HSBC Investor Day Presentation Deck

FY21 financial performance

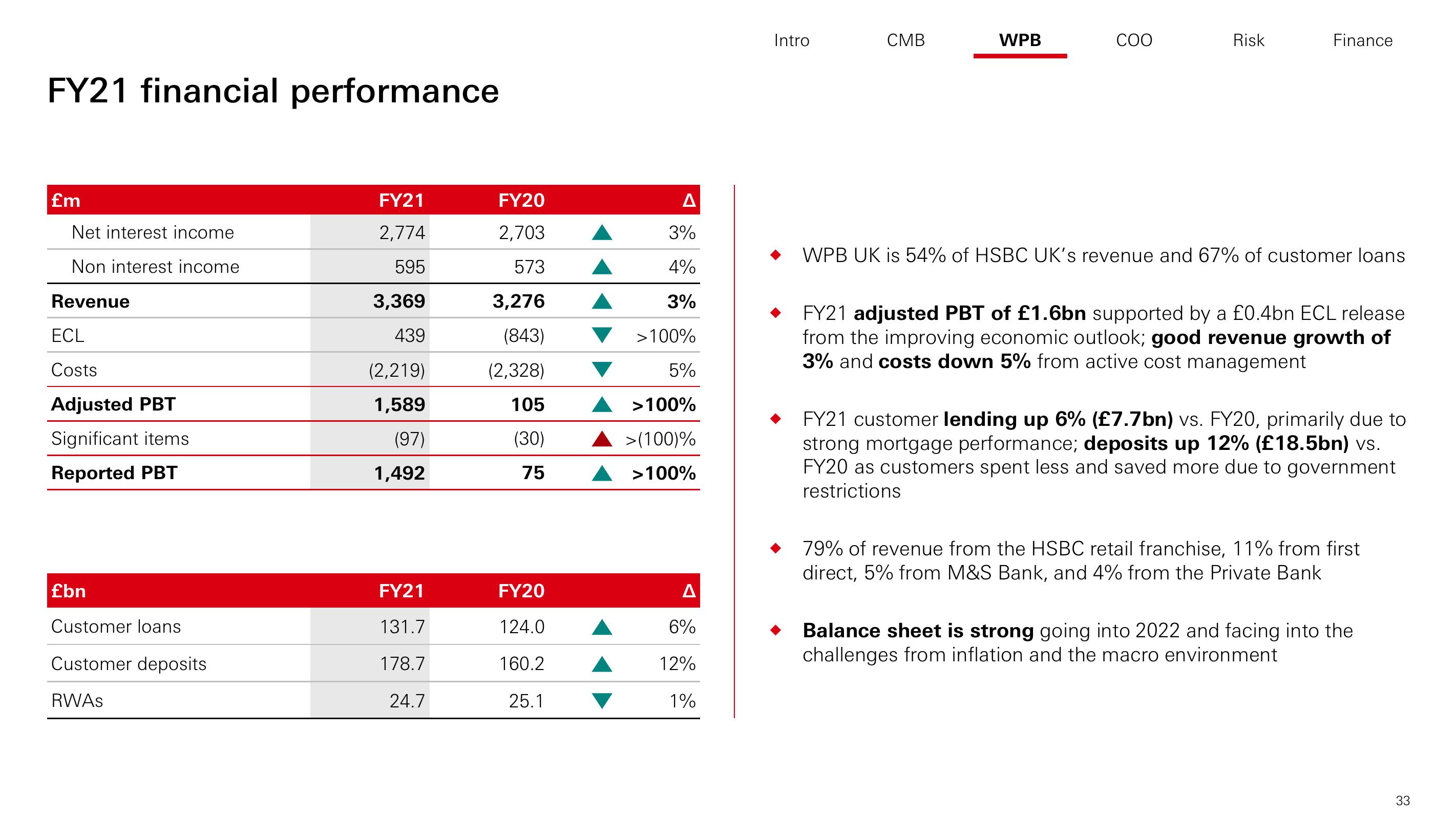

£m

Net interest income

Non interest income

Revenue

ECL

Costs

Adjusted PBT

Significant items

Reported PBT

£bn

Customer loans

Customer deposits

RWAS

FY21

2,774

595

3,369

439

(2,219)

1,589

(97)

1,492

FY21

131.7

178.7

24.7

FY20

2,703

573

3,276

(843)

(2,328)

105

(30)

75

FY20

124.0

160.2

25.1

A

3%

4%

3%

>100%

5%

>100%

▲ >(100)%

>100%

ΔΙ

6%

12%

1%

Intro

CMB

WPB

COO

Risk

Finance

WPB UK is 54% of HSBC UK's revenue and 67% of customer loans

FY21 adjusted PBT of £1.6bn supported by a £0.4bn ECL release

from the improving economic outlook; good revenue growth of

3% and costs down 5% from active cost management

FY21 customer lending up 6% (£7.7bn) vs. FY20, primarily due to

strong mortgage performance; deposits up 12% (£18.5bn) vs.

FY20 as customers spent less and saved more due to government

restrictions

79% of revenue from the HSBC retail franchise, 11% from first

direct, 5% from M&S Bank, and 4% from the Private Bank

Balance sheet is strong going into 2022 and facing into the

challenges from inflation and the macro environment

33View entire presentation