Bright Machines SPAC

Summary Forecasted Financials

Bright

Machines.

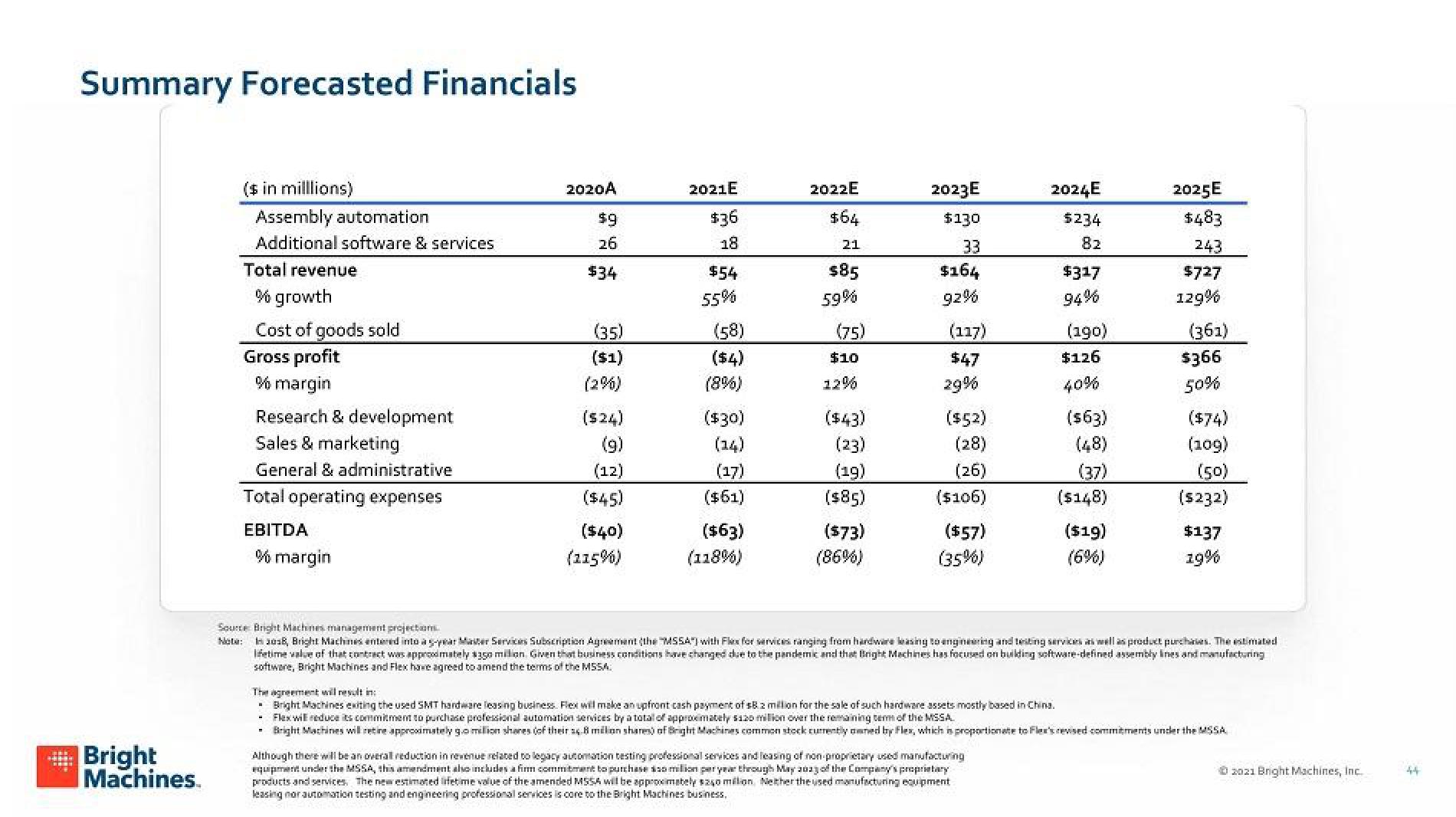

($ in milllions)

Assembly automation

Additional software & services

Total revenue

% growth

Cost of goods sold

Gross profit

% margin

Research & development

Sales & marketing

General & administrative

Total operating expenses

EBITDA

% margin

2020A

$9

26

$34

(35)

($1)

(2%)

($24)

(9)

(12)

($45)

($40)

(115%)

2021E

$36

18

$54

55%

(58)

($4)

(8%)

($30)

(14)

(17)

($61)

($63)

(118%)

2022E

$64

21

$85

59%

(75)

$10

12%

($43)

(23)

(19)

($85)

($73)

(86%)

2023E

$130

33

$164

92%

(117)

$47

29%

($52)

(28)

(26)

($106)

($57)

(35%)

2024E

$234

82

$317

94%

Although there will be an overall reduction in revenue related to legacy automation testing professional services and leasing of non-proprietary used manufacturing

equipment under the MSSA, this amendment also includes a firm commitment to purchase o milion per year through May aday of the Company's proprietary

products and services. The new estimated lifetime value of the amended MSSA will be approximately sayo million Neither the used manufacturing equipment

leasing nor automation testing and engineering professional services is core to the Bright Machines business,

(190)

$126

40%

(563)

(48)

(37)

($148)

($19)

(6%)

2025E

$483

243

$727

129%

(361)

$366

50%

($74)

(109)

(50)

($232)

$137

19%

Source Bright Machines management projection

Note: In 2018, Bright Machines entered into a 5-year Master Services Subscription Agreement (the "MSSA") with Flex for services ranging from hardware leasing to engineering and testing services as well as product purchases. The estimated

lifetime value of that contract was approximately $350 million. Given that business conditions have changed due to the pandemic and that Bright Machines has focused on building software-defined assembly lines and manufacturing

software, Bright Machines and Flex have agreed to amend the terms of the MSSA.

The agreement will result in

Bright Machines exiting the used SMT hardware leasing business. Flex will make an upfront cash payment of s8.2 million for the sale of such hardware assets mostly based in China.

-Flexwil reduce its commitment to purchase professional automation services by a total of approximately 120 million over the remaining term of the MSSA.

- Bright Machines will retire approximately go million shares of their s4.8 million shares) of Bright Machines common stock currently owned by Flex, which is proportionate to Flex's revised commitments under the MSSA

Ⓒ2021 Bright Machines, Inc.

44View entire presentation