OpenText Mergers and Acquisitions Presentation Deck

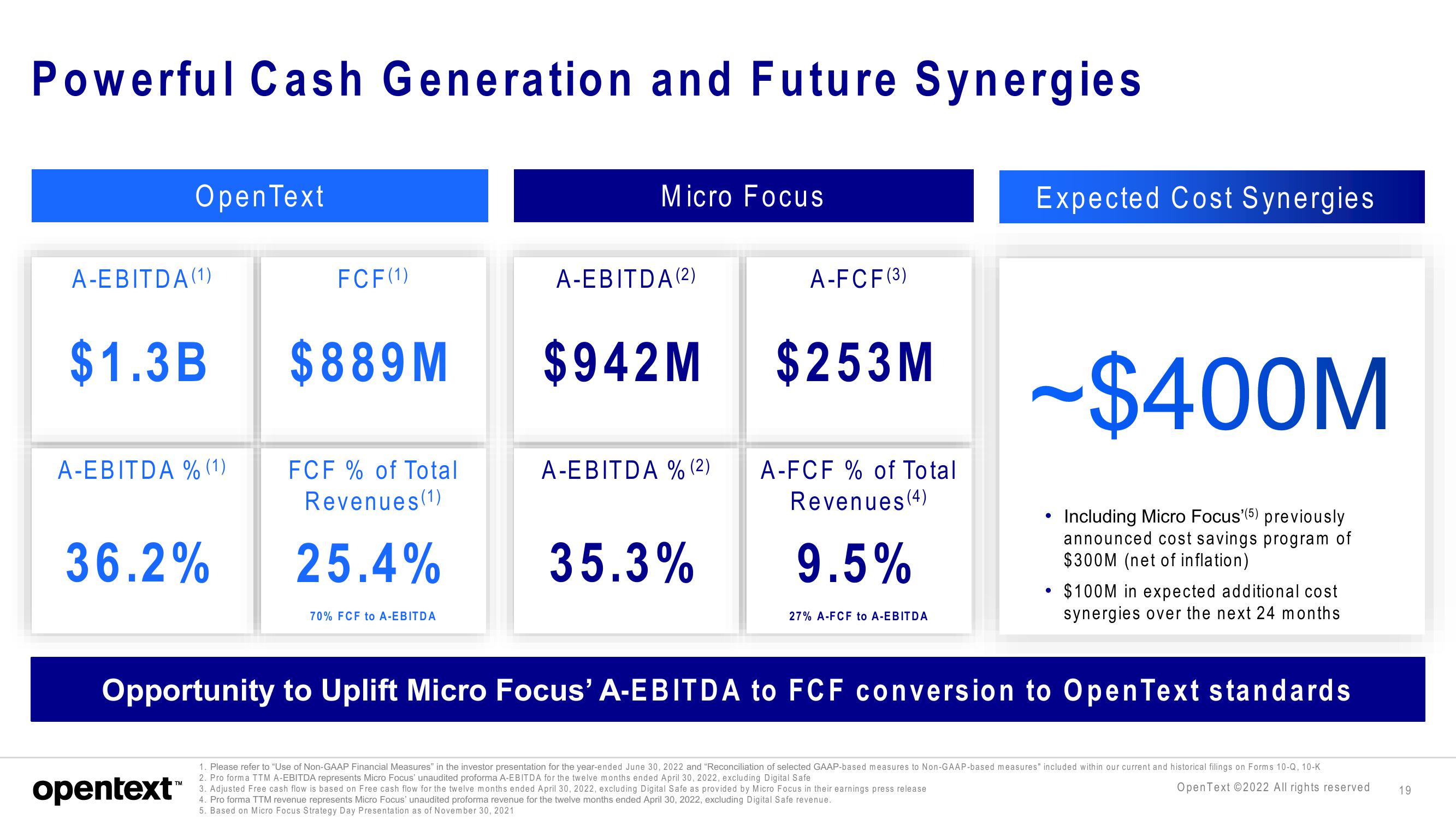

Powerful Cash Generation and Future Synergies

Open Text

A-EBITDA (1)

$1.3B

A-EBITDA % (1)

36.2%

opentext™

FCF (1)

$889M

FCF % of Total

Revenues (1)

25.4%

Micro Focus

70% FCF to A-EBITDA

A-EBITDA (2)

$942M

A-EBITDA % (2)

35.3%

A-FCF (3)

$253M

A-FCF % of Total

Revenues (4)

9.5%

• $100M in expected additional cost

synergies over the next 24 months

Opportunity to Uplift Micro Focus' A-EBITDA to FCF conversion to Open Text standards

27% A-FCF to A-EBITDA

Expected Cost Synergies.

-$400M

Including Micro Focus'(5) previously

announced cost savings program of

$300M (net of inflation)

3. Adjusted Free cash flow is based on Free cash flow for the twelve months ended April 30, 2022, excluding Digital Safe as provided by Micro Focus in their earnings press release

4. Pro forma TTM revenue represents Micro Focus' unaudited proforma revenue for the twelve months ended April 30, 2022, excluding Digital Safe revenue.

5. Based on Micro Focus Strategy Day Presentation as of November 30, 2021

●

1. Please refer to "Use of Non-GAAP Financial Measures" in the investor presentation for the year-ended June 30, 2022 and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K

2. Pro forma TTM A-EBITDA represents Micro Focus' unaudited proforma A-EBITDA for the twelve months ended April 30, 2022, excluding Digital Safe

OpenText ©2022 All rights reserved

19View entire presentation