Hyzon SPAC Presentation Deck

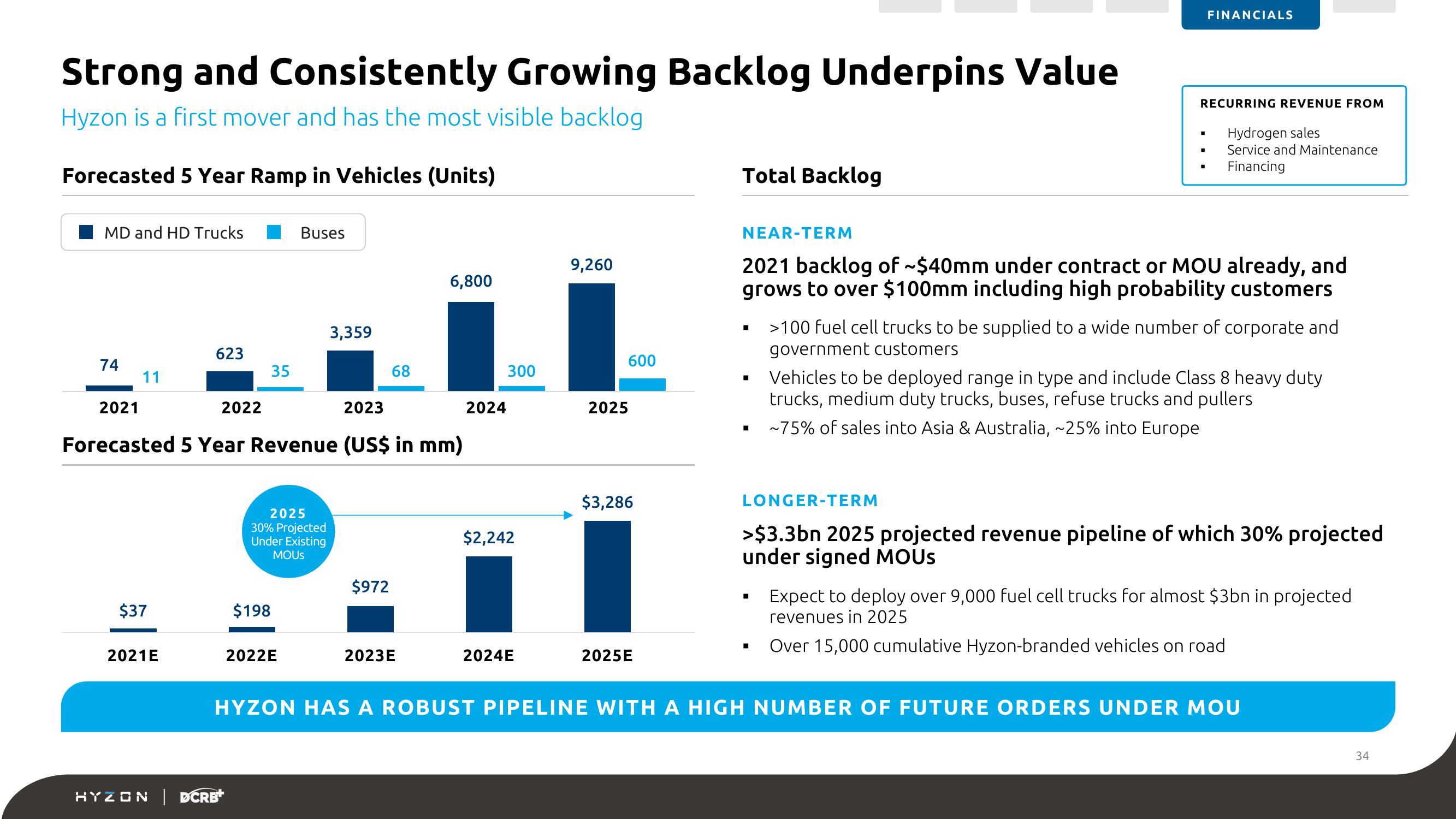

Strong and Consistently Growing Backlog Underpins Value

Hyzon is a first mover and has the most visible backlog

Forecasted 5 Year Ramp in Vehicles (Units)

MD and HD Trucks

74

11

$37

623

2021E

2022

35

2021

2023

Forecasted 5 Year Revenue (US$ in mm)

HYZON | DCRB+

Buses

2025

30% Projected

Under Existing

MOUS

$198

2022E

3,359

68

$972

6,800

2023E

2024

300

$2,242

2024E

9,260

600

2025

$3,286

2025E

Total Backlog

NEAR-TERM

■

■

2021 backlog of ~$40mm under contract or MOU already, and

grows to over $100mm including high probability customers

FINANCIALS

RECURRING REVENUE FROM

■

LONGER-TERM

■

Hydrogen sales

Service and Maintenance

Financing

>100 fuel cell trucks to be supplied to a wide number of corporate and

government customers

Vehicles to be deployed range in type and include Class 8 heavy duty

trucks, medium duty trucks, buses, refuse trucks and pullers

~75% of sales into Asia & Australia, ~25% into Europe

>$3.3bn 2025 projected revenue pipeline of which 30% projected

under signed MOUS

Expect to deploy over 9,000 fuel cell trucks for almost $3bn in projected

revenues in 2025

Over 15,000 cumulative Hyzon-branded vehicles on road

HYZON HAS A ROBUST PIPELINE WITH A HIGH NUMBER OF FUTURE ORDERS UNDER MOU

34View entire presentation