Clover Health Investor Presentation Deck

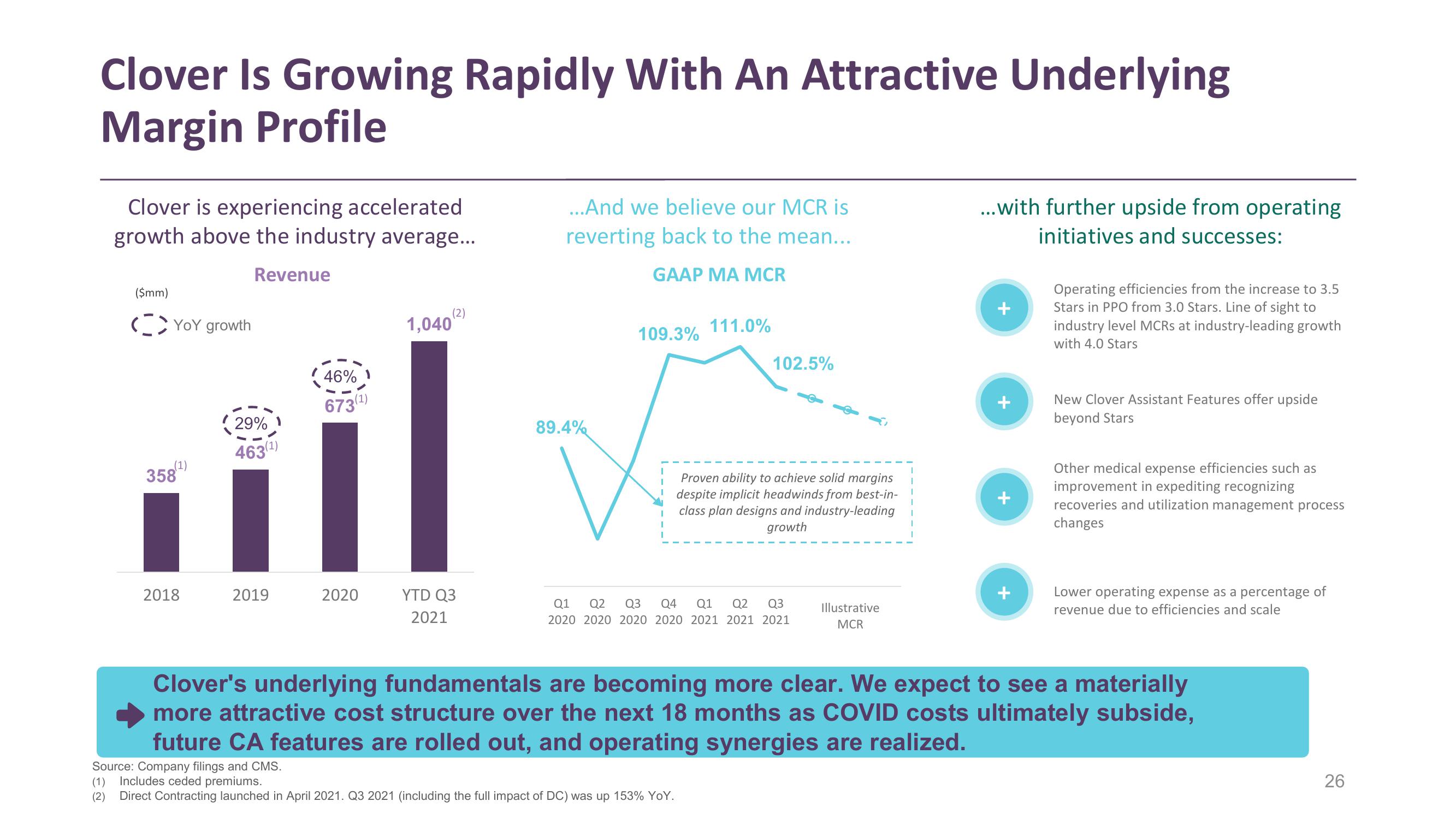

Clover Is Growing Rapidly With An Attractive Underlying

Margin Profile

Clover is experiencing accelerated

growth above the industry average...

Revenue

($mm)

YoY growth

(1)

358/¹)

2018

29%

463(¹)

2019

46%

673

T

2020

(2)

1,040

YTD Q3

2021

...And we believe our MCR is

reverting back to the mean...

GAAP MA MCR

89.4%

109.3%

111.0%

102.5%

Source: Company filings and CMS.

(1) Includes ceded premiums.

(2)

Direct Contracting launched in April 2021. Q3 2021 (including the full impact of DC) was up 153% YoY.

Proven ability to achiev solid margins

despite implicit headwinds from best-in-

class plan designs and industry-leading

growth

Q1 Q2 Q3 Q4 Q1 Q2 Q3

2020 2020 2020 2020 2021 2021 2021

Illustrative

MCR

...with further upside from operating

initiatives and successes:

Operating efficiencies from the increase to 3.5

Stars in PPO from 3.0 Stars. Line of sight to

industry level MCRS at industry-leading growth

with 4.0 Stars

New Clover Assistant Features offer upside

beyond Stars

Other medical expense efficiencies such as

improvement in expediting recognizing

recoveries and utilization management process

changes

Lower operating expense as a percentage of

revenue due to efficiencies and scale

Clover's underlying fundamentals are becoming more clear. We expect to see a materially

more attractive cost structure over the next 18 months as COVID costs ultimately subside,

future CA features are rolled out, and operating synergies are realized.

26View entire presentation