Summit Hotel Properties Investor Presentation Deck

12

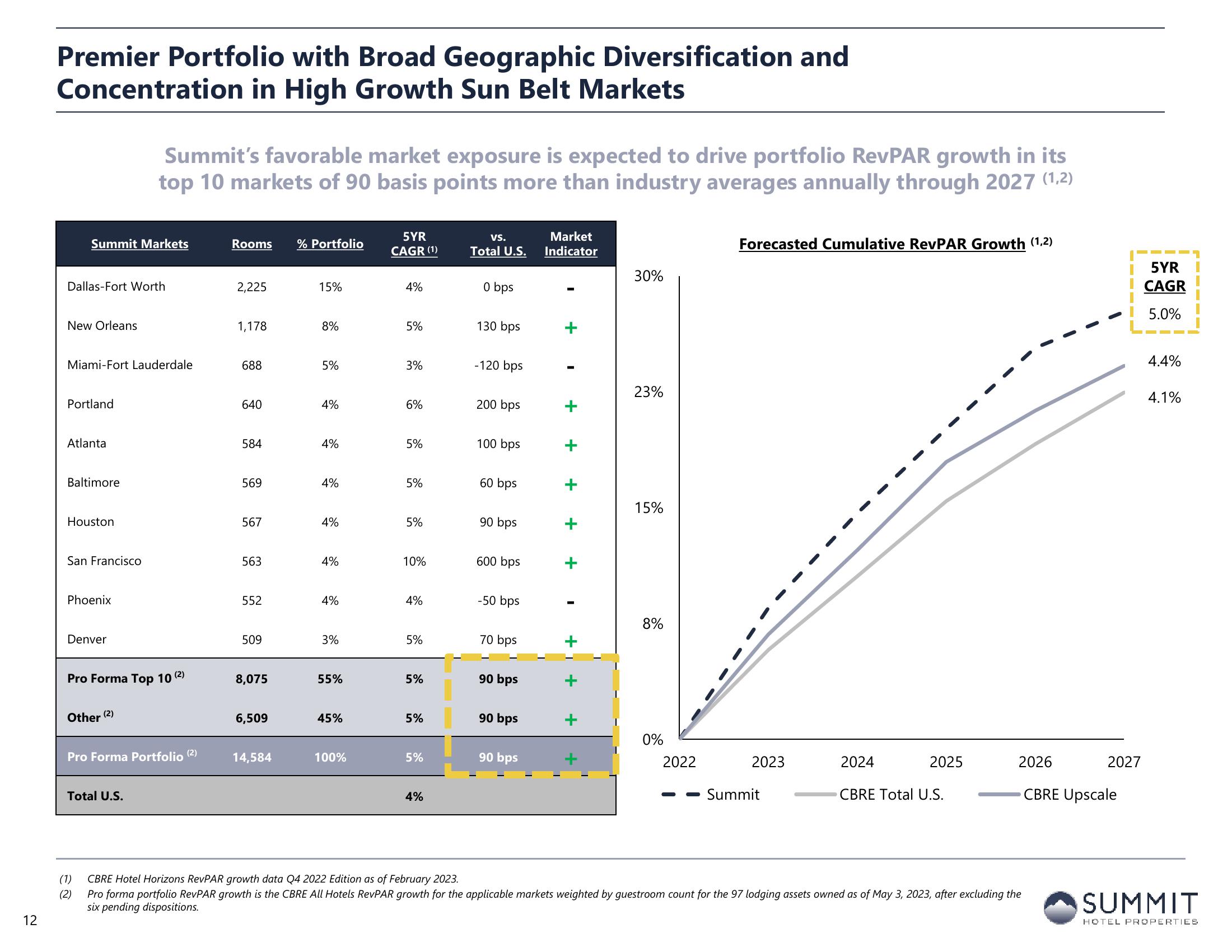

Premier Portfolio with Broad Geographic Diversification and

Concentration in High Growth Sun Belt Markets

Summit Markets

Dallas-Fort Worth

New Orleans

Miami-Fort Lauderdale

Portland

Atlanta

Baltimore

Houston

San Francisco

Phoenix

Denver

Summit's favorable market exposure is expected to drive portfolio RevPAR growth in its

top 10 markets of 90 basis points more than industry averages annually through 2027 (1,2)

Pro Forma Top 10 (²)

Other (2)

Pro Forma Portfolio (²)

Total U.S.

(1)

(2)

Rooms % Portfolio

2,225

1,178

688

640

584

569

567

563

552

509

8,075

6,509

14,584

15%

8%

5%

4%

4%

4%

4%

4%

4%

3%

55%

45%

100%

5YR

CAGR (1)

4%

5%

3%

6%

5%

5%

5%

10%

4%

5%

5%

5%

5%

4%

VS.

Total U.S.

0 bps

130 bps

-120 bps

200 bps

100 bps

60 bps

90 bps

600 bps

-50 bps

70 bps

90 bps

90 bps

90 bps

Market

Indicator

30%

23%

15%

8%

0%

2022

Forecasted Cumulative RevPAR Growth (1,2)

2023

Summit

2024

2025

CBRE Total U.S.

2026

CBRE Upscale

CBRE Hotel Horizons RevPAR growth data Q4 2022 Edition as of February 2023.

Pro forma portfolio RevPAR growth is the CBRE All Hotels RevPAR growth for the applicable markets weighted by guestroom count for the 97 lodging assets owned as of May 3, 2023, after excluding the

six pending dispositions.

‒‒‒

2027

5YR

CAGR

5.0%

4.4%

4.1%

SUMMIT

HOTEL PROPERTIESView entire presentation