Inovalon Results Presentation Deck

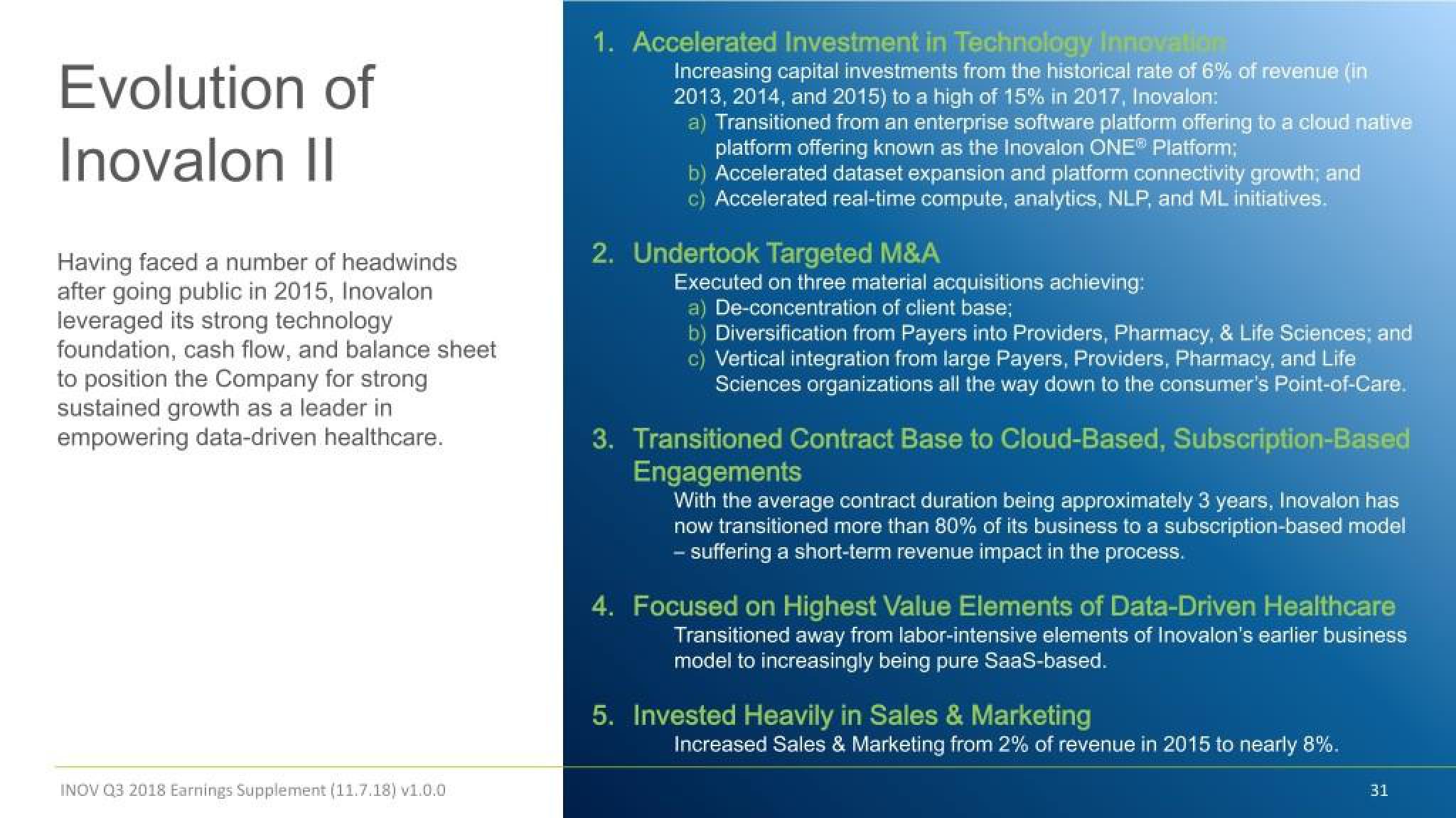

Evolution of

Inovalon II

||

Having faced a number of headwinds

after going public in 2015, Inovalon

leveraged its strong technology

foundation, cash flow, and balance sheet

to position the Company for strong

sustained growth as a leader in

empowering data-driven healthcare.

INOV Q3 2018 Earnings Supplement (11.7.18) v1.0.0

1. Accelerated Investment in Technology Innovation

Increasing capital investments from the historical rate of 6% of revenue (in

2013, 2014, and 2015) to a high of 15% in 2017, Inovalon:

a) Transitioned from an enterprise software platform offering to a cloud native

platform offering known as the Inovalon ONE® Platform;

b) Accelerated dataset expansion and platform connectivity growth; and

c) Accelerated real-time compute, analytics, NLP, and ML initiatives.

2. Undertook Targeted M&A

Executed on three material acquisitions achieving:

a) De-concentration of client base;

b) Diversification from Payers into Providers, Pharmacy, & Life Sciences; and

c) Vertical integration from large Payers, Providers, Pharmacy, and Life

Sciences organizations all the way down to the consumer's Point-of-Care.

3. Transitioned Contract Base to Cloud-Based, Subscription-Based

Engagements

With the average contract duration being approximately 3 years, Inovalon has

now transitioned more than 80% of its business to a subscription-based model

- suffering a short-term revenue impact in the process.

4. Focused on Highest Value Elements of Data-Driven Healthcare

Transitioned away from labor-intensive elements of Inovalon's earlier business

model to increasingly being pure SaaS-based.

5. Invested Heavily in Sales & Marketing

Increased Sales & Marketing from 2% of revenue in 2015 to nearly 8%.

31View entire presentation