Kinnevik Results Presentation Deck

Intro

.

Net Asset Value

sions. Solugen is a Houston-based company that aims to

decarbonise the chemicals industry. Founded by Gaurab

Chakrabarti and Sean Hunt in 2016, the company has de-

veloped, and is now scaling, an industrial green chemicals

platform that produces safer, cheaper, and more environ-

mentally friendly chemical products from sugar rather than

petroleum. Solugen is a global leader in clean chemistry, and

we are very excited to be able to support this journey with

our investment and partnership.

In October, we invested EUR 25m into H2 Green Steel,

the Swedish producer of green steel. Steel today makes up

around 7 percent of carbon emissions globally and is therefor,

together with chemicals, one of the most important areas to

target first in the clean industrial revolution. As a first step,

H2 Green Steel is developing a fully integrated, digitalized,

and sustainable plant in Boden, northern Sweden, where the

company will produce green steel, reducing carbon emissions

by up to 95 percent compared to traditional steelmaking.

And steel is only the beginning - their expertise in green

hydrogen will enable H2 Green Steel to also decarbonize

other heavy industries.

Management Changes

In September, we announced that Samuel Sjöström will take

over as Chief Financial Officer at Kinnevik on 1 November

2022, replacing Erika Söderberg Johnson who is moving into

a role as Senior Advisor to our investee companies. Samuel

has been instrumental in developing the strategic and finan-

cial framework that underpins our financial decision-making,

reporting and communication, and I look forward to working

KINNEVIK

Interim Report - Q3 2022

Portfolio Overview

Sustainability

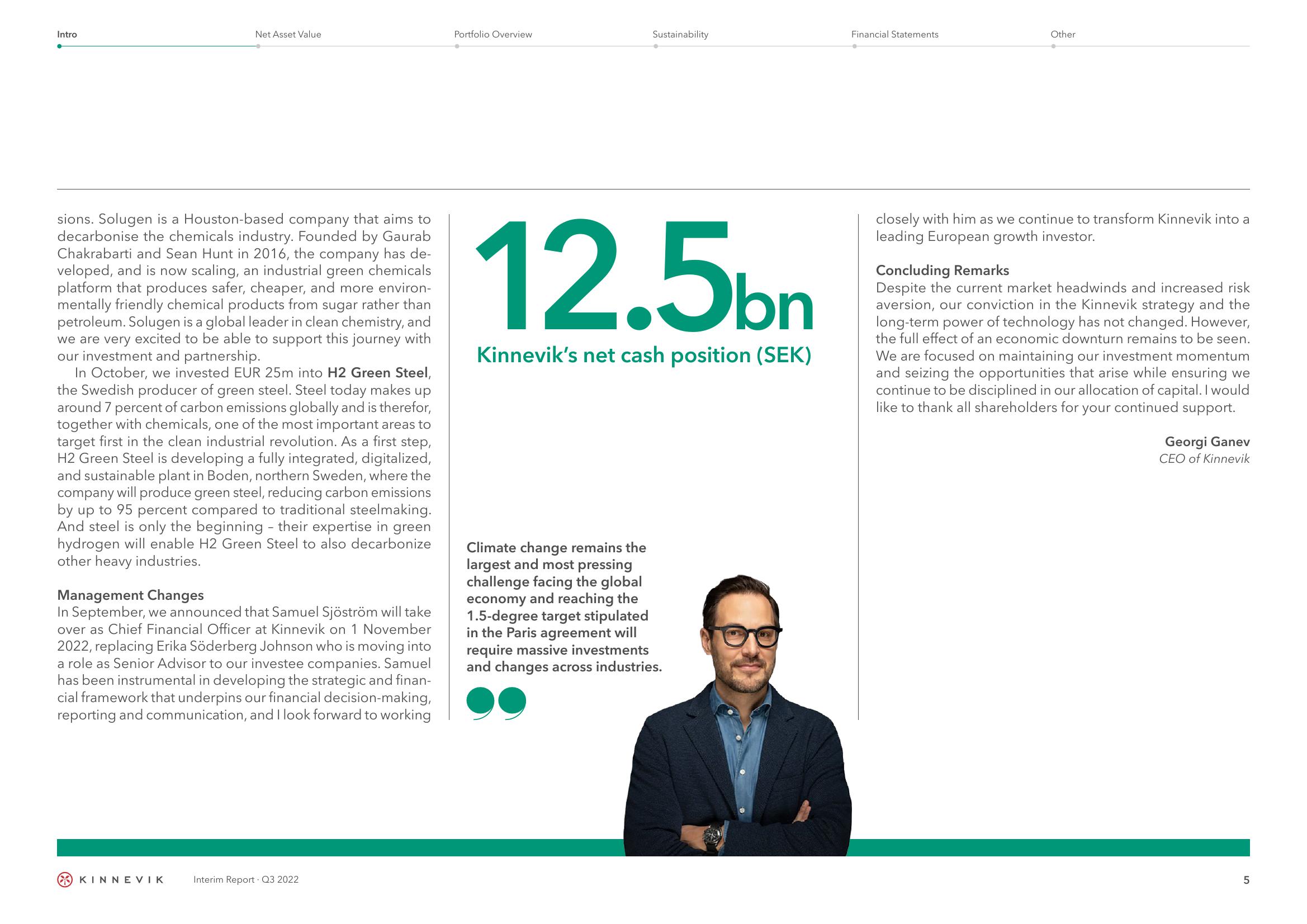

12.5bn

Kinnevik's net cash position (SEK)

Climate change remains the

largest and most pressing

challenge facing the global

economy and reaching the

1.5-degree target stipulated

in the Paris agreement will

require massive investments

and changes across industries.

Financial Statements

Other

closely with him as we continue to transform Kinnevik into a

leading European growth investor.

Concluding Remarks

Despite the current market headwinds and increased risk

aversion, our conviction in the Kinnevik strategy and the

long-term power of technology has not changed. However,

the full effect of an economic downturn remains to be seen.

We are focused on maintaining our investment momentum

and seizing the opportunities that arise while ensuring we

continue to be disciplined in our allocation of capital. I would

like to thank all shareholders for your continued support.

Georgi Ganev

CEO of Kinnevik

5View entire presentation