87%

$

Six months ended

June 30,

2021

41,010

(38,621)

55,864

4,180

100,691

163,124

232,034

70%

$

$

2020

135,042

(29,756)

57,846

12,124

5,369

180,625

223,145

81%

(1) Includes purchases of property plant & equipment and purchases of other intangible assets, including software development costs. Capital expenditure does not include purchases of merchant portfolios.

(2) Restructuring and other costs include acquisition costs related to the Company's merger and acquisition activity, restructuring costs, strategic transformation costs resulting from value creation initiatives following

business acquisitions and professional consulting and advisory fees related to public company readiness activities. This includes certain professional advisory costs, office closure costs and resulting severance

payments to employees.

(3)

In accordance with ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash, the Company includes customer accounts and other restricted cash in the Cash and Cash Equivalents balance reported in the

Consolidated Statements of Cash Flows. Management consider the movement in Customer accounts and other restricted cash as settlement related, and have therefore offset against movements in Settlement

Receivables and Funds payable and amounts due to customers. The movement stated is net of foreign exchange movements on translation of non-USD subsidiaries to USD at the reporting date, as well as realized

foreign exchange movements.

30View entire presentation