Cheesecake Factory Investor Presentation Deck

$0.84

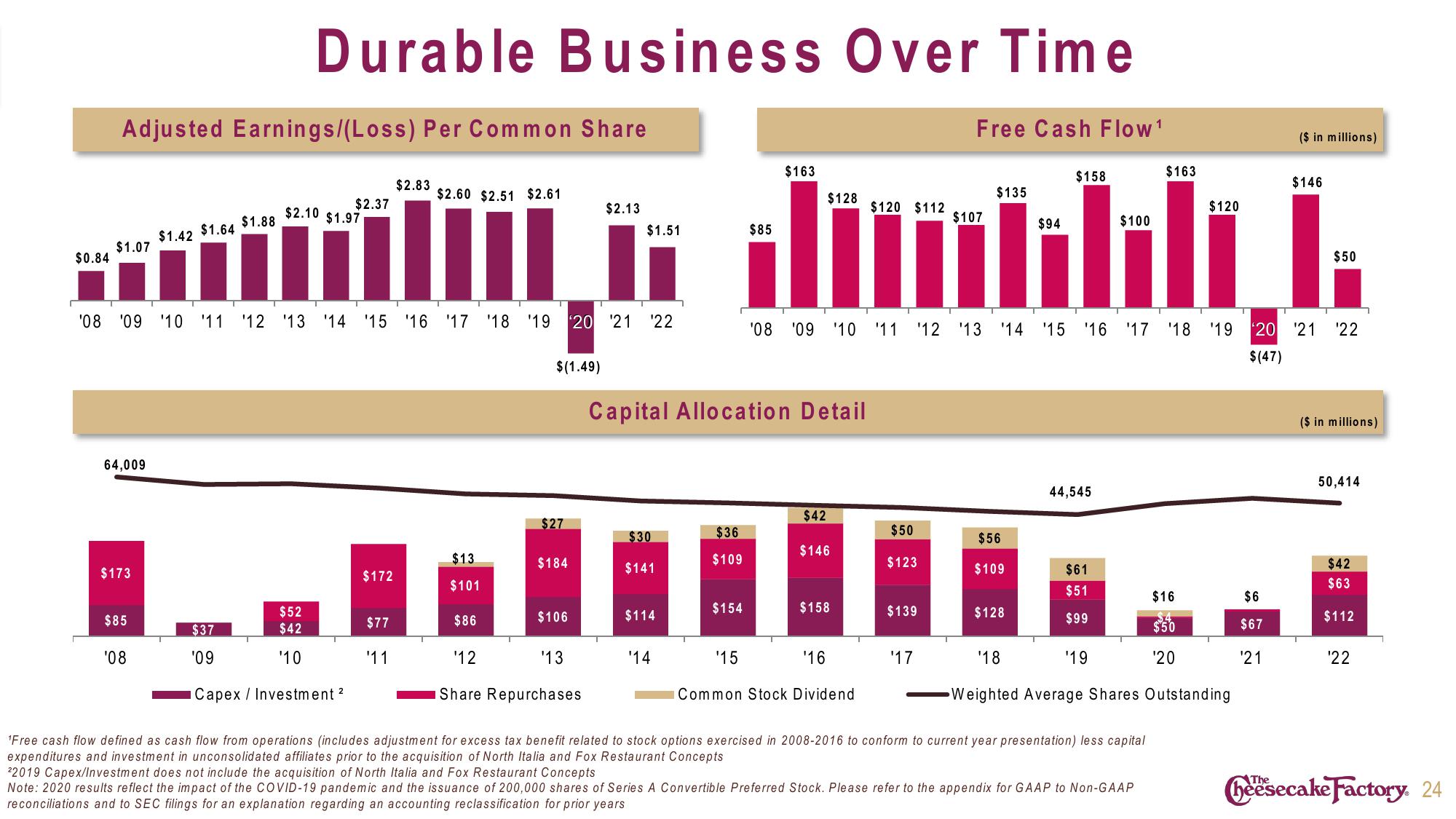

Adjusted Earnings/(Loss) Per Common Share

$1.07

64,009

$173

$1.42

$85

'08

$1.64

$1.88

$37

'09

Durable Business Over Time

$2.10

'08 ¹09 '10 11 '12 '13 '14 15 16 17 18 19 20 21 22

$52

$42

'10

$2.37

$1.97

Capex / Investment 2

$172

$2.83

$77

'11

$13

$101

$86

$158

$2.60 $2.51 $2.61

$135

$2.13

$107

$94

$100

$1.51

LG dimbllit.

'08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

$(47)

$(1.49)

$27

$184

$106

'12

Share Repurchases

'13

$30

$141

Capital Allocation Detail

$114

'14

$36

$109

$154

$163

$85

'15

$128

$42

$146

$158

'16

Common Stock Dividend

$120 $112

$50

$123

$139

Free Cash Flow ¹

'17

$56

$109

$128

44,545

$61

$51

$99

'19

$163

Free cash flow defined as cash flow from operations (includes adjustment for excess tax benefit related to stock options exercised in 2008-2016 to conform to current year presentation) less capital

expenditures and investment in unconsolidated affiliates prior to the acquisition of North Italia and Fox Restaurant Concepts

22019 Capex/Investment does not include the acquisition of North Italia and Fox Restaurant Concepts

Note: 2020 results reflect the impact of the COVID-19 pandemic and the issuance of 200,000 shares of Series A Convertible Preferred Stock. Please refer to the appendix for GAAP to Non-GAAP

reconciliations and to SEC filings for an explanation regarding an accounting reclassification for prior years

$16

$50

'20

$120

'18

Weighted Average Shares Outstanding

($ in millions)

$6

$67

'21

$146

T

$50

($ in millions)

50,414

$42

$63

$112

7

'22

heesecake Factory. 24View entire presentation