Selina SPAC

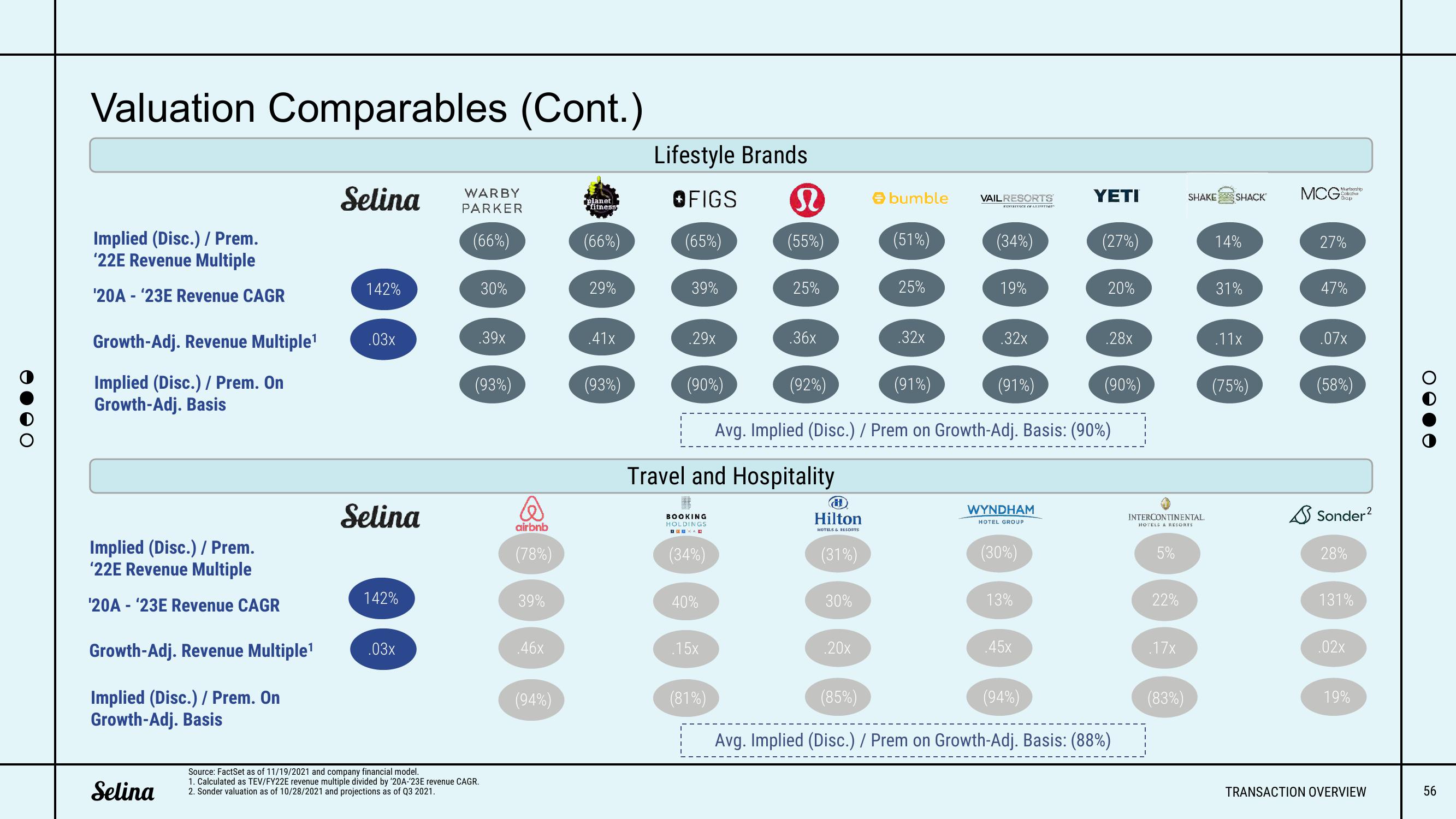

Valuation Comparables (Cont.)

Implied (Disc.) / Prem.

'22E Revenue Multiple

'20A- '23E Revenue CAGR

Growth-Adj. Revenue Multiple¹

Implied (Disc.) / Prem. On

Growth-Adj. Basis

Implied (Disc.) / Prem.

'22E Revenue Multiple

'20A - ¹23E Revenue CAGR

Growth-Adj. Revenue Multiple¹

Implied (Disc.) / Prem. On

Growth-Adj. Basis

Selina

Selina

142%

.03x

Selina

142%

.03x

WARBY

PARKER

(66%)

30%

.39x

(93%)

Source: FactSet as of 11/19/2021 and company financial model.

1. Calculated as TEV/FY22E revenue multiple divided by '20A-'23E revenue CAGR.

2. Sonder valuation as of 10/28/2021 and projections as of Q3 2021.

@

airbnb

(78%)

39%

.46x

(94%)

planet

fitness

(66%)

29%

.41x

(93%)

Lifestyle Brands

OFIGS

(65%)

39%

.29x

(90%)

BOOKING

HOLDINGS

BED

(34%)

40%

.15x

n

(55%)

(81%)

25%

Travel and Hospitality

.36x

(92%)

H

Hilton

HOTELS & RESORTS

(31%)

30%

> bumble

.20x

(51%)

25%

.32x

VAIL RESORTS

EXPERIENCE OF ALAPRTIMES

(34%)

19%

(91%)

Avg. Implied (Disc.) / Prem on Growth-Adj. Basis: (90%)

32x

(91%)

WYNDHAM

HOTEL GROUP

(30%)

13%

.45x

YETI

(27%)

(94%)

20%

.28x

(90%)

(85%)

Avg. Implied (Disc.) / Prem on Growth-Adj. Basis: (88%)

INTERCONTINENTAL

HOTELS & RESORTS

5%

22%

.17x

SHAKE SHACK

(83%)

14%

31%

.11x

(75%)

MCG

Marlbership

Colectiva

Grap

27%

47%

.07x

(58%)

Sonder²

28%

131%

.02x

19%

TRANSACTION OVERVIEW

56View entire presentation