Kinnevik Results Presentation Deck

WE ARE NAVIGATING A HIGHLY CHALLENGING ENVIRONMENT FROM A POSITION

OF STRENGTH, WITH SHORT-TERM CHALLENGES AND LONG-TERM OPPORTUNITIES

Note:

budbee

Mathem

TELE2

Highlights of The Quarter

Q2 2022

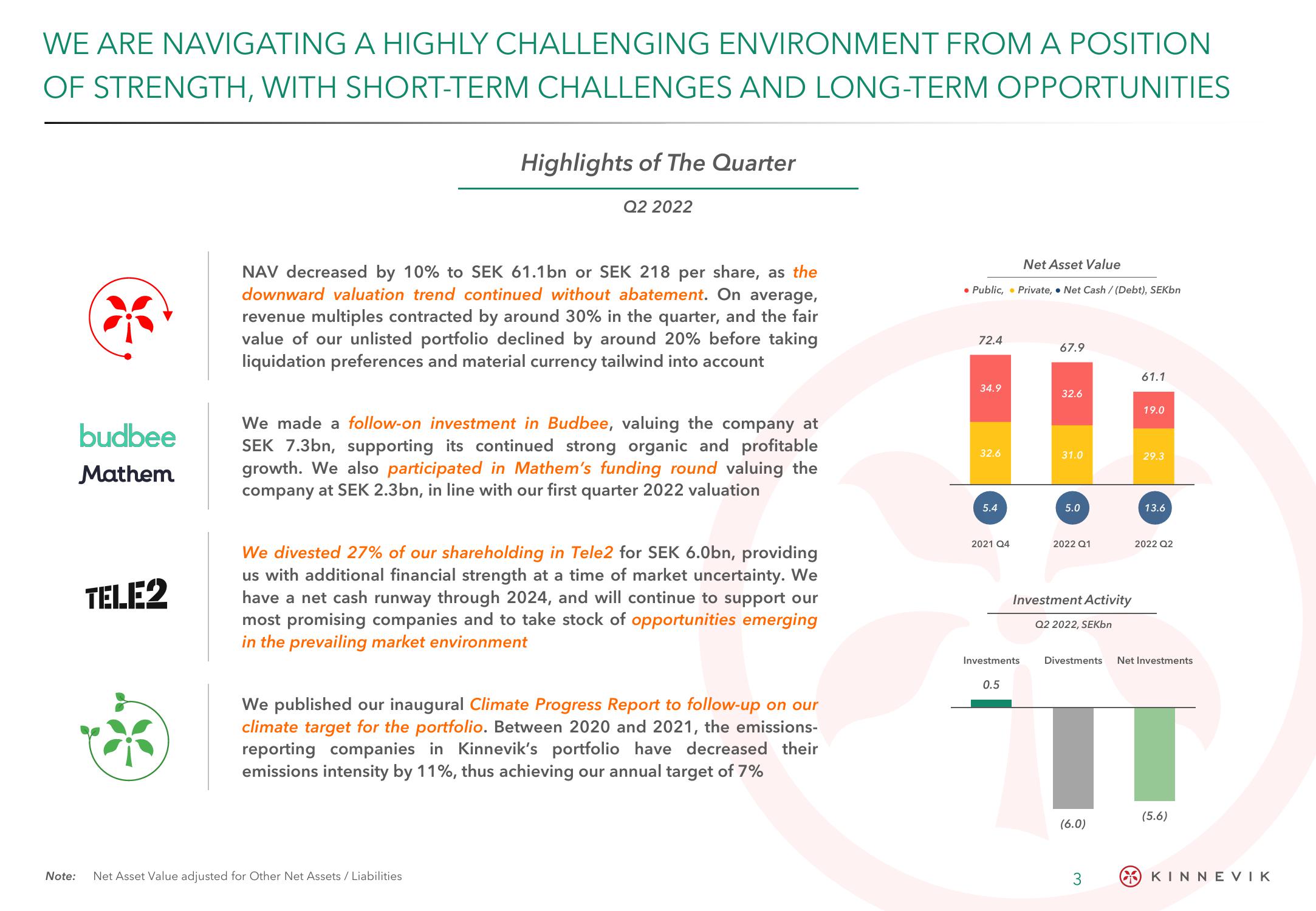

NAV decreased by 10% to SEK 61.1 bn or SEK 218 per share, as the

downward valuation trend continued without abatement. On average,

revenue multiples contracted by around 30% in the quarter, and the fair

value of our unlisted portfolio declined by around 20% before taking

liquidation preferences and material currency tailwind into account

We made a follow-on investment in Budbee, valuing the company at

SEK 7.3bn, supporting its continued strong organic and profitable

growth. We also participated in Mathem's funding round valuing the

company at SEK 2.3bn, in line with our first quarter 2022 valuation

We divested 27% of our shareholding in Tele2 for SEK 6.0bn, providing

us with additional financial strength at a time of market uncertainty. We

have a net cash runway through 2024, and will continue to support our

most promising companies and to take stock of opportunities emerging

in the prevailing market environment

Net Asset Value adjusted for Other Net Assets / Liabilities

We published our inaugural Climate Progress Report to follow-up on our

climate target for the portfolio. Between 2020 and 2021, the emissions-

reporting companies in Kinnevik's portfolio have decreased their

emissions intensity by 11%, thus achieving our annual target of 7%

Net Asset Value

• Public, Private, Net Cash / (Debt), SEKbn

72.4

67.9

32.6

!!!

32.6

31.0

29.3

5.0

34.9

5.4

2021 Q4

Investments

0.5

2022 Q1

Investment Activity

Q2 2022, SEKbn

Divestments

(6.0)

3

61.1

19.0

13.6

2022 Q2

Net Investments

(5.6)

KINNEVIKView entire presentation