Ares US Real Estate Opportunity Fund III

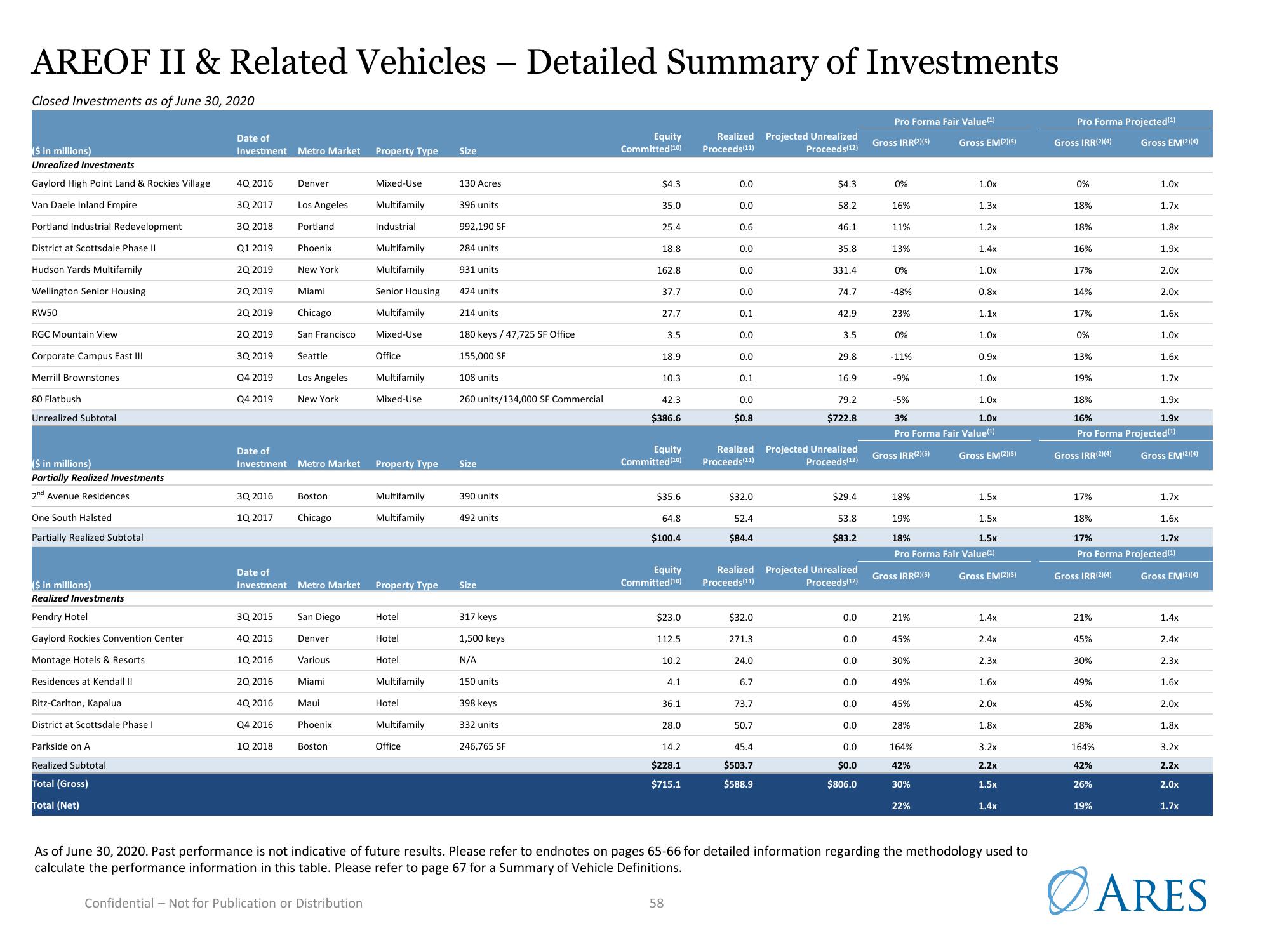

AREOF II & Related Vehicles - Detailed Summary of Investments

Closed Investments as of June 30, 2020

($ in millions)

Unrealized Investments

Gaylord High Point Land & Rockies Village

Van Daele Inland Empire

Portland Industrial Redevelopment

District at Scottsdale Phase II

Hudson Yards Multifamily

Wellington Senior Housing

RW50

RGC Mountain View

Corporate Campus East III

Merrill Brownstones

80 Flatbush

Unrealized Subtotal

($ in millions)

Partially Realized Investments

2nd Avenue Residences

One South Halsted

Partially Realized Subtotal

($ in millions)

