AG Direct Lending SMA

ANGELO

AG GORDON

Active Portfolio Management

●

●

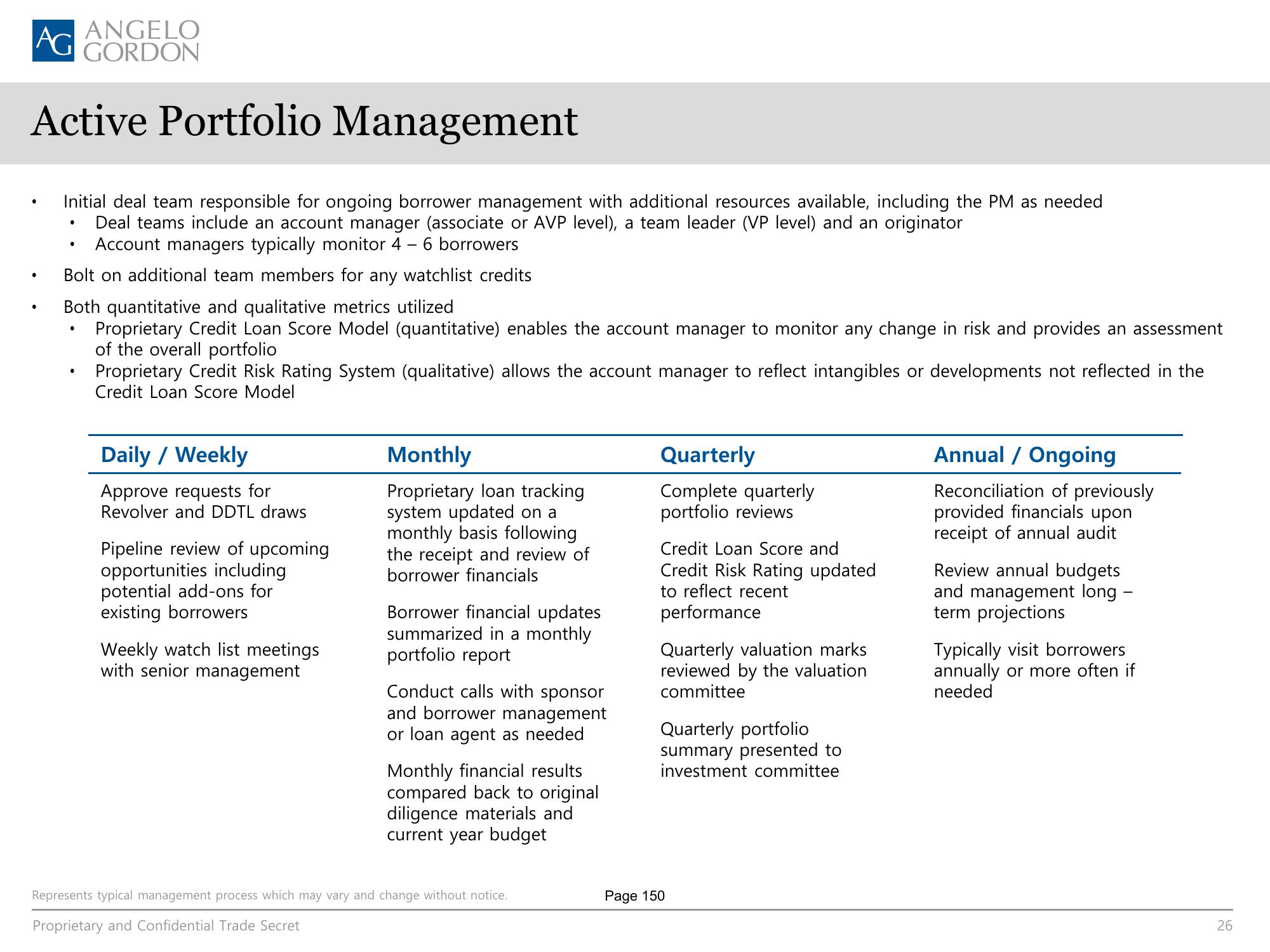

Initial deal team responsible for ongoing borrower management with additional resources available, including the PM as needed

Deal teams include an account manager (associate or AVP level), a team leader (VP level) and an originator

Account managers typically monitor 4 - 6 borrowers

Bolt on additional team members for any watchlist credits

●

●

Both quantitative and qualitative metrics utilized

Proprietary Credit Loan Score Model (quantitative) enables the account manager to monitor any change in risk and provides an assessment

of the overall portfolio

●

●

Proprietary Credit Risk Rating System (qualitative) allows the account manager to reflect intangibles or developments not reflected in the

Credit Loan Score Model

Daily / Weekly

Approve requests for

Revolver and DDTL draws

Pipeline review of upcoming

opportunities including

potential add-ons for

existing borrowers

Weekly watch list meetings

with senior management

Monthly

Proprietary loan tracking

system updated on a

monthly basis following

the receipt and review of

borrower financials

Borrower financial updates

summarized in a monthly

portfolio report

Conduct calls with sponsor

and borrower management

or loan agent as needed

Monthly financial results

compared back to original

diligence materials and

current year budget

Represents typical management process which may vary and change without notice.

Proprietary and Confidential Trade Secret

Quarterly

Complete quarterly

portfolio reviews

Credit Loan Score and

Credit Risk Rating updated

to reflect recent

performance

Quarterly valuation marks

reviewed by the valuation

committee

Quarterly portfolio

summary presented to

investment committee

Page 150

Annual / Ongoing

Reconciliation of previously

provided financials upon

receipt of annual audit

Review annual budgets

and management long -

term projections

Typically visit borrowers

annually or more often if

needed

26View entire presentation