Realized Investments

Pendry Hotel

Gaylord Rockies Convention Center

Montage Hotels & Resorts

Residences at Kendall II

Ritz-Carlton, Kapalua

District at Scottsdale Phase I

Parkside on A

Realized Subtotal

Total (Gross)

Total (Net)

Date of

Investment Metro Market

4Q 2016

3Q 2017

3Q 2018

Q1 2019

2Q 2019

2Q 2019

2Q 2019

2Q 2019

3Q 2019

Q4 2019

Q4 2019

3Q 2016

1Q 2017

3Q 2015

Date of

Investment Metro Market

4Q 2015

1Q 2016

2Q 2016

Denver

4Q 2016

Q4 2016

Los Angeles

Portland

Phoenix

New York

Miami

Chicago

1Q 2018

San Francisco

Date of

Investment Metro Market

Seattle

Los Angeles

New York

Boston

Chicago

San Diego

Denver

Various

Miami

Maui

Phoenix

Boston

Property Type

Confidential - Not for Publication or Distribution

Mixed-Use

Multifamily

Industrial

Multifamily

Multifamily

Senior Housing

Multifamily

Mixed-Use

Office

Multifamily

Mixed-Use

Property Type

Multifamily

Multifamily

Property Type

Hotel

Hotel

Hotel

Multifamily

Hotel

Multifamily

Office

Size

130 Acres

396 units

992,190 SF

284 units.

931 units

424 units

214 units

180 keys / 47,725 SF Office

155,000 SF

108 units

260 units/134,000 SF Commercial

Size

390 units

492 units

Size

317 keys

1,500 keys

N/A

150 units

398 keys

332 units

246,765 SF

Equity

Committed (10)

$4.3

35.0

25.4

18.8

162.8

37.7

27.7

3.5

18.9

10.3

42.3

$386.6

Equity

Committed (10)

$35.6

64.8

$100.4

Equity

Committed (10)

$23.0

112.5

10.2

4.1

36.1

28.0

14.2

$228.1

$715.1

58

Realized Projected Unrealized

Proceeds(11)

Proceeds(12)

0.0

0.0

0.6

0.0

0.0

0.0

0.1

0.0

0.0

0.1

0.0

$0.8

$32.0

52.4

$84.4

$32.0

271.3

24.0

6.7

73.7

$4.3

58.2

50.7

46.1

45.4

$503.7

$588.9

35.8

331.4

Realized Projected Unrealized

Proceeds(11)

Proceeds (12)

74.7

42.9

3.5

29.8

Realized Projected Unrealized

Proceeds(11)

Proceeds(12)

16.9

79.2

$722.8

$29.4

53.8

$83.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

$0.0

$806.0

Pro Forma Fair Value(¹)

Gross IRR(2)(5)

0%

16%

11%

13%

0%

-48%

23%

0%

-11%

Gross IRR(2)(5)

18%

Gross IRR(2)(5)

21%

45%

30%

49%

45%

-9%

1.0x

-5%

3%

Pro Forma Fair Value(¹)

1.0x

28%

164%

42%

Gross EM(2)(5)

30%

1.0x

22%

1.3x

1.2x

1.4x

19%

1.5x

18%

1.5x

Pro Forma Fair Value(¹)

1.0x

0.8x

1.1x

1.0x

0.9x

1.0x

Gross EM(2)(5)

1.5x

Gross EM(2)(5)

1.4x

2.4x

2.3x

1.6x

2.0x

1.8x

3.2x

2.2x

1.5x

As of June 30, 2020. Past performance is not indicative of future results. Please refer to endnotes on pages 65-66 for detailed information regarding the methodology used to

calculate the performance information in this table. Please refer to page 67 for a Summary of Vehicle Definitions.

1.4x

Pro Forma Projected(¹)

Gross IRR(2)(4) Gross EM(2)(4)

0%

18%

18%

16%

17%

14%

17%

0%

13%

19%

Gross IRR(2)(4)

17%

Gross IRR(2)(4)

21%

45%

30%

49%

45%

18%

16%

Pro Forma Projected(¹)

28%

1.0x

164%

42%

26%

1.7x

19%

1.8x

1.9x

2.0x

18%

17%

Pro Forma Projected(¹)

2.0x

1.6x

1.0x

1.6x

1.7x

1.9x

1.9x

Gross EM(2)(4)

1.7x

1.6x

1.7x

Gross EM(2)(4)

1.4x

2.4x

2.3x

1.6x

2.0x

1.8x

3.2x

2.2x

2.0x

1.7x

ARESView entire presentation